How Does The Motor Insurance Bureau Work

How Does The Motor Insurance Bureau Work?

The Motor Insurance Bureau (MIB) is an organization that was set up to provide compensation to victims of road traffic accidents that involve a driver who is either uninsured or untraced. The MIB ensures that victims of such accidents get the compensation they deserve and is funded by an insurance levy placed on all motor insurers operating in the UK. The MIB operates across the UK, so anyone who has been injured in a road traffic accident involving an uninsured driver can make a claim to the MIB.

What Does The Motor Insurance Bureau Do?

The MIB’s main purpose is to offer compensation to victims of road traffic accidents involving uninsured and untraced drivers. They also administer the Untraced Drivers Agreement and the Uninsured Drivers Agreement. These are agreements between the MIB and all motor insurers in the UK, and are designed to provide compensation for victims of road traffic accidents involving uninsured and untraced drivers. The MIB also works to reduce the number of uninsured drivers on the roads, by providing information and advice to motor insurers and the public.

How Does The Motor Insurance Bureau Work?

The MIB works by providing compensation to victims of road traffic accidents involving uninsured and untraced drivers. The MIB does this by assessing the claim and deciding the amount of compensation to be paid. The MIB then pays the compensation to the victim. In order to assess the claim, the MIB may need to contact the victim’s insurer, the police, the person responsible for the accident, and any other relevant parties.

How Do I Make A Claim To The MIB?

Making a claim to the MIB is relatively straightforward. The first step is to contact the MIB and provide details of the accident and the injured party. The MIB will then assess the claim and contact the victim’s insurer to discuss the claim and any other relevant parties. The MIB will then decide the amount of compensation to be paid to the victim and will pay the compensation directly to them.

What Can I Claim For?

The MIB can pay compensation for a variety of losses including medical expenses, loss of earnings, damage to property, and pain and suffering. The amount of compensation a victim can claim depends on the individual circumstances of the case. The MIB may also be able to provide other services such as medical treatment, legal advice, and assistance with finding alternative transport.

Conclusion

The Motor Insurance Bureau is a valuable resource for victims of road traffic accidents involving uninsured and untraced drivers. It provides compensation to victims and helps to reduce the number of uninsured drivers on the roads. If you have been injured in a road traffic accident involving an uninsured or untraced driver, you should contact the MIB to make a claim.

