Adding Provisional Driver To Insurance

Wednesday, July 12, 2023

Edit

Adding Provisional Driver To Insurance

What Is Provisional Driver?

A provisional driver is someone who has recently been issued a license to operate a motor vehicle. They are typically granted a license after they have completed a driver's education course or passed a driving test. They are often inexperienced drivers and may not have the same privileges as a fully licensed driver. For example, provisional drivers may be restricted from driving at night or in certain areas. Additionally, provisional drivers may be subject to increased insurance premiums.

Why Add Provisional Driver To Insurance?

Adding a provisional driver to your insurance policy can help protect you in the event of an accident. This is especially important if the provisional driver will be operating the vehicle on a regular basis. The insurance company will consider the driver's experience level when calculating the policy premium and may offer a discounted rate as a result. Additionally, by adding the driver to the policy, you are protecting yourself from any legal or financial liability that may arise from an accident.

How To Add Provisional Driver To Insurance?

If you are looking to add a provisional driver to your insurance policy, the process is relatively straightforward. First, you will need to contact the insurance company and provide them with the driver's information. This includes the driver's name, address, phone number, and driver's license number. You will also need to provide the insurance company with information regarding the driver's driving experience, such as the length of time they have been driving and any driving courses they have taken.

Once you have provided the insurance company with the necessary information, they will review the driver's record and determine the cost of the policy. The cost of the policy will depend on a variety of factors, including the driver's experience level and driving record. Once the policy has been approved, you will be able to add the provisional driver to your policy.

What To Consider Before Adding Provisional Driver To Insurance?

Before adding a provisional driver to your insurance policy, it is important to consider a few things. First, you should make sure that the provisional driver is responsible and experienced enough to operate a motor vehicle. It is also important to consider the cost of the policy, as the addition of a provisional driver may increase your premiums. Additionally, you should make sure that the driver is aware of any restrictions that may be placed on them, such as restrictions on the time of day or type of vehicle they can drive.

Conclusion

Adding a provisional driver to your insurance policy is a great way to protect yourself in the event of an accident. However, it is important to consider a few things before adding a provisional driver to your policy, such as the driver's experience level and the cost of the policy. By taking the time to consider these factors, you can ensure that you are properly protected in the event of an accident.

2017 Driver Insurance Policy | Adding A Young Driver To Your Auto

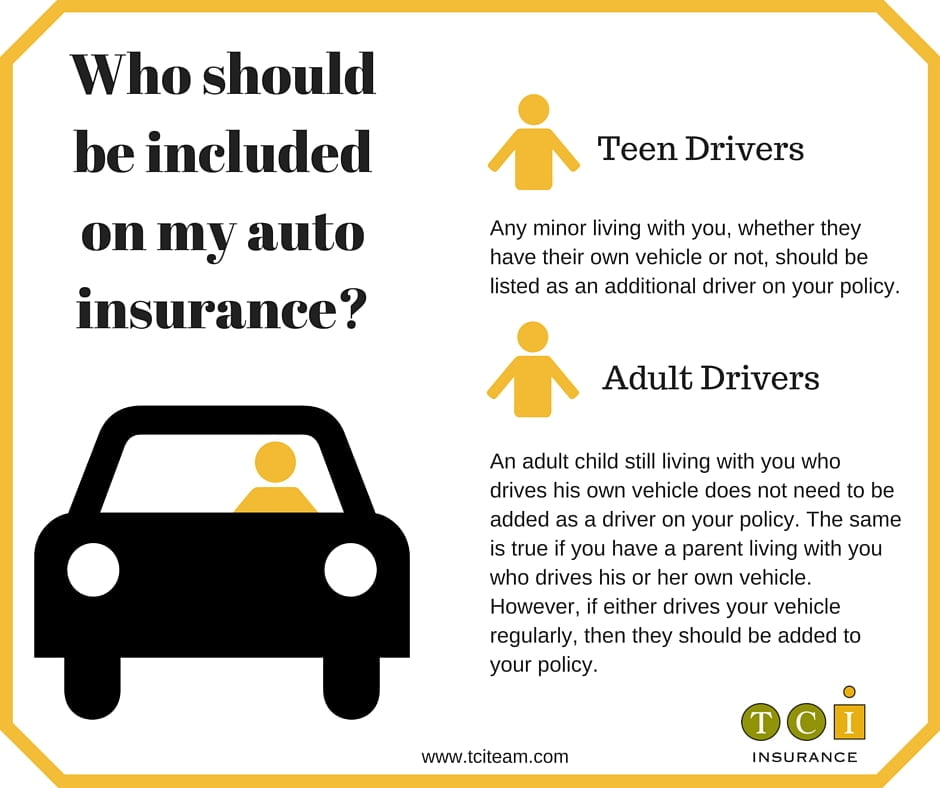

Adding Drivers - TCI Insurance

Making Provisional Insurance More Affordable - 2017 Vehicle Insurance

Adding a Driver To Car Insurance - 2022 Guide : Motorcycling 2022

PPT - DRIVER EDUCATION FORUM 5/10/2007 SFC. T. ARCARO PowerPoint