Third Party Property Damage Coverage

What is Third Party Property Damage Coverage?

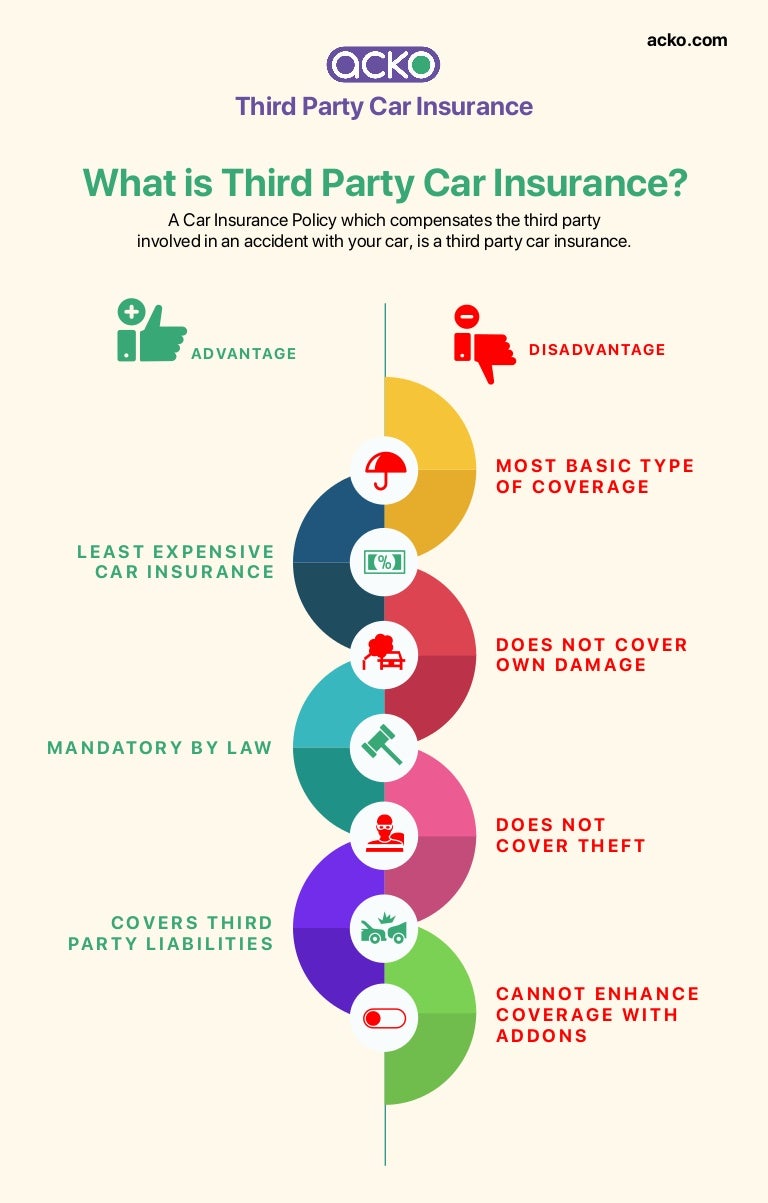

Third Party Property Damage Coverage, also known as Liability Coverage, is one of the most important types of insurance coverage to have. It provides protection against financial losses that may occur as a result of property damage, bodily injury, and/or death caused by the insured party. It is important to note that Liability Coverage does not cover the insured party’s property; it only covers the property of others.

Third Party Property Damage Coverage is a must-have for all individuals and businesses involved in any kind of activity that has a potential for causing property damage or injury to a third party, such as a business owner or even a pedestrian. It is important to note that this coverage does not provide protection for any kind of intentional damage or injury caused by the insured party.

What Does Third Party Property Damage Coverage Include?

Third Party Property Damage Coverage generally includes coverage for the following: medical expenses, repair costs, and legal costs associated with the damage or injury caused by the insured party. In addition, it also includes coverage for any property damage caused by the insured party, including damage to vehicles, buildings, and other personal property. It is important to note that this coverage does not include coverage for any kind of intentional damage or injury caused by the insured party.

What Are the Benefits of Having Third Party Property Damage Coverage?

The most important benefit of having Third Party Property Damage Coverage is that it provides protection against financial losses that may occur as a result of property damage, bodily injury, and/or death caused by the insured party. This type of coverage also provides protection against legal costs associated with any lawsuits that may arise as a result of the damage or injury caused by the insured party. In addition, Liability Coverage can provide peace of mind in knowing that you are financially protected in the event of an accident or injury caused by the insured party.

When Should You Purchase Third Party Property Damage Coverage?

It is important to understand that Third Party Property Damage Coverage should be purchased at the same time as your other types of insurance coverage. This is because it is essential to have this type of coverage in order to provide protection against any financial losses that may occur as a result of property damage, bodily injury, and/or death caused by the insured party. It is also important to note that this type of coverage does not provide protection for any kind of intentional damage or injury caused by the insured party.

Conclusion

Third Party Property Damage Coverage is an essential part of any insurance policy, as it provides protection against financial losses that may occur as a result of property damage, bodily injury, and/or death caused by the insured party. It is important to note that this coverage does not provide protection for any kind of intentional damage or injury caused by the insured party. It is also important to purchase this type of coverage at the same time as your other types of insurance coverage in order to ensure you are fully protected.

Third Party Property Damage Cover - PROFRTY

Third Party Property Car Insurance | iSelect

Third Party Property Damage Liability (TPPD Insurance) Explained

Third Party Property Car Insurance Quote - PROFRTY

Acko Car Third Party Insurance / Which is best third party insurance or