Car Insurance For Private Hire

All You Need to Know About Car Insurance For Private Hire

What is Car Insurance for Private Hire?

Car insurance for private hire is a specialized form of coverage that helps protect individuals or companies who use their vehicles for private hire purposes. This type of insurance is intended to provide financial protection to those who use their vehicles to transport passengers, goods or services in exchange for a fee. It is important to note that this type of insurance differs from the standard car insurance, which is designed to protect the owner of the vehicle from any damage or theft of their property.

What Does Car Insurance for Private Hire Cover?

Car insurance for private hire usually covers third party liability, which means that if you are responsible for an accident that causes injury or damage to another person or property, your insurance will cover the other person’s costs. It also usually covers damage to the vehicle itself, such as repairs or replacement parts. It is important to note that the coverage can vary from one insurer to another, so it is important to check what is included in the policy before signing up.

Who Is Eligible for Car Insurance for Private Hire?

Most insurers have specific requirements for who is eligible to purchase car insurance for private hire. Generally, the policyholder must be the owner of the vehicle, and the vehicle must be used for private hire purposes only. The driver must also have a valid driver’s license and be over the age of 21. Other requirements may include the vehicle having an annual mileage limit, and the policyholder having a clean driving record.

How Much Does Car Insurance for Private Hire Cost?

The cost of car insurance for private hire can vary greatly from one insurer to another. The cost is usually based on the type of vehicle, the amount of coverage, the age of the driver, and the driver’s driving record. It is important to note that the cost of car insurance for private hire can be more expensive than standard car insurance, so it is important to shop around to find the best deal.

What Other Factors Can Affect the Cost of Car Insurance for Private Hire?

In addition to the factors mentioned above, the cost of car insurance for private hire can also be affected by the type of vehicle that is being used, its age, and its safety features. For example, vehicles that are older or have fewer safety features are likely to be more expensive to insure. Additionally, the type of hire that the vehicle is being used for can also affect the cost of the policy.

How Can I Lower My Car Insurance for Private Hire Costs?

There are several steps that you can take to help lower the cost of car insurance for private hire. For example, you should consider installing safety features such as an alarm system or anti-theft devices, which can help to reduce the cost of the policy. Additionally, you should consider increasing your voluntary excess, which can help to reduce the monthly premiums. Lastly, you should shop around to compare quotes from different insurers, as this can help you to find the best deal.

Questions Before Your Purchase Auto Insurance Policy | Red Neck Marketers

Do rental cars get coverage under personal car insurance?

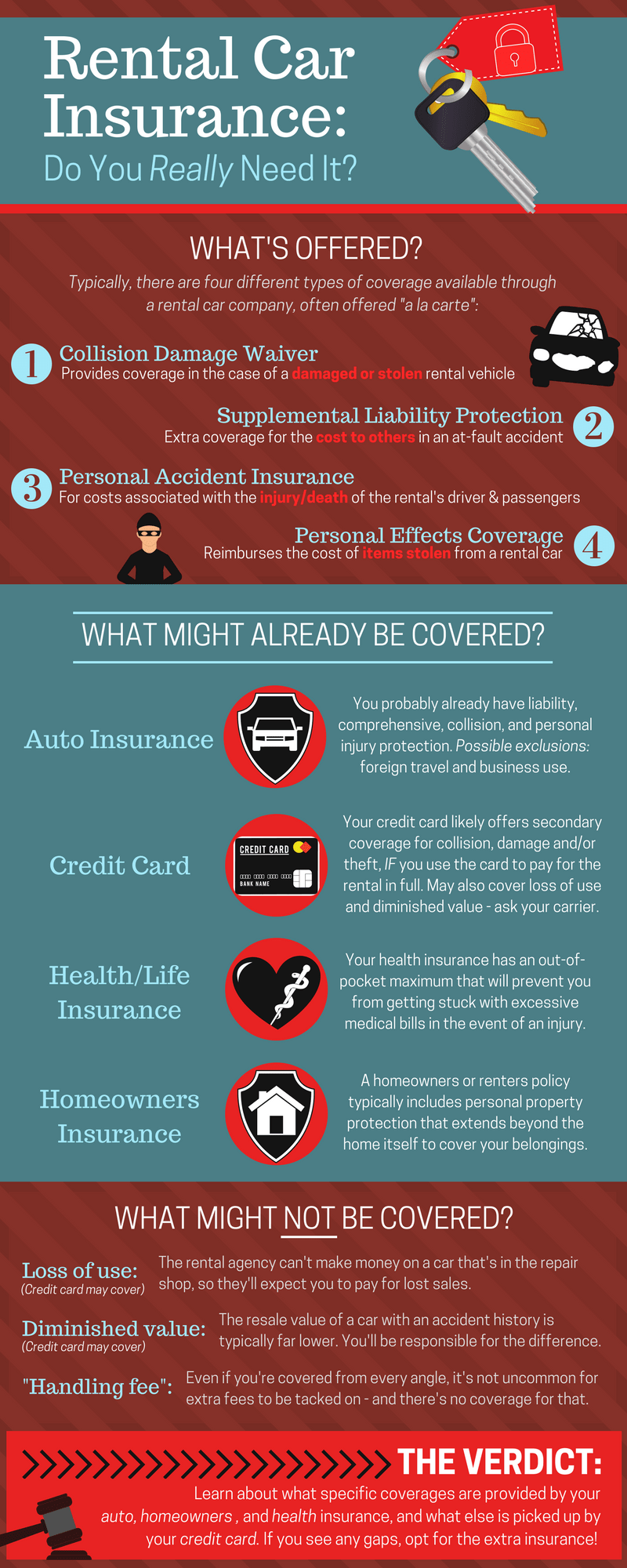

Car Rental Insurance: Do I Really Need It? - Crush the Road

Quick Primer on Car Rental Insurance | AutoSlash | Car Rental Tips