21st Century Car Insurance Coronavirus

Thursday, February 2, 2023

Edit

21st Century Car Insurance and Coronavirus

The coronavirus pandemic has caused massive disruption to the global economy. As a result, the car insurance industry is having to adapt to the new normal. With the majority of people having to stay home for the foreseeable future, there are concerns about how car insurance will change in the 21st century.

How is the Car Insurance Industry Changing?

The car insurance industry is facing unprecedented changes due to the coronavirus pandemic. With lockdowns and travel restrictions being put in place all around the world, the traditional car insurance model is no longer viable. Insurance companies are having to adapt to the new normal and come up with innovative ways to keep drivers covered.

One of the biggest changes to the industry has been the introduction of telematics-based car insurance. This type of insurance relies on data collected from a vehicle's onboard diagnostics system in order to determine the risk profile of a driver. The data is then used to calculate premiums, allowing insurance companies to offer tailored coverage for each individual driver.

What Does This Mean for 21st Century Drivers?

The introduction of telematics-based car insurance means that 21st century drivers are no longer tied to the traditional car insurance model. Drivers now have more options when it comes to their coverage, allowing them to choose a plan that best suits their individual needs. This can help drivers save money on their premiums and ensure that they are properly protected in the event of an accident.

In addition, telematics-based insurance can also help drivers stay safe on the road. By monitoring a driver's behavior, the insurance company can provide feedback and suggest changes that can reduce the risk of an accident. This can be especially helpful in the current environment, as many drivers are unfamiliar with the new normal and may be more prone to making mistakes on the road.

How Can Drivers Get the Best Coverage?

The key to getting the best car insurance coverage is to shop around and compare different policies. Drivers should make sure to read the fine print of each policy and make sure that they understand the coverage. They should also make sure to check for any discounts or special offers that may be available.

In addition, drivers should also consider other factors such as their driving record, the type of vehicle they drive, and where they live. All of these factors can affect the cost of car insurance and it is important to take them into account when choosing a policy.

Final Thoughts

The coronavirus pandemic has caused massive changes to the car insurance industry. With the introduction of telematics-based insurance, 21st century drivers now have more options when it comes to their coverage. Drivers should make sure to shop around and compare different policies in order to get the best possible coverage for their individual needs.

Coronavirus: Insurance companies paying drivers back for driving less

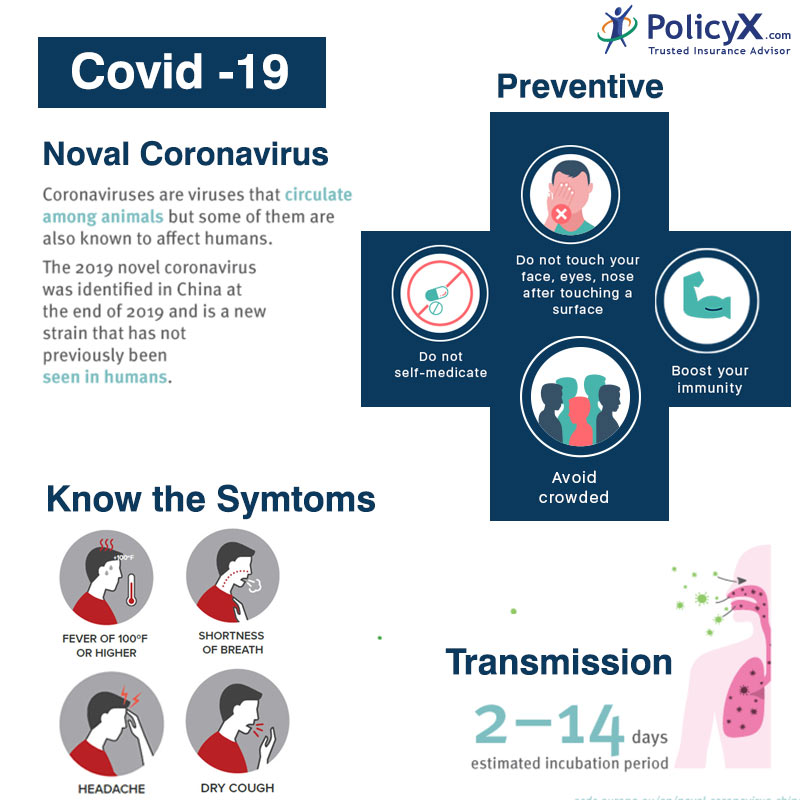

The Insurance Impacts of 2019 Novel Coronavirus - Ascend Broking Ltd

Covid Insurance India - Buy Corona Virus Insurance Plan Online

What Should Car Dealerships Do During the Coronavirus Pandemic?

Business Insurance and COVID-19 Coronavirus | Layr