MIB Motor Insurers Bureau - How To Claim Compensation? ( 2021 ) UK

Motor Insurance Service, Pan India, Waheguru Auto Products | ID

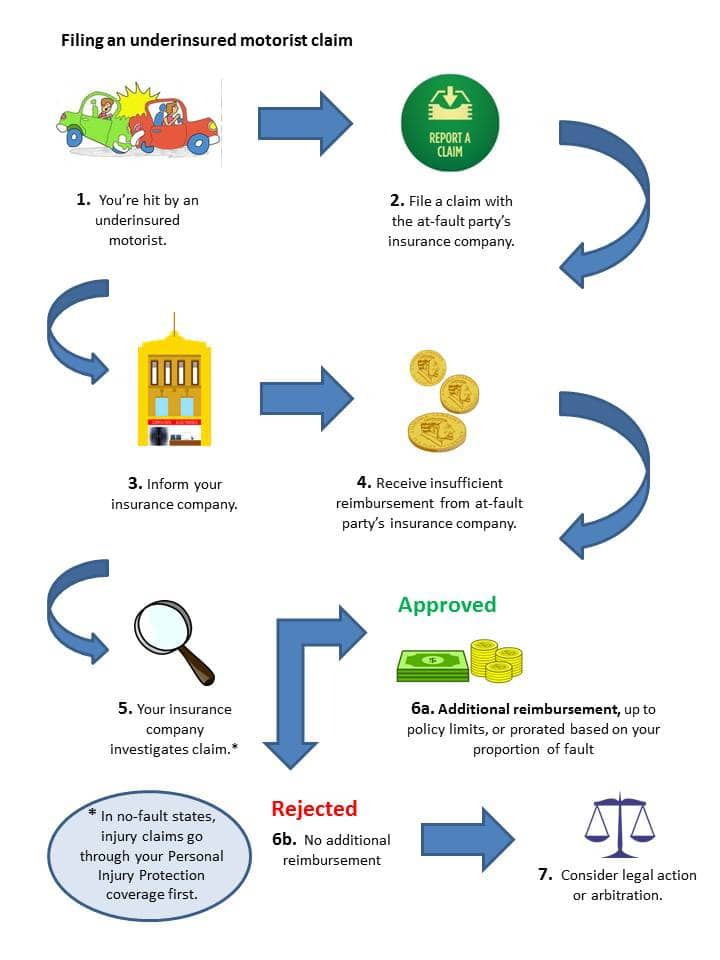

Uninsured and Underinsured Motorist Coverage (UM/UIM) and why you need it

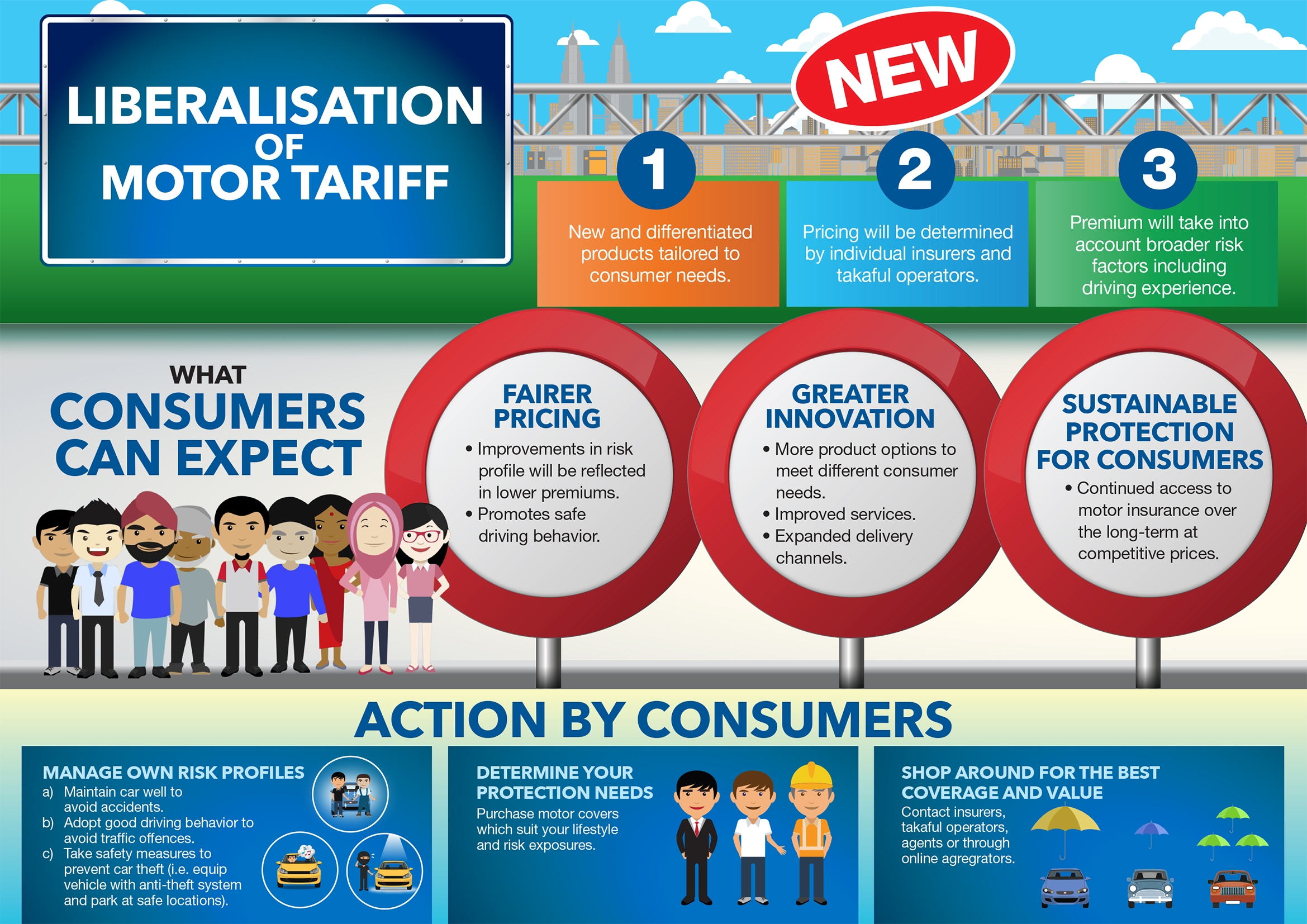

Liberalisation of comprehensive motor insurance – Bank Negara expects