Learn More About Short Term Insurance

What Is Short Term Insurance?

Short term insurance is a type of insurance that provides coverage for a specific amount of time. It is designed to provide protection for an individual or a business against financial losses due to unexpected events. The length of coverage can range from a few days up to one year. Depending on the type of insurance and the length of coverage, premiums can be quite affordable. Short term insurance is typically used to cover temporary needs such as medical expenses, car repairs, travel costs, or other unexpected expenses.

Types of Short Term Insurance

The most common types of short term insurance are health insurance, life insurance, travel insurance, and auto insurance. Health insurance covers medical bills, hospital stays, and other health-related expenses. Life insurance provides coverage for death, disability, or other end-of-life situations. Travel insurance covers the costs of travel-related expenses such as medical bills, baggage loss, and other unforeseen events. Auto insurance covers damages to your vehicle caused by an accident or theft.

Benefits of Short Term Insurance

Short term insurance has several benefits. First, it provides coverage for a specific period of time and can be tailored to fit your specific needs. Secondly, it is more affordable than longer-term insurance policies. Third, it is easier to get a short-term policy than a longer-term policy. Fourth, it is flexible and can be adjusted to fit your budget. Finally, it can provide you with peace of mind knowing that you are protected in the event of an emergency.

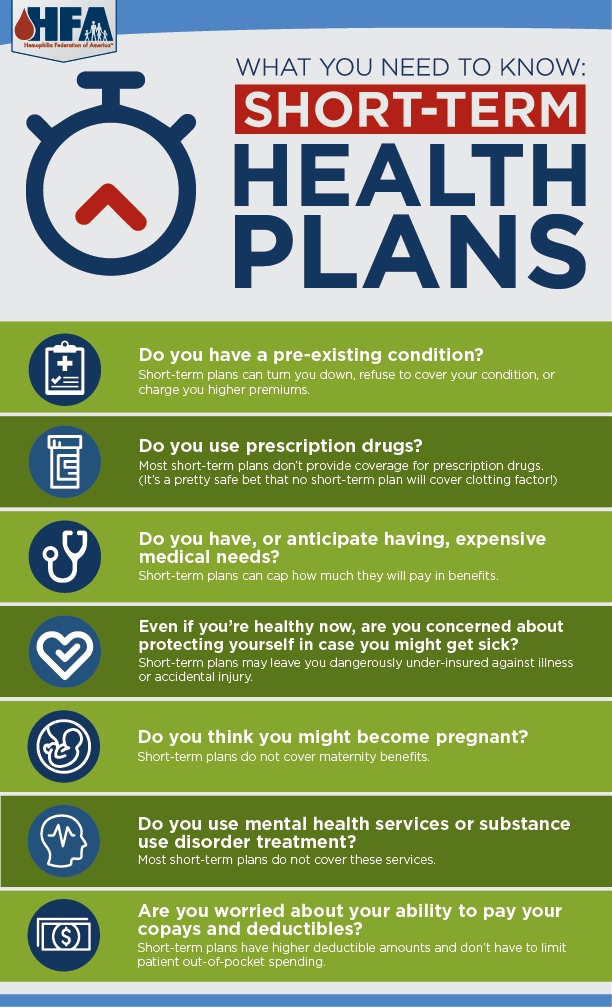

Things to Consider When Choosing a Short Term Insurance Policy

When choosing a short term insurance policy, it is important to consider your needs and budget. Make sure you understand the coverage you are getting and the length of time it will be in effect. Also, make sure you understand the different types of policies available and how they may affect your premiums. Additionally, it is important to research the company and make sure they are reputable and reliable.

Conclusion

Short term insurance can be a great way to provide protection for yourself or your business. It is affordable, flexible, and can be tailored to your specific needs. However, it is important to understand the different types of policies available and research the company before making a decision. By researching the company and understanding your needs, you can find the best policy for you.

Best Short Term Health Insurance | Buy Short Term Health Insurance

Caring For Your Valuables

Waiting Periods for Short Term Health Insurance Plan Review

Short-term insurance 101 | Fin24

Short Term Health Insurance And Pre Existing Conditions