Non Standard Auto Insurance Research

What is Non Standard Auto Insurance?

Non-standard auto insurance is a type of car insurance coverage for drivers who are considered higher risk by the insurance company. Drivers who are seen as higher risk are those who have had multiple traffic violations, multiple accidents or have received a DUI or DWI. These drivers may be required to purchase non-standard auto insurance in order to cover the higher risk they represent to the insurance company. Non-standard auto insurance is not offered by all insurance companies and may be more expensive than standard auto insurance.

What Factors Determine Non Standard Auto Insurance Rates?

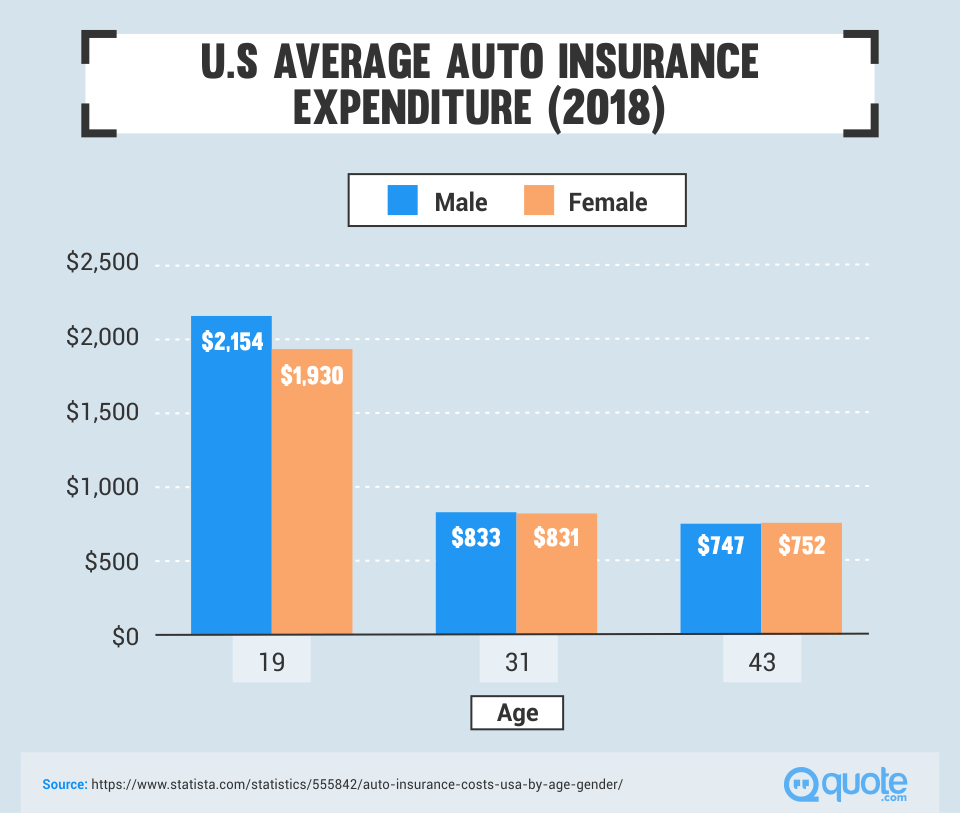

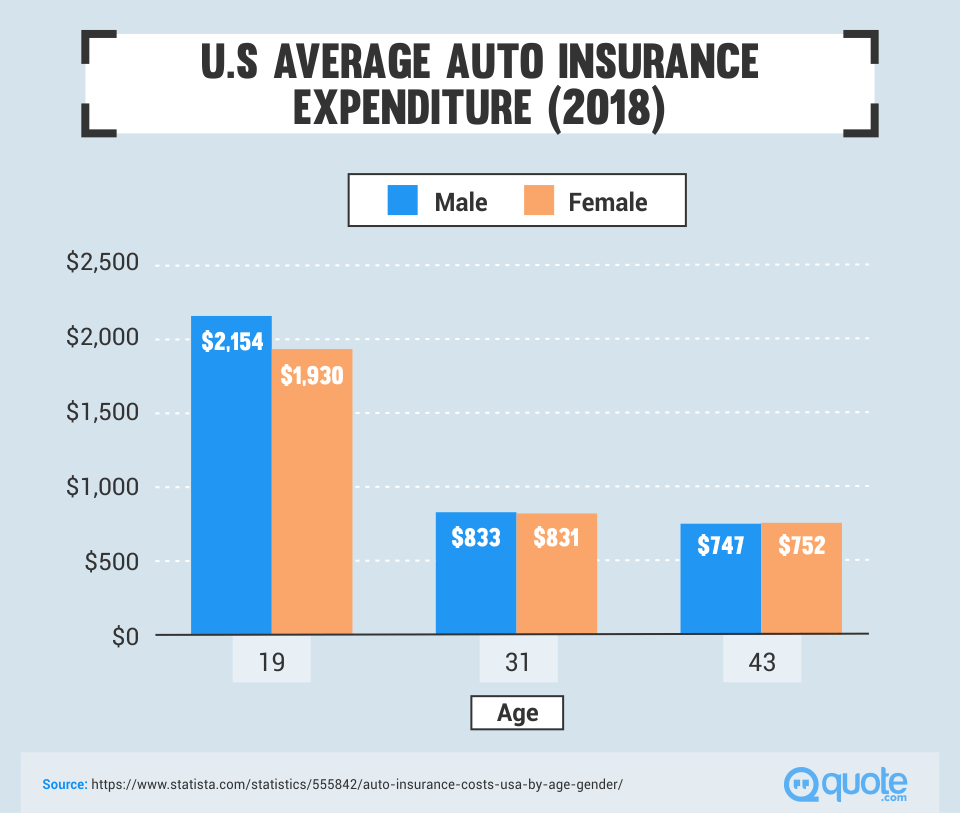

There are several factors that can determine the cost of non-standard auto insurance. These include the driver’s age, driving history, credit score, and the type of car insured. Drivers who are younger, have a poor driving record, or have bad credit are likely to pay higher premiums for non-standard auto insurance. Additionally, cars that are more expensive or have more horsepower will also need to be insured with non-standard policies.

How to Research Non Standard Auto Insurance?

When researching non-standard auto insurance, it is important to compare quotes from multiple insurance companies. This allows you to find the best rate for your particular situation. It is also important to ask about any discounts that might be available for things like taking a defensive driving course or being a safe driver. Additionally, it is important to make sure that the policy you are considering has all of the coverage that you need. It is also a good idea to research the reputation of the insurance company you are considering.

