Car Insurance Traders Policy Under 25

Car Insurance for Traders Under 25

Why Would a Trader Need a Car Insurance Policy?

Traders aged under 25 are especially vulnerable to high car insurance costs. Insurance firms are often wary of providing cover for younger drivers due to their inexperience, which can lead to higher risk of accidents. It can be difficult for traders under 25 to find a policy that is both affordable and comprehensive. However, there are some steps you can take to try and get the best cover for your needs.

How to Get the Best Car Insurance for a Trader Under 25?

The first step to finding the best car insurance policy for a trader under 25 is to shop around. Insurance companies have different rates, so it is important to compare policies to ensure you get the best deal. Be sure to look at the coverage offered, as well as the cost. Some companies may offer additional benefits such as breakdown cover, so it is worth checking these out too.

It is also important to be honest when providing information to the insurer. Failing to declare any previous accidents or convictions could invalidate your policy. This could result in you having to pay more in the long term, or even having the policy cancelled. Being honest about your circumstances will help you to get the best cover for your needs.

What Should You Look for in a Car Insurance Policy?

When looking for car insurance for a trader under 25, it is important to make sure the policy meets your needs. You should check the coverage offered, as well as any excess payments that may be required. It is also worth checking for any additional benefits, such as breakdown cover or courtesy car cover. Finally, it is important to check the cost of the policy, as this will determine how much you will have to pay out in premiums.

What Are the Benefits of Having Car Insurance for Traders Under 25?

Having car insurance for a trader under 25 is beneficial in a number of ways. Firstly, it can provide peace of mind if you are involved in an accident. You will be protected from financial losses, as well as any legal costs that may arise. Secondly, it can also help to build up a no claims bonus, which can lead to discounted premiums in the future. Finally, having car insurance for traders under 25 can also protect you from any fraudulent claims.

Where Can I Find the Best Car Insurance for Traders Under 25?

The best way to find the best car insurance for traders under 25 is to shop around. Comparing quotes from different providers will help you to find the most affordable and comprehensive policy. It is also important to read the terms and conditions of any policy you are considering, to ensure it meets your needs. Finally, it is worth checking customer reviews to make sure you are getting the best value for your money.

