Difference Between First And Third Party Insurance

The Difference Between First and Third Party Insurance

What Is First Party Insurance?

First party insurance is a type of coverage that insures the policyholder against losses that they may suffer. This type of insurance typically covers property damage, medical bills, and other losses that may arise as a result of an accident or other incident. It is usually purchased to cover the policyholder against financial losses that they might incur due to a claim. First party insurance is also known as “direct” or “personal” insurance.

What Is Third Party Insurance?

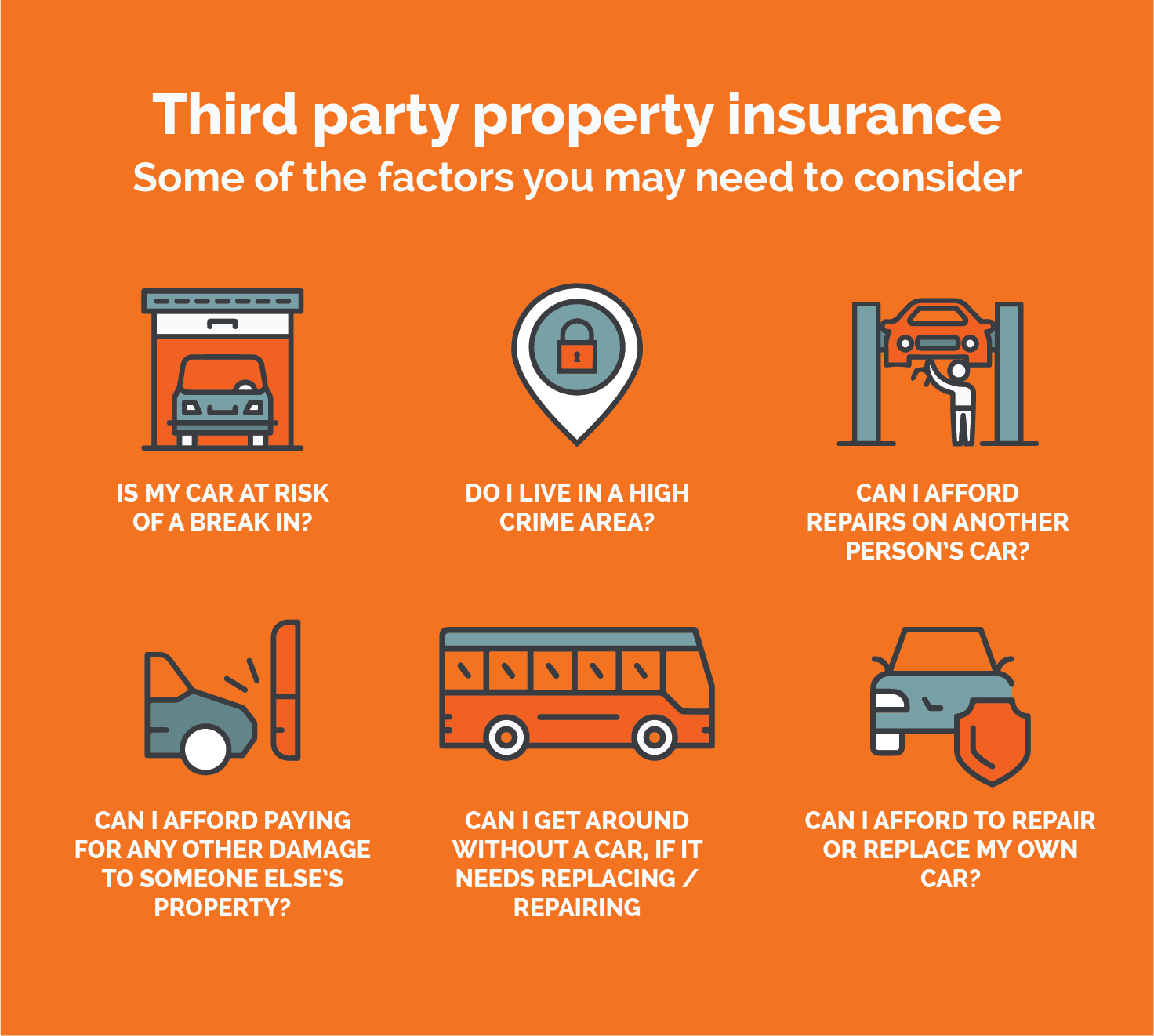

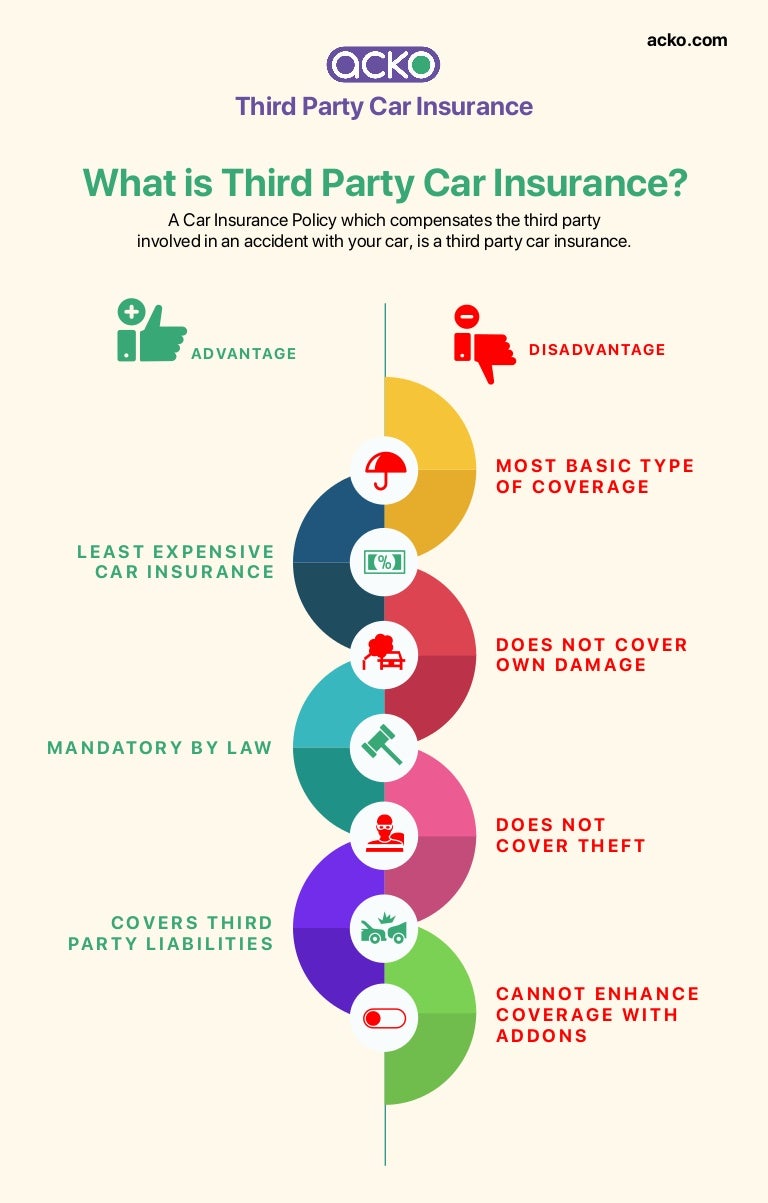

Third party insurance is a type of coverage that covers the policyholder against losses that may be suffered by a third party, such as another person or business. This type of insurance includes coverage for liability, property damage, and other losses that may arise from an accident or other incident. Third party insurance is also known as “indirect” or “business” insurance.

The Differences Between First and Third Party Insurance

The main difference between first and third party insurance is the type of losses they cover. First party insurance covers losses that the policyholder may suffer directly, while third party insurance covers losses that a third party may suffer. Another difference is the type of insurance coverage that is provided. First party insurance usually provides coverage for property damage, medical bills, and other losses, while third party insurance usually provides coverage for liability, property damage, and other losses.

Which Type of Insurance Is Right for You?

The type of insurance that is right for you will depend on your individual needs and circumstances. If you are looking for coverage for losses that you may suffer directly, then first party insurance may be the best option for you. On the other hand, if you are looking for coverage for losses that a third party may suffer, then third party insurance may be your best option. It is important to compare the different types of coverage offered by different insurance companies before making a decision.

Conclusion

The difference between first and third party insurance is the type of losses they cover. First party insurance covers losses that the policyholder may suffer directly, while third party insurance covers losses that a third party may suffer. The type of insurance that is right for you will depend on your individual needs and circumstances. It is important to compare the different types of coverage offered by different insurance companies before making a decision.

First Party और Third Party insurance क्या होता है, दोनों में अंतर तथा लाभ?

Difference between first and third party insurance information | Loss

What Is The Difference Between First-Party And Third-Party Insurance?

Acko Car Third Party Insurance / Which is best third party insurance or

The loss your car incurs is not covered by your insurance provider but