Benefits Of No Fault Auto Insurance

Benefits Of No Fault Auto Insurance

What Is No Fault Auto Insurance

No fault auto insurance is a type of coverage that protects you, the insured, from being held liable for any damages or injuries that occur as a result of a car accident. In a no-fault system, each party's insurance company pays for their own losses, regardless of who caused the accident. This type of coverage is designed to protect the insured from being held liable for any damages or injuries that occur. It also provides coverage for medical expenses, lost wages, and other costs associated with an accident.

Benefits of No Fault Auto Insurance

No fault auto insurance is considered one of the most important types of coverage for drivers. It provides many benefits, including:

- It reduces the chances of becoming involved in a lawsuit, since you won't be held liable for any accidents that occur.

- It provides coverage for medical expenses and lost wages, which can help you recover from an accident faster.

- It helps reduce the overall costs associated with an accident, since each party's insurance company pays for their own losses.

- It helps protect you from financial hardship in the event of an accident.

- It helps ensure that you are able to receive the medical care you need following an accident.

Things to Consider When Choosing No Fault Auto Insurance

When choosing no fault auto insurance, it is important to consider several factors. These include:

- The type of coverage you need: Different types of coverage are available, including liability, uninsured/underinsured motorist, collision, and comprehensive.

- The cost of the coverage: Different insurers offer different rates, so it is important to compare prices to find the best deal.

- The amount of coverage: It is important to make sure you have sufficient coverage to protect you in the event of an accident.

- The insurer's reputation: It is important to make sure you are dealing with a reputable insurer who can provide you with the protection you need.

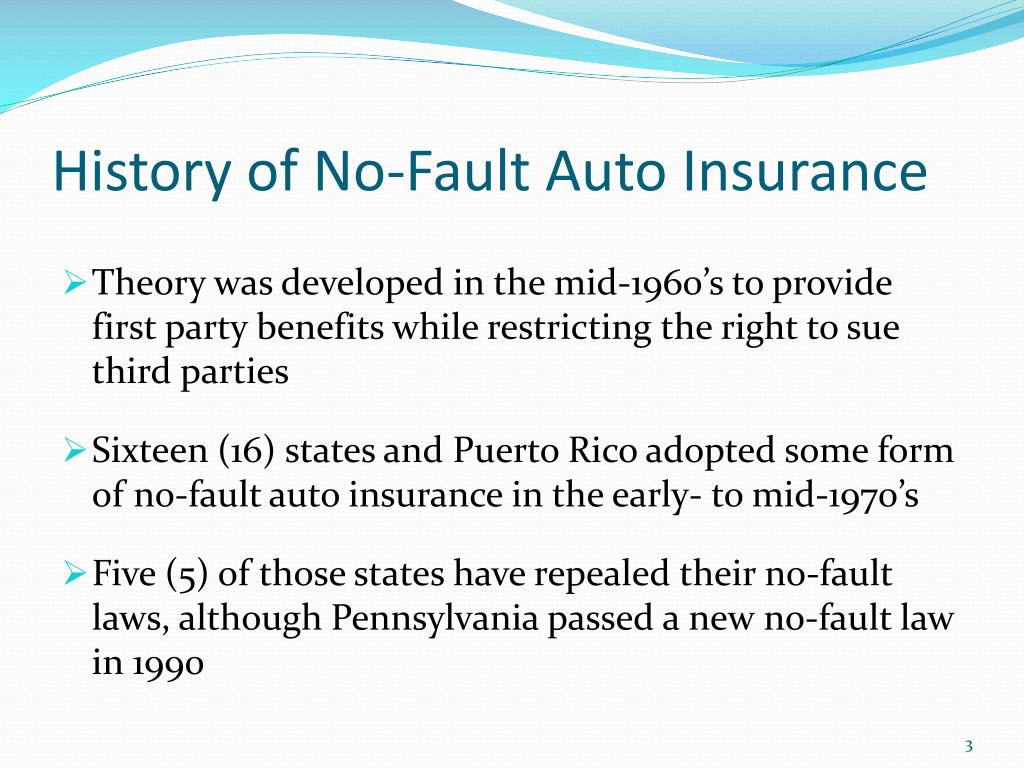

No Fault Auto Insurance Laws by State

No fault auto insurance laws vary by state. In some states, such as Florida, New York, and Michigan, no fault auto insurance is mandatory. In other states, such as California, no fault auto insurance is optional. It is important to check with your state's insurance department to find out what the requirements are in your state.

Conclusion

No fault auto insurance offers many benefits to drivers. It helps reduce the chances of becoming involved in a lawsuit, provides coverage for medical expenses and lost wages, and helps protect you from financial hardship in the event of an accident. It is important to consider the type of coverage you need, the cost of the coverage, the amount of coverage, and the insurer's reputation when choosing no fault auto insurance.

Michigan No Fault Benefit Overview

BC Drivers Deserve Better Auto Insurance

PPT - Reserving for Unlimited Long-Term No-Fault (PIP) Claims

auto-no-fault – MiCare Matters

Michigan No Fault insurance system is the nation's best for providing