Is It Worth Buying Gap Insurance

Is It Worth Buying Gap Insurance?

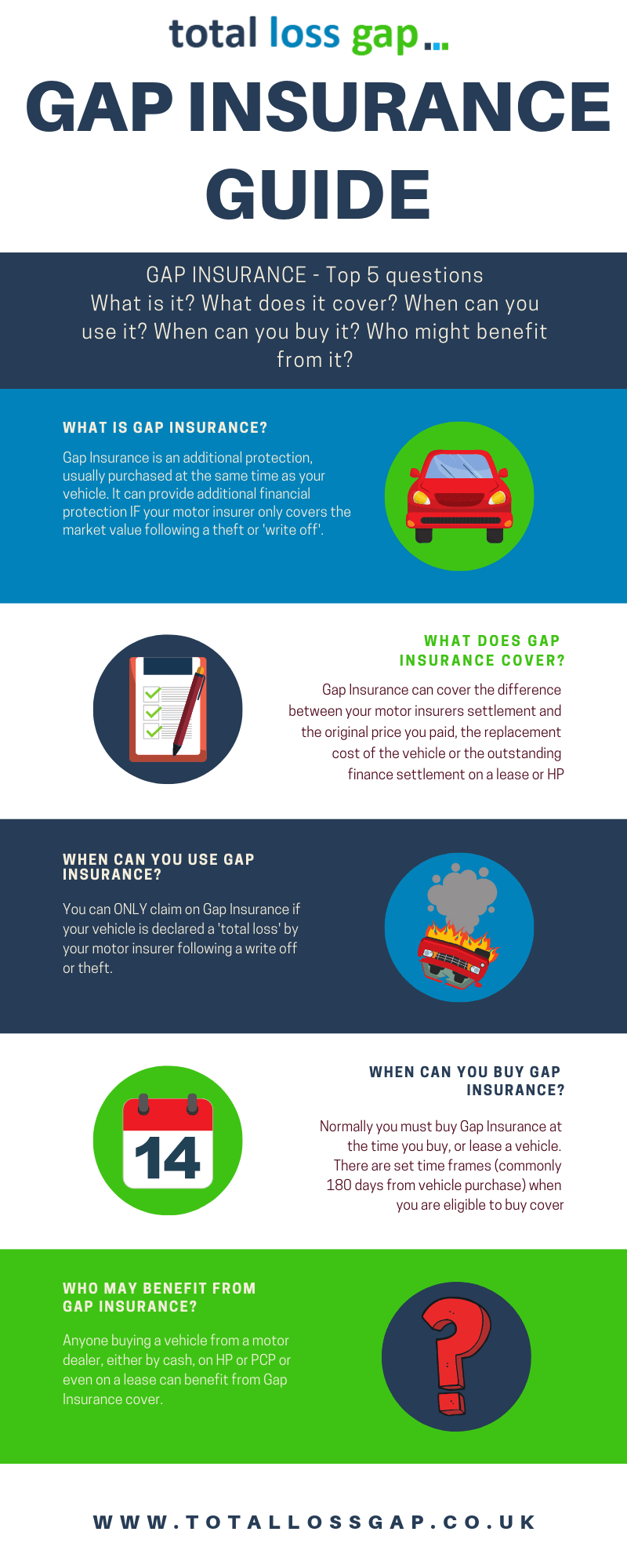

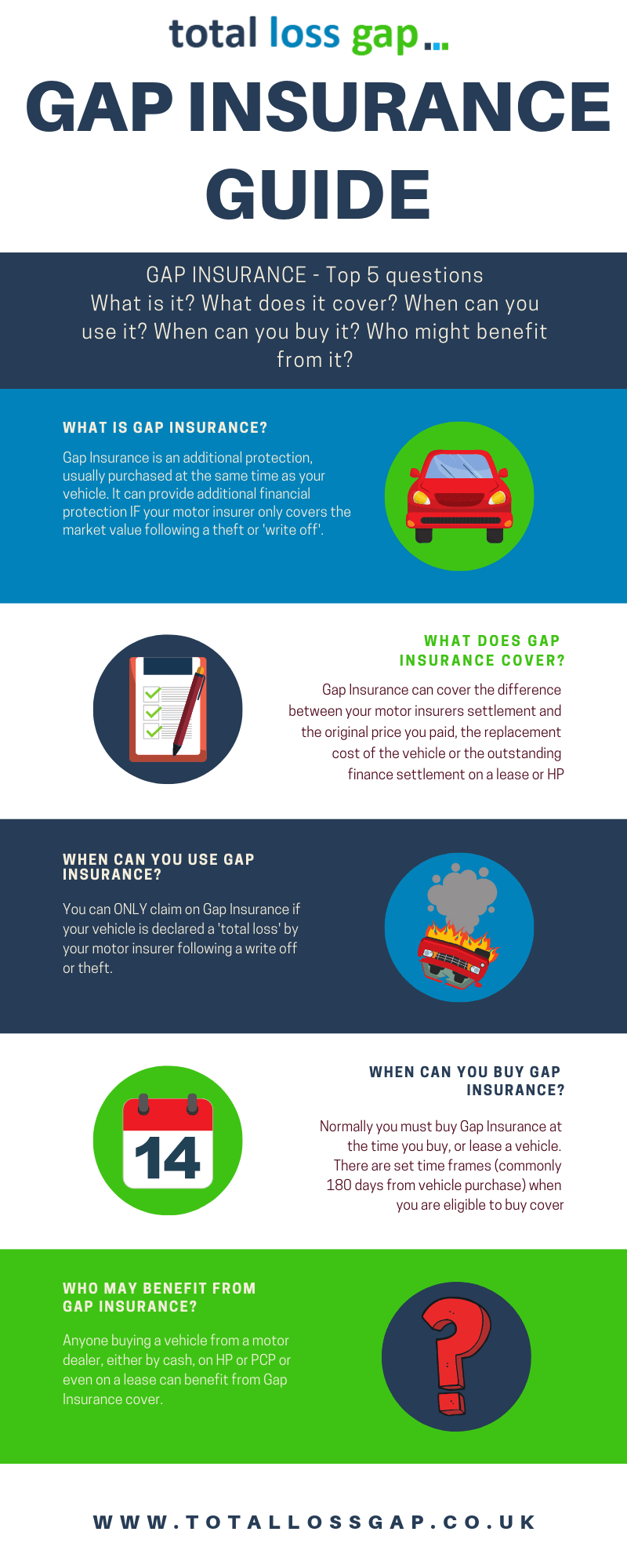

What Is Gap Insurance?

Gap insurance, also known as Guaranteed Asset Protection, is an optional form of car insurance that helps cover the difference between the amount you owe on a car loan and the amount your car is worth in the event of an accident. Gap insurance can help protect you financially if your car is totaled or stolen. It can also provide additional protection if you have a loan with a high interest rate.

Why Should I Consider Gap Insurance?

Gap insurance can provide peace of mind if you have an expensive car loan and you're worried about being stuck with a large bill if your car is totaled or stolen. It can also provide additional protection if you have a loan with a high interest rate. For example, if you have a loan with a 15% interest rate and your car is totaled, you may be stuck paying the remaining balance of the loan even if the car is worth less than what you owe. Gap insurance can help cover that difference, allowing you to pay off the loan and move on with your life.

What Are the Benefits of Gap Insurance?

The biggest benefit of gap insurance is that it can provide additional financial protection if your car is totaled or stolen. It can also provide protection if you have a loan with a high interest rate, as it can help cover the difference between what you owe and what your car is worth. Additionally, gap insurance can also provide protection if your car is leased or if you are upside down on your loan.

Are There Any Drawbacks to Gap Insurance?

