How Much Is Gap Insurance Cost

Everything You Need To Know About Gap Insurance Cost

What Is Gap Insurance?

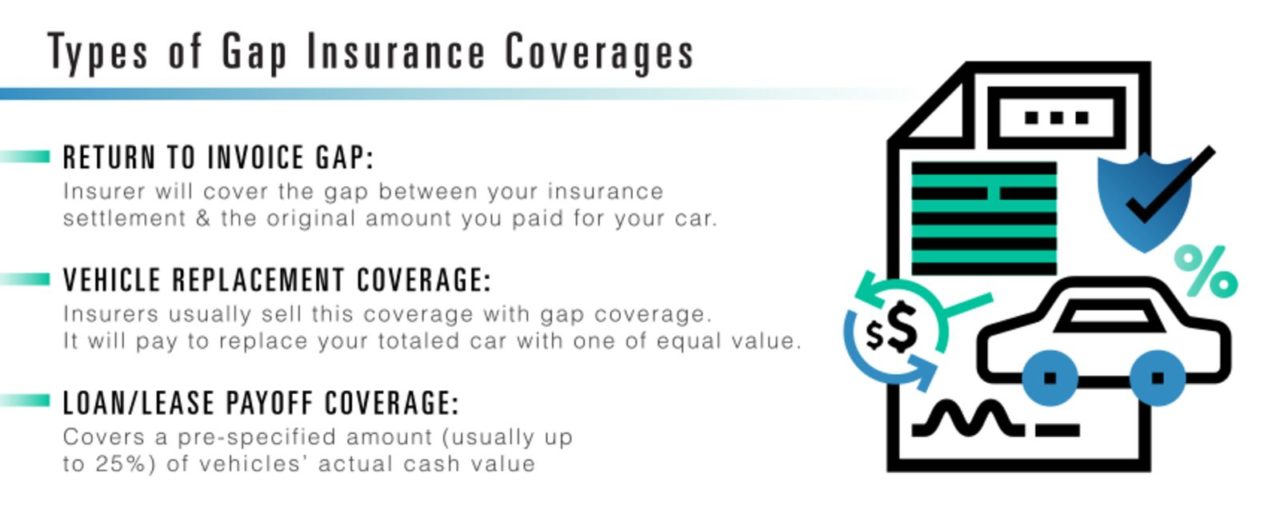

Gap insurance is a type of coverage that helps to protect you from owing money on a financed vehicle after an accident or theft. If your vehicle is totaled or stolen, gap insurance will cover the difference between the actual cash value of the vehicle and the amount you owe on it. It is an important type of coverage for those who are financing a car with a loan, as it can help to ensure that you do not end up owing more money than the car is worth.

What Does Gap Insurance Cost?

