Ala Gap Insurance Terms And Conditions

Sunday, March 12, 2023

Edit

Ala Gap Insurance Terms And Conditions

What is GAP Insurance?

GAP insurance is a type of car insurance that covers the difference between what you owe on a vehicle loan and the vehicle's actual cash value in the event of a total loss. It's sometimes referred to as "loan/lease gap coverage" or "gap coverage." GAP insurance is important to have if you are financing a vehicle and owe more than it is worth. It can help protect you from having to pay a large out-of-pocket expense if the vehicle is totaled or stolen.

How Does GAP Insurance Work?

GAP insurance is a type of coverage that pays the difference between the actual cash value (ACV) of a vehicle and the amount owed on a loan or lease. The ACV of a vehicle is the current market value of a vehicle, which can be determined by factors such as the year, make, model, condition, mileage, and features.

If a vehicle is totaled or stolen and the insurer pays the ACV of the vehicle, the owner may still owe money on the loan or lease balance. This is the "gap" that GAP insurance covers. Without GAP insurance, the owner would be responsible for paying the difference between the ACV and the loan or lease balance.

When Do I Need GAP Insurance?

GAP insurance is important to have if you are financing a vehicle and owe more than it is worth. It can help protect you from having to pay a large out-of-pocket expense if the vehicle is totaled or stolen. This can be the case if you are financing a vehicle with a loan term that is longer than the vehicle's expected life, or if you make a small down payment.

GAP insurance can also be important if you lease a vehicle. Leasing companies often require GAP insurance and charge a fee for it.

How Much Does GAP Insurance Cost?

The cost of GAP insurance varies depending on the insurer and the specific policy. Some insurers may offer GAP insurance as part of an auto insurance policy for an additional fee. Other insurers may offer GAP insurance as a stand-alone policy. The cost of GAP insurance may also depend on the make and model of the vehicle and the coverage limits.

What Does GAP Insurance Not Cover?

GAP insurance does not cover any additional costs beyond the difference between the ACV of the vehicle and the amount owed on a loan or lease. GAP insurance does not cover other expenses such as towing, rental car fees, or other out-of-pocket expenses associated with a vehicle accident. GAP insurance also does not cover any remaining loan or lease payments after a total loss.

What Are the Benefits of GAP Insurance?

The main benefit of GAP insurance is that it can provide financial protection if a vehicle is totaled or stolen. Without GAP insurance, the owner would be responsible for paying the difference between the ACV and the loan or lease balance.

GAP insurance can also provide peace of mind, knowing that if something happens to your vehicle, you won't be stuck with a large out-of-pocket expense. Additionally, GAP insurance can help free up some of your financial resources that can be used for other expenses.

ALA Gap insurance | Audi-Sport.net

ALA Gap insurance | Audi-Sport.net

ALA Gap insurance | Audi-Sport.net

Buying A Car Gap Insurance ~ designologer

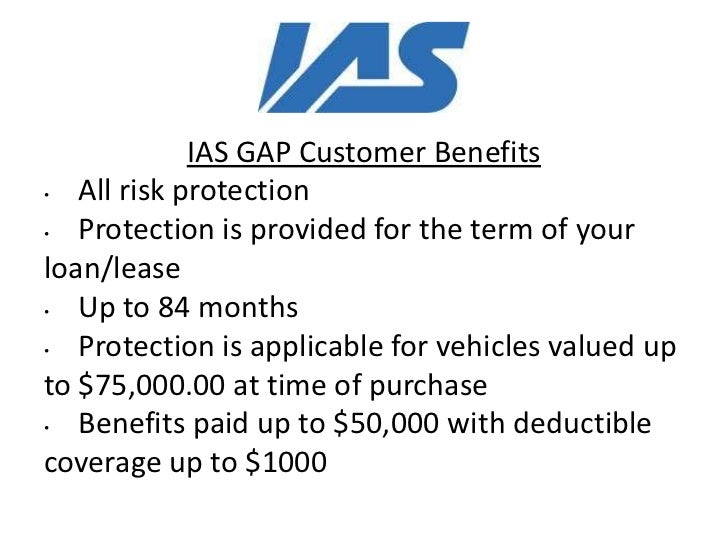

Ias gap insurance