One potential drawback to gap insurance is that it can be expensive. Depending on your loan and the value of your car, the cost of gap insurance can be hundreds or even thousands of dollars. Additionally, gap insurance may not be necessary if you have comprehensive and collision coverage on your car, as those types of coverage can provide similar protection. Therefore, it's important to weigh the costs and benefits of gap insurance before making a decision.

When Should I Buy Gap Insurance?

The best time to buy gap insurance is when you are taking out a loan on a new car. This is because gap insurance typically only covers loans that are less than a year old, so if you wait too long you may not be able to purchase it. Additionally, gap insurance is typically only available through your lender or car dealership, so it's important to check with them as soon as possible if you are interested in purchasing it.

Is It Worth Buying Gap Insurance?

The decision to purchase gap insurance is a personal one and should be based on your financial situation and the value of the car. If you have an expensive loan with a high interest rate, or if you are leasing or upside down on your loan, gap insurance may be worth considering. However, if you have comprehensive and collision coverage, or if you have a loan with a low interest rate, gap insurance may not be necessary. Ultimately, it's important to weigh the costs and benefits of gap insurance before making a decision.

Is It Worth Getting Gap Insurance On A Pcp - TRAVELVOS

Should I Buy Gap Insurance : What Is GAP Insurance And When Should

Buying A Car Gap Insurance ~ designologer

Which Insurance Companies Offer Gap Insurance

Gap Insurance Meaning Auto Gap, Sometimes Called Gap Insurance, Helps

.jpg)