Should You Buy Gap Insurance On A Used Car

Should You Buy Gap Insurance On A Used Car?

What is Gap Insurance?

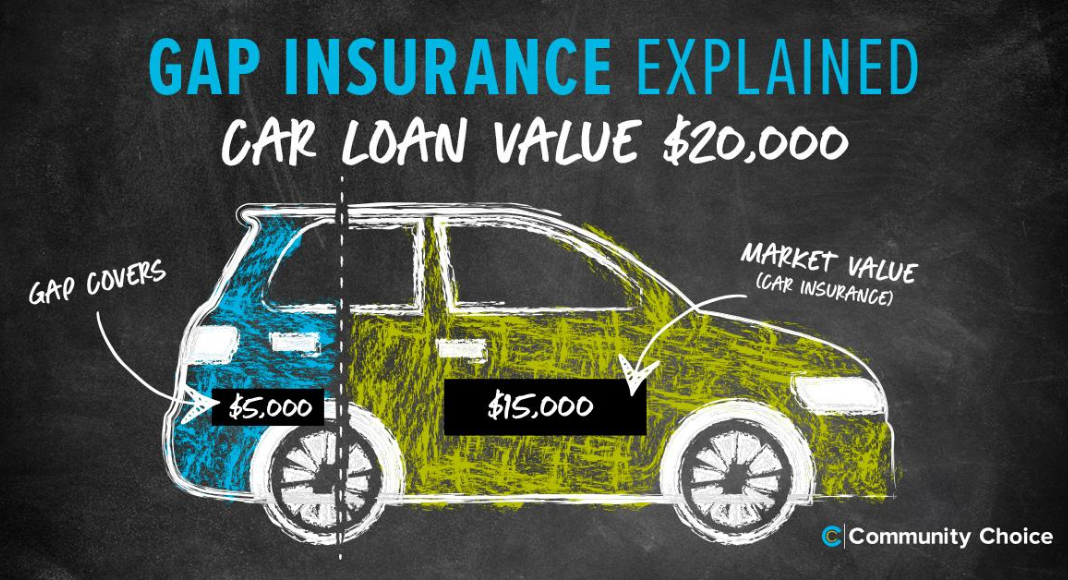

Gap insurance, also known as guaranteed asset protection, is a type of insurance that covers the difference between what you owe on a financed car and its current market value. It’s important to note that gap insurance only applies to vehicles that are bought with a loan or leased. Gap insurance can be purchased from your lender, or you can buy it from an insurance company. It’s important to understand how gap insurance works so you can decide if it’s right for you.

Do You Need Gap Insurance On A Used Car?

It’s important to keep in mind that gap insurance only applies to vehicles that are bought with a loan or leased. So, if you’re buying a used car with cash, gap insurance won’t be necessary. However, if you’re financing the purchase of a used car, gap insurance can be a wise investment.

Gap insurance is particularly important if you’re financing a used car with a high purchase price or if the car depreciates quickly. If you total your vehicle in an accident and you’re still making payments on it, gap insurance can help you avoid having to pay the difference between the car’s current market value and the amount you still owe on the loan.

What Does Gap Insurance Cover?

Gap insurance covers the difference between the amount you owe on your car loan and the amount your car is worth if it’s totaled in an accident. It also covers the difference between the amount you owe on your car loan and the amount your car is worth if it’s stolen and not recovered. Gap insurance doesn’t cover any other type of damage to the vehicle.

How Much Does Gap Insurance Cost?

Gap insurance can be purchased from your lender or an insurance company. The cost of gap insurance varies, but it’s typically a one-time payment of a few hundred dollars. If you’re financing a used car, it’s important to factor the cost of gap insurance into the total cost of the loan.

Is Gap Insurance Worth It?

Gap insurance is worth considering if you’re financing a used car with a loan or lease. It can help you avoid having to pay the difference between the car’s current market value and the amount you still owe on the loan if the car is totaled in an accident or stolen and not recovered. Gap insurance typically costs a few hundred dollars, so it’s important to factor it into the total cost of the loan.

In Conclusion

Gap insurance can be a wise investment if you’re financing a used car with a loan or lease. It covers the difference between what you owe on the car and its current market value if it’s totaled in an accident or stolen and not recovered. Gap insurance typically costs a few hundred dollars, so it’s important to factor it into the total cost of the loan.

Should I Buy Gap Insurance : What Is GAP Insurance And When Should

Gap Car Insurance Tips - Can I Buy Gaping Coverage Without Paying More

Buying A Car Gap Insurance ~ designologer

Do you need gap insurance for your car? How does it work?

What to Consider When You Buy a Car from Community Choice