State Farm Accident Forgiveness Policy

Tuesday, August 15, 2023

Edit

State Farm Accident Forgiveness Policy: All You Need to Know

State Farm is a well-known insurance company in the United States, and they have an accident forgiveness policy that can be very beneficial to their policyholders. This policy is designed to protect policyholders from having their premiums increase after an accident. In this article, we will explore the State Farm Accident Forgiveness policy, what it is, and how it can benefit State Farm policyholders.

What is State Farm Accident Forgiveness Policy?

State Farm Accident Forgiveness policy is a program designed to protect policyholders from having their premiums increase after an accident. This policy applies to all State Farm auto insurance policies and is designed to allow policyholders to keep their premiums from increasing after a covered accident. The policy applies to the policyholder and their family members, and it covers the policyholder for up to three years after the date of the accident.

What Does the Policy Cover?

State Farm Accident Forgiveness policy covers the policyholder for up to three years after the date of the accident. This policy covers the policyholder, their family members, and any vehicles they own that are covered by their State Farm auto insurance policy. The policy does not cover any accidents that occurred prior to the policyholder's policy start date. It also does not cover any accidents that occurred after the policyholder's policy end date.

How Does the Policy Work?

The State Farm Accident Forgiveness policy works by allowing policyholders to keep their premiums from increasing after an accident. The policy applies to all State Farm auto insurance policies, and it covers the policyholder for up to three years after the date of the accident. If the policyholder is involved in an accident during the coverage period, their premium will not increase.

Who is Eligible for the Policy?

The State Farm Accident Forgiveness policy is available to all State Farm policyholders. The policy applies to all State Farm auto insurance policies, and it covers the policyholder for up to three years after the date of the accident. To be eligible for the policy, the policyholder must maintain a good driving record and have no other accidents on their record in the three years prior to the date of the accident.

What Are the Benefits of the Policy?

The major benefit of the State Farm Accident Forgiveness policy is that it allows policyholders to keep their premiums from increasing after an accident. This can be a great benefit for policyholders who are involved in an accident, as it can save them a significant amount of money in the long run. Additionally, the policy is designed to give policyholders peace of mind, knowing that their premiums will not increase if they are involved in an accident.

Conclusion

The State Farm Accident Forgiveness policy is a great option for policyholders who want to protect themselves from having their premiums increase after an accident. The policy is available to all State Farm policyholders, and it covers the policyholder for up to three years after the date of the accident. The policy can be a great way to save money and provide peace of mind for policyholders who are involved in an accident.

Forgiveness: State Farm Accident Forgiveness

Forgiveness: State Farm Accident Forgiveness

Forgiveness: State Farm Accident Forgiveness

What Should I Expect from the Car Accident Injury Settlement Process

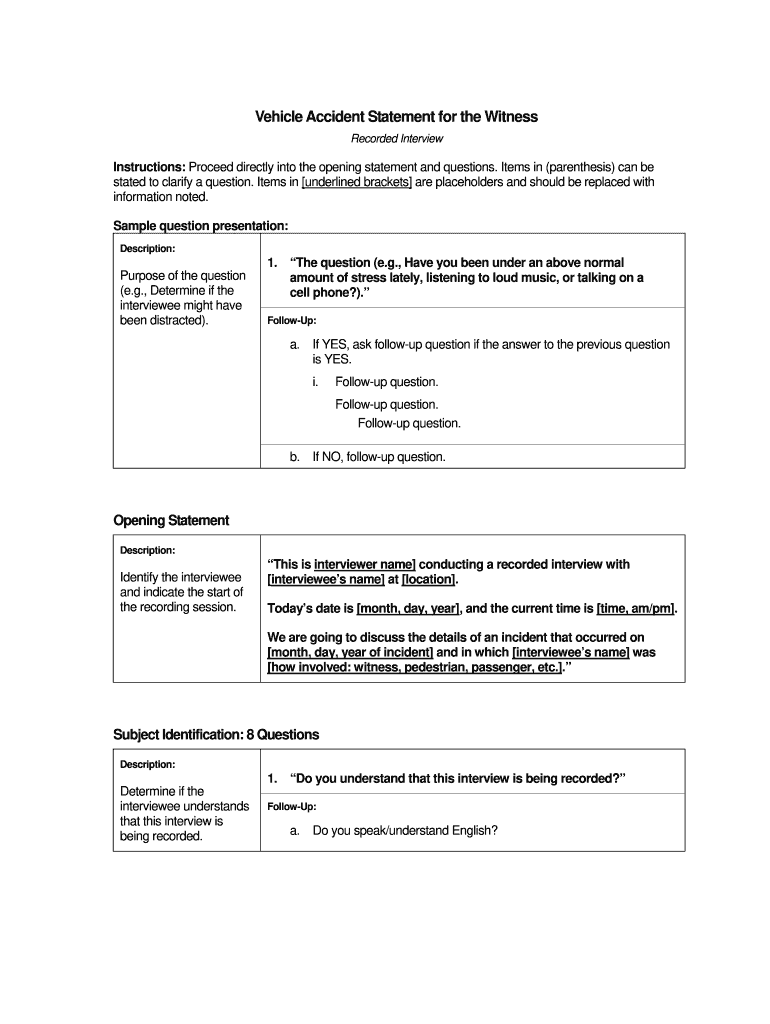

State Farm Accident Report Form - Fill Out and Sign Printable PDF