Under 25 Car Insurance – The Housing Forum

81 reference of Auto Insurance Policy Number | Car insurance, Insurance

Car Insurance Under 25: Can I Get Cheap Car Insurance? - Cover

7 Useful Tips on How to Read Your Car Insurance Policy Wordings

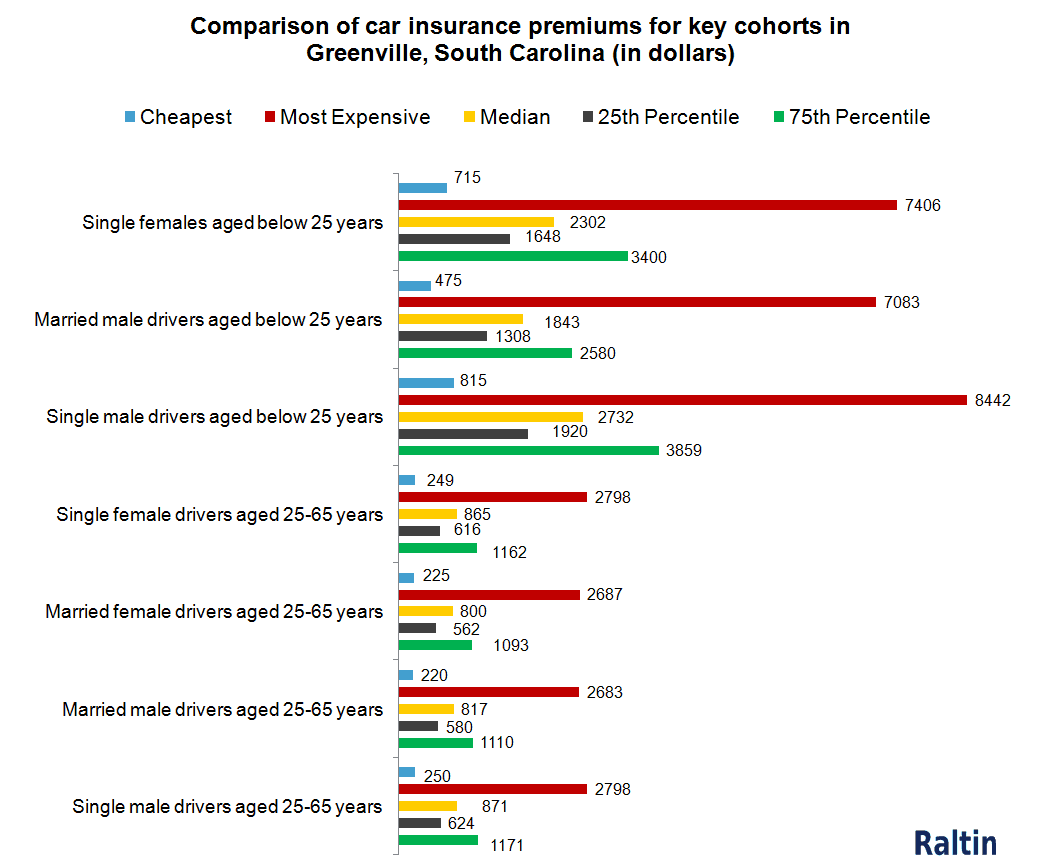

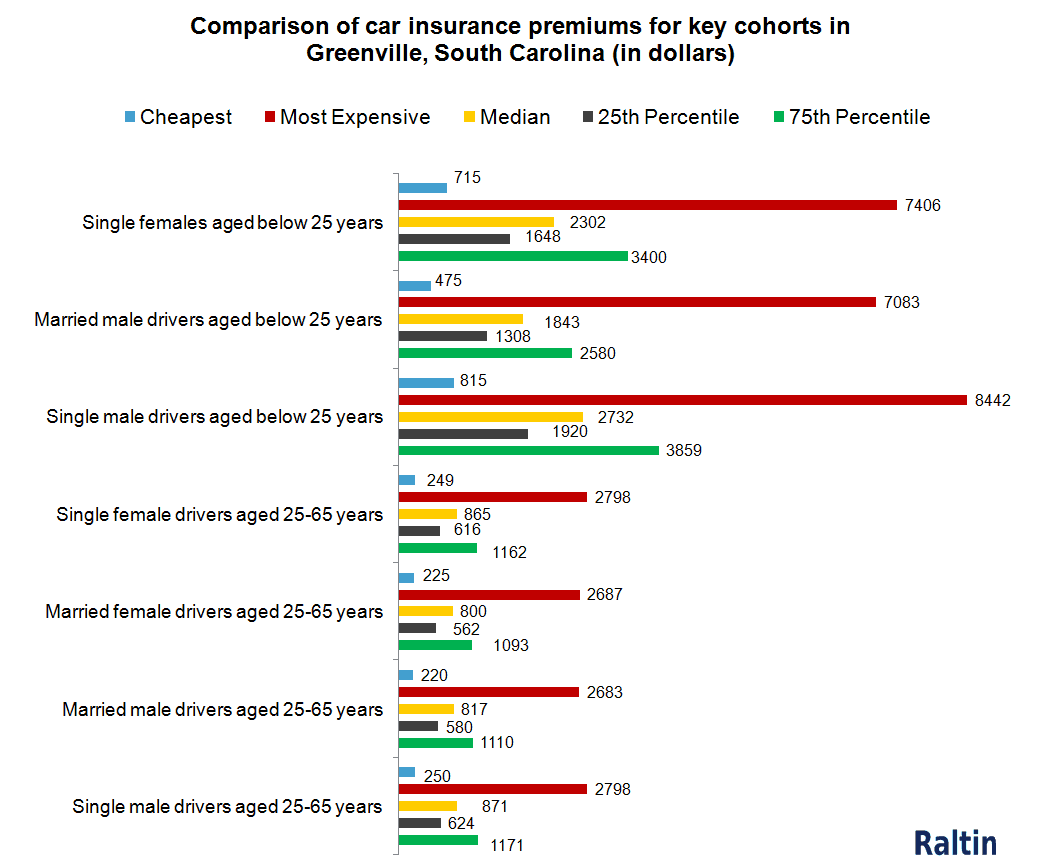

Average Car Insurance Rates Under 25 - Rating Walls