Icici Lombard Car Insurance Claim Settlement Ratio

The Claim Settlement Ratio of Icici Lombard Car Insurance

Introduction

Getting your car insured is essential in this era of increasing thefts and accidents. Insurance companies offer various policies to suit the needs of the customers. Icici Lombard is one such company that provides car insurance policies. The claim settlement ratio is an important aspect to consider before investing in a policy. It will give you an idea of how much of the claims get approved and settled by the company. In this article, you will know about the Icici Lombard car insurance claim settlement ratio.

The Claim Settlement Ratio of Icici Lombard Car Insurance

Icici Lombard has one of the highest claim settlement ratios in the market. According to the latest data, the company has a claim settlement ratio of 91.12%. This means that the company settles 91 claims out of every 100 made. This is a very high number and ensures that customers get their claims settled without any hassle. The claim settlement ratio has increased from last year when it was 90.28%. This shows that the company is continuously improving its services in order to ensure customer satisfaction.

The Process of Claim Settlement

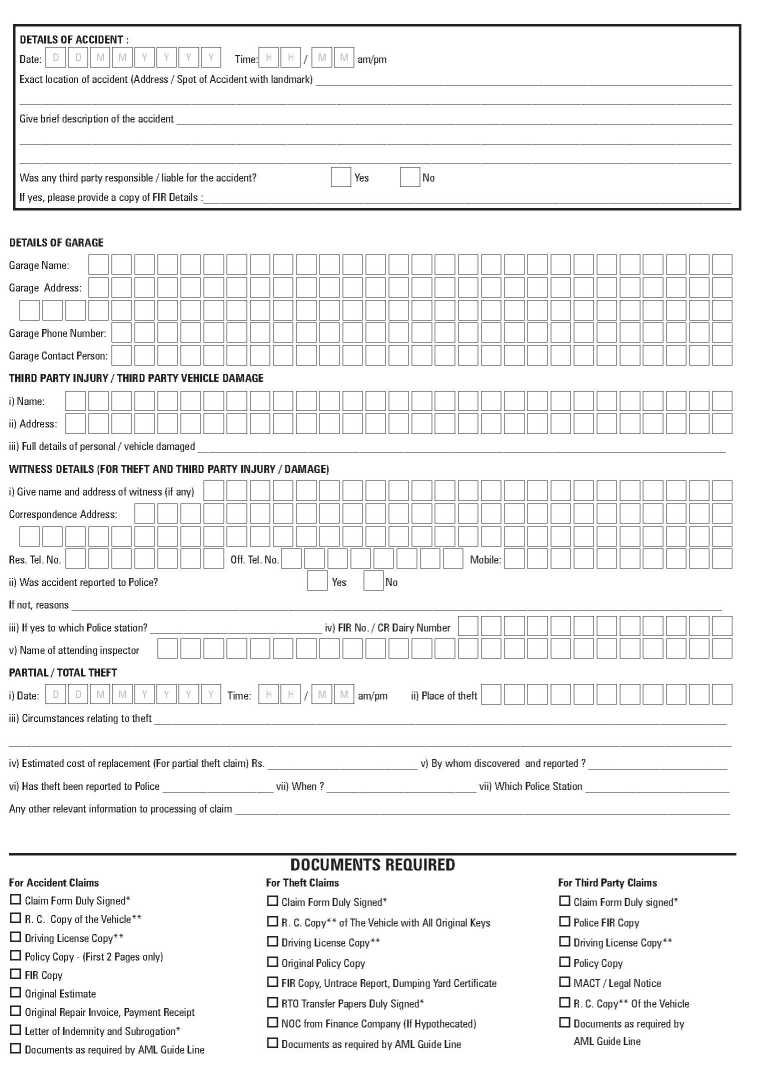

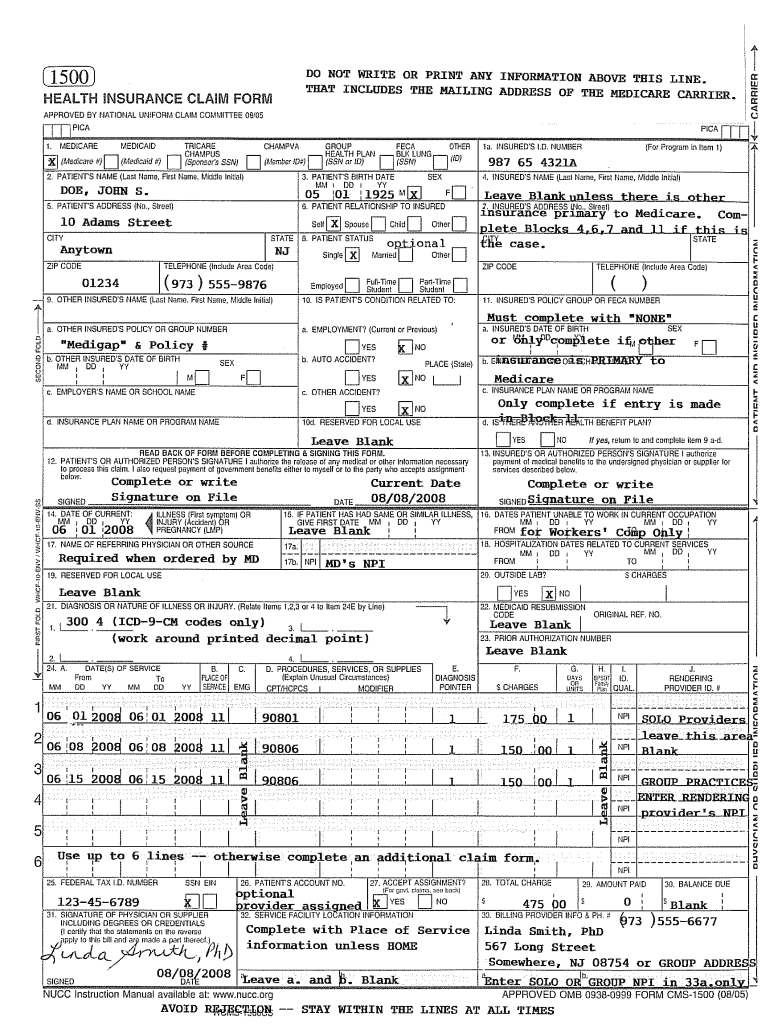

The process of claim settlement is simple and hassle-free. All you have to do is fill up the claim form and submit the required documents. The documents include your car insurance policy copy, repair bills, RC copy, invoice copy and other relevant documents. Once the documents are submitted, the company will review the claim. If the claim is approved, the company will start the process of settling the claim. The amount will be credited to your bank account within a few days. The entire process is simple and smooth.

Factors That Affect Claim Settlement

The claim settlement of Icici Lombard car insurance is dependent on certain factors. One of the main factors is the type of policy that you have purchased. If you have purchased a comprehensive policy, then the chances of claim settlement are higher compared to a third party liability policy. Additionally, the company also checks the documents and review the claim before approving the settlement. If there is any discrepancy in the documents or if the claim is not valid, then the company will reject the claim.

Conclusion

In conclusion, Icici Lombard car insurance has a claim settlement ratio of 91.12%. This ratio is very high and ensures that customers get their claims settled without any hassle. The process of claim settlement is simple and hassle-free. Additionally, the company also checks the documents and review the claim before approving the settlement. It is important to keep all the documents in order to ensure that the process of claim settlement is smooth. So, if you are looking for a car insurance policy, then Icici Lombard is a great option.

Icici Lombard Car Insurance Claim Settlement Ratio ~ designersfore

Car Insurance Renewal - Check Claim Settlement Ratios

ICICI Lombard Two Wheeler Insurance Claim - 2020 2021 Student Forum

Icici Lombard Claim Form - Fill Online, Printable, Fillable, Blank

Best Health Insurance & Motor Insurance Companies