Average House Insurance Cost Per Month

How Much is the Average House Insurance Cost Per Month?

When it comes to protecting your home, it’s important to understand how much you can expect to pay each month. Homeowners insurance is one of the most important investments you can make, and the average house insurance cost per month can vary dramatically depending on a variety of factors. In this article, we’ll explore the average cost of homeowner’s insurance, what factors affect it, and how to save money on your policy.

Average House Insurance Cost Per Month

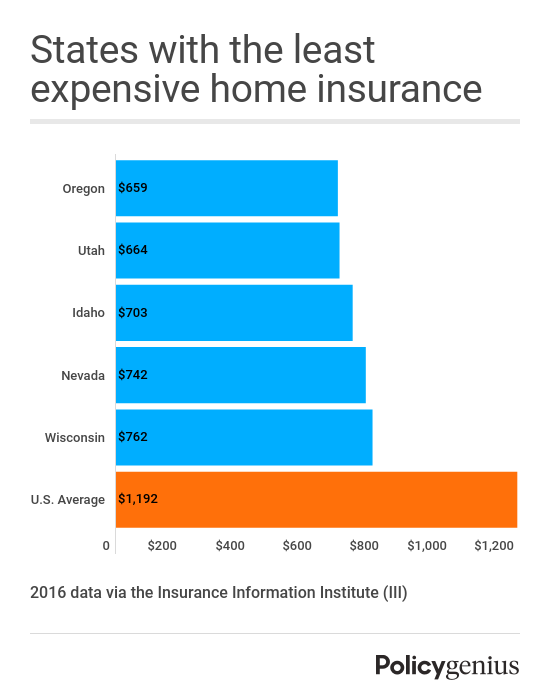

The average cost of homeowners insurance is around $1,000 per year, or about $80 per month. This varies significantly, however, depending on the size of your home, its age, the materials used to construct it, and the location. Homeowners in hurricane-prone areas, for example, may pay significantly more for their insurance than those in areas with less risk of natural disaster. The type of coverage you select, such as liability and medical payments, will also influence the cost of your policy.

Factors that Affect the Cost of Homeowners Insurance

Aside from location and coverage, there are other factors that can influence the cost of your policy, such as the condition of your home. If your home is in good condition, you may be eligible for discounts, while homes in need of repair or renovation may be subject to higher rates. The type of materials used to construct your home can also affect the cost of your policy. Homes built with more durable materials, such as brick or stone, are generally more expensive to insure than homes built with wood or other less durable materials.

How to Save Money on Homeowners Insurance

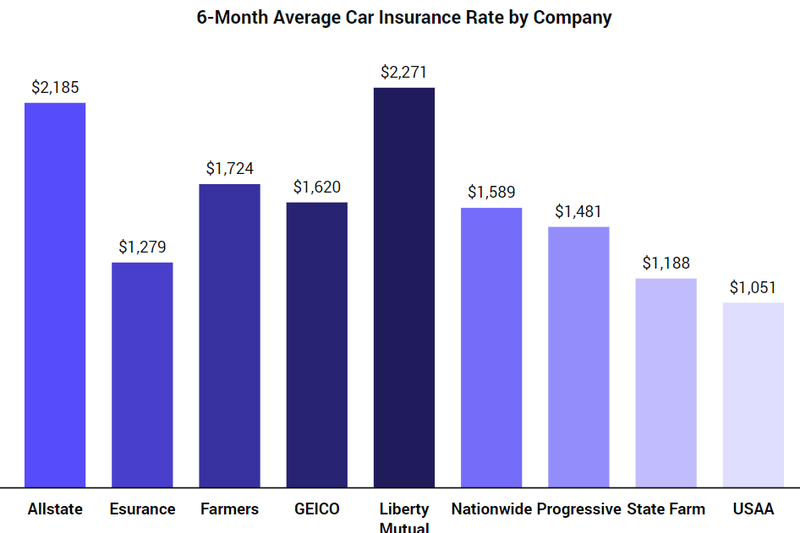

The good news is, there are ways to save money on your homeowners insurance policy. One way is to shop around for the best deal. Different insurance providers offer different rates, so it’s important to compare quotes from multiple providers to find the cheapest rate. In addition, many insurance companies offer discounts for things like home security systems, smoke detectors, and other safety features. Finally, you can also save money by raising your deductible. A higher deductible means a lower premium, but it also means you’ll pay more out-of-pocket if you ever need to file a claim.

Conclusion

The average house insurance cost per month can vary significantly depending on a variety of factors, such as the size of your home, its age, the materials used to construct it, and the location. There are also ways to save money on your policy, such as shopping around for the best deal, taking advantage of discounts, and raising your deductible. Ultimately, it’s important to understand the cost of homeowners insurance and take steps to ensure you’re getting the best deal.

Here's Why It Costs $1,204 a Month to Maintain the Average Home

Average Home Insurance Cost Per Month

Average Home Insurance Cost Per Month Ohio

Average Cost Of Home Insurance In Colorado – Home Sweet Home | Modern

Homeowners Insurance Cost