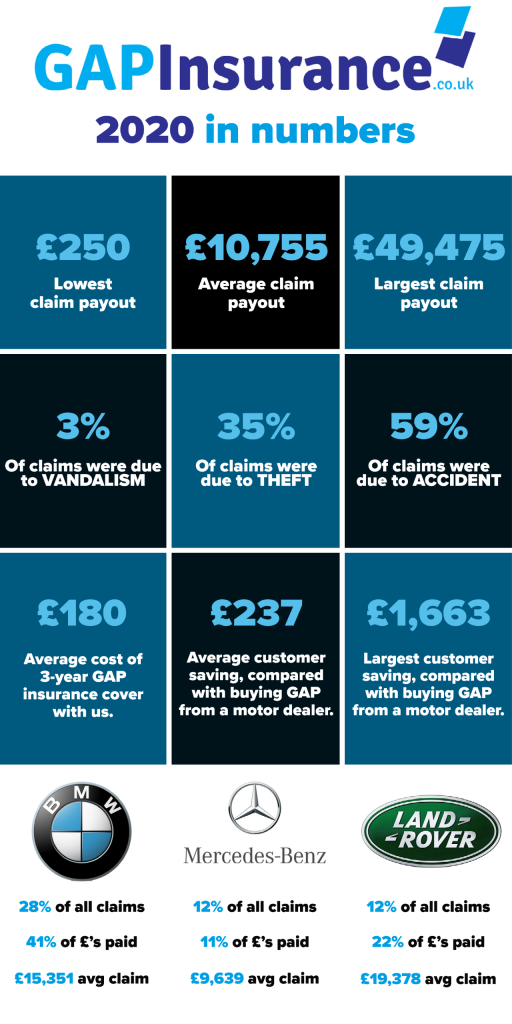

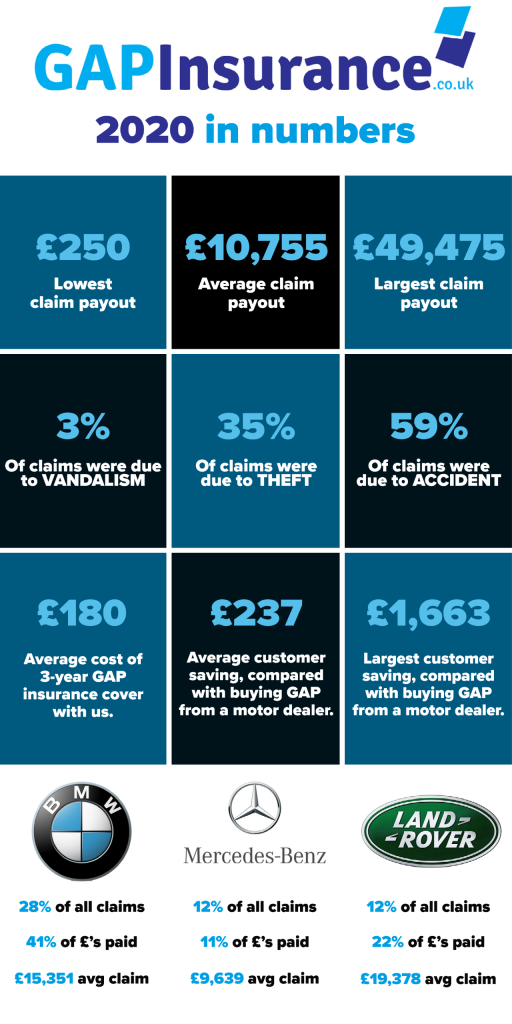

The cost of gap insurance varies depending on the type of coverage you choose and the amount of coverage you need. Generally speaking, the cost of gap insurance is determined by the value of the vehicle, the length of the loan and the type of coverage you choose. The cost of gap insurance can range from a few hundred dollars to a few thousand dollars, but most policies cost between $500 and $2,000. Additionally, the cost of gap insurance typically decreases over time as the value of the vehicle decreases and the loan is paid off.

Do I Need Gap Insurance?

Whether or not you need gap insurance depends on your individual situation. If you are financing a vehicle, you should consider purchasing gap insurance. This type of coverage can provide you with peace of mind in case your vehicle is totaled or stolen, as it will help to ensure that you do not end up owing more money than the car is worth. Additionally, if you are leasing a vehicle, gap insurance may be required by the leasing company.

How Do I Buy Gap Insurance?

Gap insurance can typically be purchased through your insurance company, car dealership or finance company. When purchasing gap insurance, it is important to make sure that you are getting the right type of coverage for your needs. This means that you should know the value of your vehicle and the terms of your loan in order to choose the right amount of coverage. Additionally, it is important to understand the terms and conditions of any gap insurance policy you purchase.

What Are the Benefits of Gap Insurance?

The primary benefit of gap insurance is that it can provide you with peace of mind in the event of an accident or theft. It can help to ensure that you do not end up owing more money than the car is worth. Additionally, gap insurance can also help to protect you from financial hardship in the event that your vehicle is totaled or stolen. Finally, gap insurance can also help to reduce the risk of repossession if you are unable to make payments on your loan.

Conclusion

Gap insurance is an important type of coverage for those who are financing a car with a loan. The cost of gap insurance varies depending on the type of coverage you choose and the amount of coverage you need. Additionally, it is important to understand the terms and conditions of any gap insurance policy you purchase. Gap insurance can provide you with peace of mind in the event of an accident or theft and can also help to protect you from financial hardship. Ultimately, it is important to carefully consider your individual situation and determine whether or not gap insurance is right for you.

Is GAP insurance worthwhile? - babybmw.net

What Is A Health Insurance Deductible for Beginners - The Facts About

How Much Car Insurance Do You Really Need? | DaveRamsey.com

Leasing vs. financing a car (and how it affects your insurance

How much is GAP insurance?