Average Price Of Car Insurance California

Sunday, August 20, 2023

Edit

Average Price Of Car Insurance In California

An Overview Of Car Insurance In California

California is one of the most populous states in the United States, with nearly 39 million people living in the state. It is also one of the most expensive states to insure a vehicle in. The cost of car insurance in California is higher than in many other states, but the good news is that there are still ways to save on your car insurance. In this article, we'll look at the average cost of car insurance in California and explore some ways to save money on your car insurance.

What Factors Impact The Cost Of Car Insurance In California?

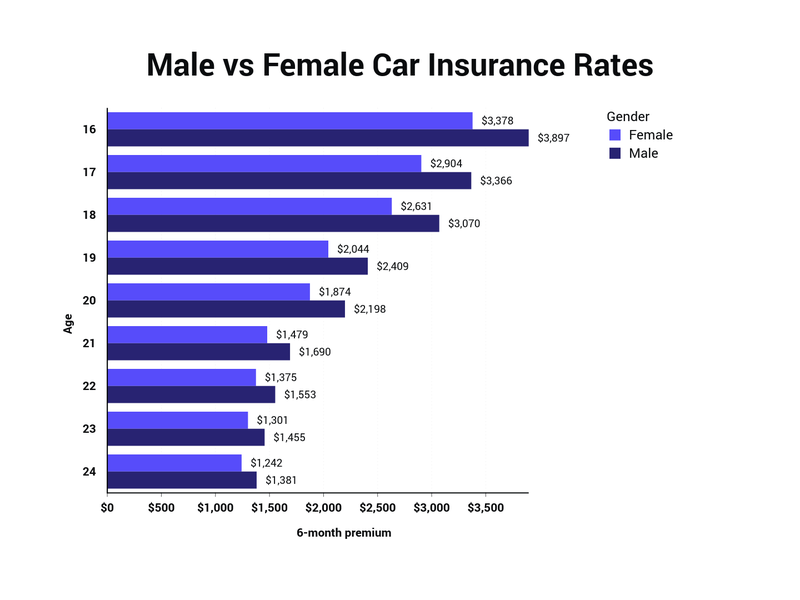

There are a variety of factors that can influence the cost of car insurance in California, including the type of coverage you choose, the make and model of your vehicle, your driving record, and the amount of miles you drive each year. Additionally, your age, gender, and credit history can all play a role in determining your car insurance rate.

What Is The Average Cost Of Car Insurance In California?

According to the Insurance Information Institute (III), the average cost of car insurance in California is $1,664 per year. This figure is higher than the national average of $1,548. The most expensive state for car insurance is Louisiana, with an average annual premium of $2,539. The cheapest state is Maine, with an average annual premium of just $957.

How To Save On Car Insurance In California?

There are several ways to save on your car insurance in California. The first is to shop around and compare quotes from multiple insurers. Prices can vary significantly between different insurance companies, so it pays to compare quotes to get the best deal. Additionally, you may be able to get a discount if you have a clean driving record or if you bundle your car insurance with other types of insurance, such as home or renters insurance.

What Are The Minimum Car Insurance Requirements In California?

In California, you are required to have a minimum of liability insurance coverage. This includes $15,000 per person for bodily injury liability and $30,000 per accident for bodily injury liability, as well as $5,000 per accident for property damage liability. If you are financing or leasing a vehicle, you may also be required to have additional coverage, such as comprehensive and collision coverage.

Conclusion

Car insurance in California is more expensive than in many other states, but there are still ways to save. By shopping around and comparing quotes, you can find the best deal for your situation. Additionally, you may be able to get discounts for having a clean driving record or by bundling your car insurance with other types of insurance. Be sure to understand the minimum car insurance requirements in California and purchase the appropriate coverage for your needs.

How Much Does Car Insurance Cost in California? (2019 Average

Average Cost Of Car Insurance - 2019 (Research & Study by Experts)

Average Car Insurance California - What Car Insurance Companies Don't

Car insurance prices In California - jihan ni

Average Cost Of Car Insurance For 19 Year Old Female - Car Retro