Average Cost Of Sr22 Insurance In Washington State

Average Cost Of SR22 Insurance In Washington State

What Is SR22 Insurance?

SR22 insurance is a type of liability insurance that may be required by the state. It is sometimes referred to as a “certificate of financial responsibility” and it is designed to show the state that the driver has the means to pay for any damage or injury that they may cause in an accident. SR22 insurance is usually required when a driver has had their license suspended or revoked due to certain violations, such as, a DUI or DWI. The SR22 insurance must be maintained for a specific period of time, and if it is not, the driver’s license may be suspended or revoked again.

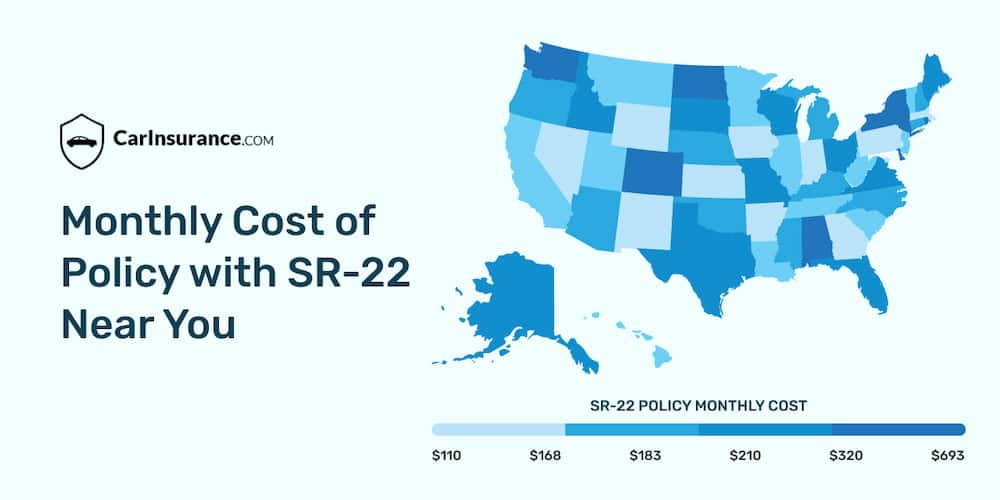

How Much Does SR22 Insurance Cost In Washington State?

The cost of SR22 insurance in Washington State varies depending on a number of factors, such as, the driver’s age, driving record and the type of vehicle they drive. Generally, however, the cost of SR22 insurance in Washington State is relatively low compared to other states. The average cost of SR22 insurance in Washington State is around $150 per year, but it can range from as low as $90 to as high as $200. It is important to shop around and compare quotes from different insurers to get the best rate possible.

What Is The Difference Between SR22 Insurance And Regular Auto Insurance?

The main difference between SR22 insurance and regular auto insurance is that SR22 insurance is required for those who have had their license suspended or revoked due to certain violations, whereas regular auto insurance is not. SR22 insurance can also be more expensive than regular auto insurance, as it is required for a specific period of time. SR22 insurance is usually required for three years, but it can be required for up to five years depending on the violation.

What Are The Benefits Of SR22 Insurance?

The main benefit of SR22 insurance is that it allows drivers who have had their license suspended or revoked to reinstate their license and get back on the road. It also shows the state that the driver is financially responsible and can pay for any damages or injuries that they may cause in an accident. SR22 insurance can also help to reduce a driver’s car insurance rates, as it shows the insurer that the driver is taking responsibility for their actions.

What Are The Drawbacks Of SR22 Insurance?

The main drawback of SR22 insurance is that it can be more expensive than regular auto insurance. It is also important to remember that if the SR22 insurance is not maintained for the required period of time, the driver’s license may be suspended or revoked again. Another drawback of SR22 insurance is that it is required in all states, so if a driver moves to another state, they will still be required to maintain the SR22 insurance.