What Are the Benefits of Non Standard Auto Insurance?

One of the main benefits of non-standard auto insurance is that it offers coverage for drivers who may not be able to get standard auto insurance. This can be especially helpful for drivers who have had multiple accidents or moving violations. Additionally, non-standard auto insurance typically offers more flexible coverage plans that can be tailored to meet the individual needs of the driver. This can be beneficial for drivers who need coverage for a particular type of car or certain types of drivers.

Where to Get Non Standard Auto Insurance?

Non-standard auto insurance can be purchased from insurance companies that specialize in this type of coverage. These companies typically offer competitive rates and can provide coverage for a wide variety of drivers. Additionally, many insurance agents can help drivers find the best coverage for their particular situation. It is important to compare multiple companies and policies to ensure that you are getting the best coverage for your needs.

Conclusion

Non-standard auto insurance is a type of coverage designed for drivers who are considered higher risk by the insurance company. Factors such as age, driving history, and credit score can affect the cost of non-standard auto insurance. It is important to compare quotes from multiple companies and to ask about any discounts that might be available. Non-standard auto insurance can provide coverage for drivers who are unable to get standard auto insurance, as well as offering more flexible coverage plans.

Car Insurance Denied – Now What? | quote.com

(PDF) Modeling the Frequency of Auto Insurance Claims by Means of

Import Car Insurance For Imported Cars & Vehicles in Australia | iSelect

Call Us

2012 Mitsubishi Outlander Sport grabs IIHS Top Safety Pick | Autoblog