Racq Car Insurance Age Excess

Everything You Need to Know About Racq Car Insurance Age Excess

What is Insurance Excess?

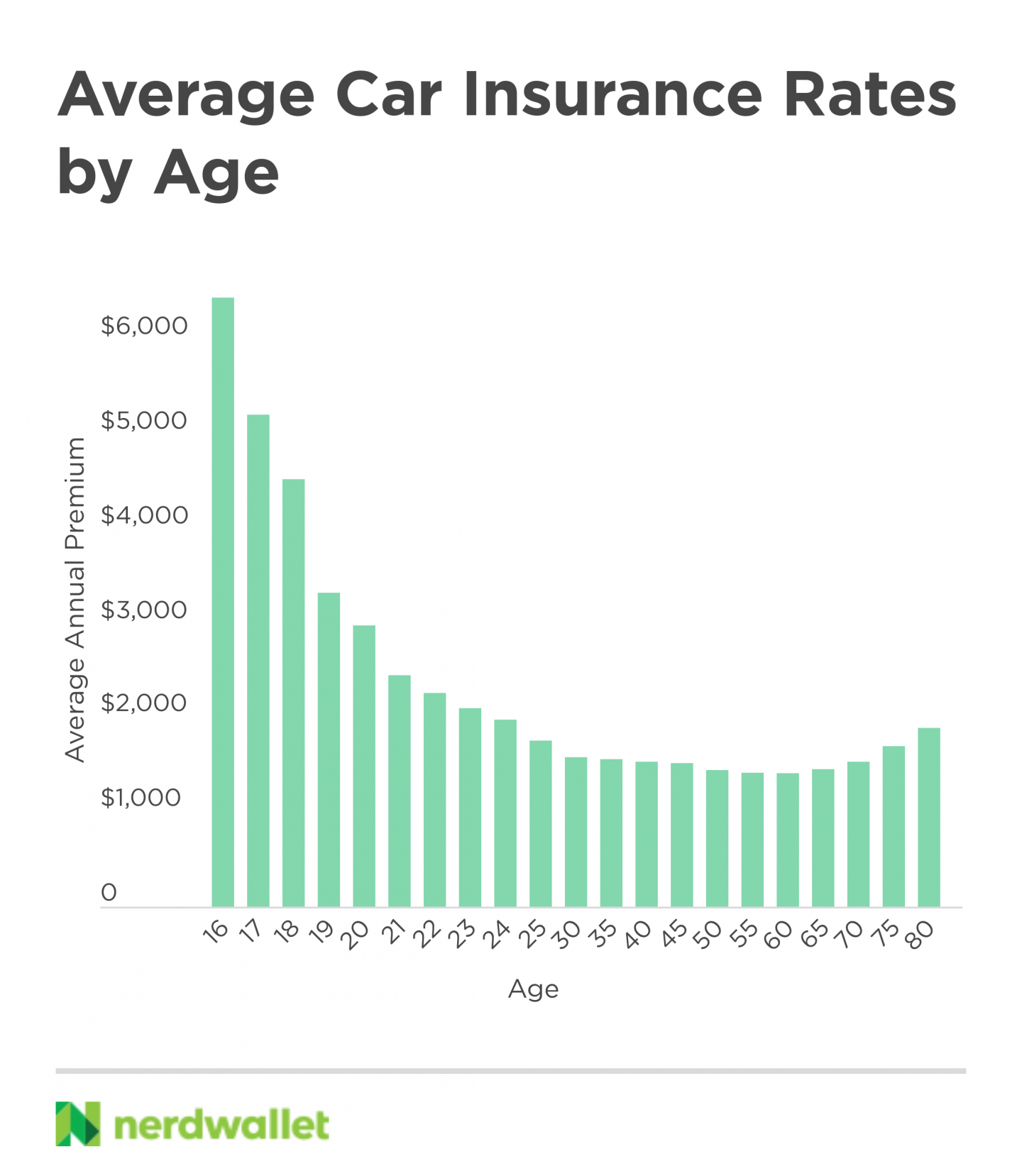

Insurance excess is the amount of money you must pay when making a claim on your insurance policy. This excess is in addition to any fees and charges that your insurer may charge. It is important to understand your insurance excess amount as this can affect how much you will have to pay out when making a claim. In the case of car insurance, the excess depends on the age of the driver and can be quite high for younger drivers.

What is Racq Car Insurance Age Excess?

Racq Car Insurance Age Excess is an insurance policy offered by the Royal Automobile Club of Queensland (RACQ). This policy provides cover for drivers between the ages of 18 and 30. It covers the costs of repairs and medical expenses incurred as a result of an accident. The premiums for this policy are lower than other car insurance policies and the excess is also lower than many other policies.

How Does Racq Car Insurance Age Excess Work?

Racq Car Insurance Age Excess works by covering the costs of repairs and medical expenses up to the amount of the excess. In the case of young drivers, the excess amount is usually based on the age of the driver. For example, an 18-year-old driver may have an excess of $500 while a 25-year-old driver may have an excess of $1,000. The excess amount is usually stated in the policy documents.

What Are the Benefits of Racq Car Insurance Age Excess?

Racq Car Insurance Age Excess is a great option for young drivers as it offers lower premiums and lower excess amounts than other car insurance policies. This policy also offers a number of other benefits such as 24-hour roadside assistance, rental car cover and a no-claims bonus. As the policy is tailored to young drivers, it also provides cover for new and inexperienced drivers.

What Should I Consider Before Taking Out Racq Car Insurance Age Excess?

Before taking out Racq Car Insurance Age Excess, you should consider the following: your budget, the type of vehicle you drive, the age of the driver, your driving record and the amount of cover you need. You should also consider any additional benefits and features offered by the policy such as roadside assistance and rental car cover. You should also make sure that you read and understand the terms and conditions of the policy before signing up.

Conclusion

Racq Car Insurance Age Excess is a great option for young drivers as it offers lower premiums and lower excess amounts. It also offers a range of additional benefits such as roadside assistance and rental car cover. However, it is important to consider your budget, the type of vehicle you drive and the age of the driver before taking out this policy. It is also important to read and understand the terms and conditions of the policy before signing up.

RACQ Insurance Logo [ Download - Logo - icon ] png svg

![Racq Car Insurance Age Excess RACQ Insurance Logo [ Download - Logo - icon ] png svg](https://iconape.com/wp-content/files/mo/208251/png/208251.png)

RACQ Car Insurance | ProductReview.com.au

RACQ Car Insurance Reviews - ProductReview.com.au

Average Car Insurance rates by Age | Money Clinic

Car Insurance Rates By Age - What are the car insurance rates by age