Conclusion

SR22 insurance is a type of liability insurance that is required for those who have had their license suspended or revoked due to certain violations. The cost of SR22 insurance in Washington State is usually relatively low, and the benefits of SR22 insurance include allowing drivers to reinstate their license and reducing car insurance rates. The drawbacks of SR22 insurance include the fact that it can be more expensive than regular auto insurance and it is required in all states. It is important to shop around and compare quotes from different insurers to get the best rate possible.

The CHEAPEST, non Owner SR22 Insurance! Only $15 | maricehatmaker's Blog

Sr22 Insurance Wa / What Is Sr22 Insurance And Who Needs It 1st Rate

Getting The Best Sr-22 Insurance Options For 2022 - Benzinga To Work

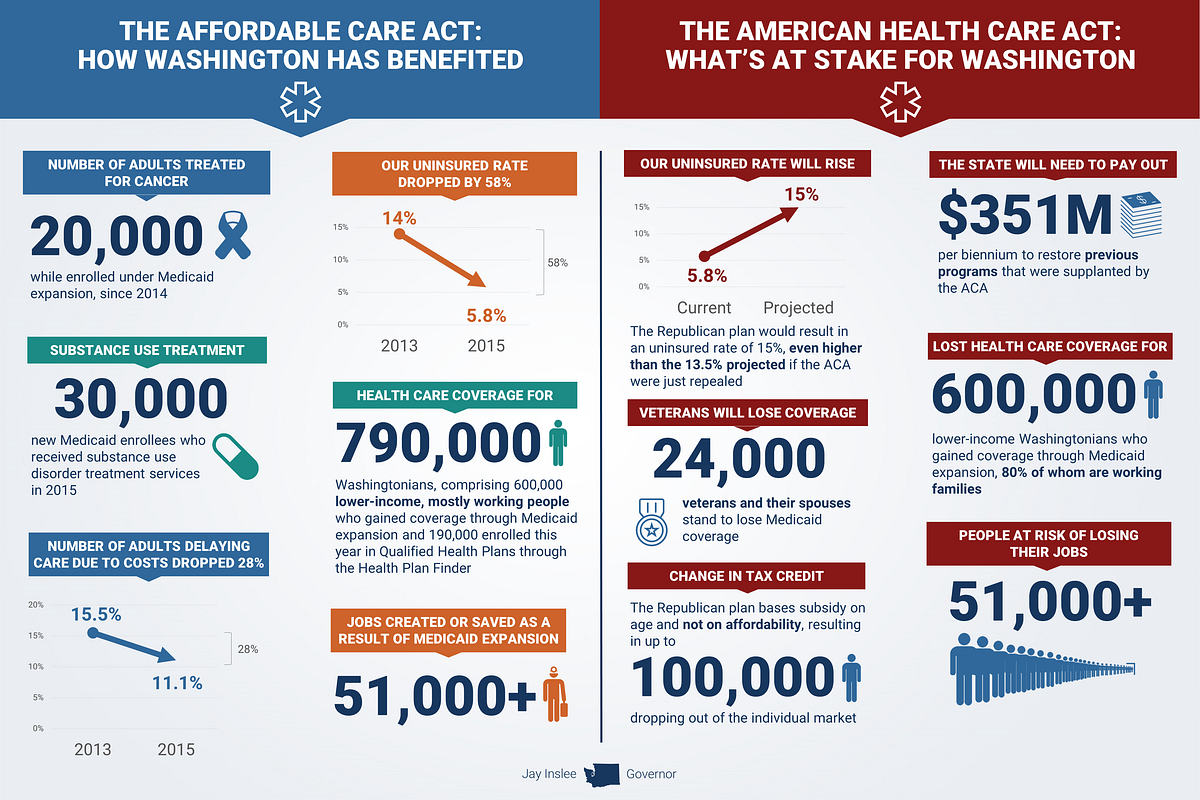

Less coverage, higher cost – Washington State Governor’s Office – Medium

How Much Does Sr22 Insurance Cost : What To Do If Your Sr22 Insurance