How Much Is Car Insurance For A 20 Year Old

How Much Is Car Insurance For A 20 Year Old?

What Factors Affect Car Insurance for 20 Year Olds?

Car insurance rates for 20 year olds are notoriously high. This is due to the fact that 20 year old drivers are considered to be high-risk by insurance companies. Insurance companies see them as inexperienced drivers who are more likely to get into accidents. As a result, they charge higher rates for car insurance for 20 year olds. But there are certain factors that can affect the cost of car insurance for 20 year olds. These include the type of car they drive, their driving record, the amount of coverage they choose, and other factors.

What Type of Car Can Affect Car Insurance for 20 Year Olds?

The type of car that a 20 year old drives can have a significant effect on the cost of their car insurance. Insurance companies consider certain types of cars to be more risky than others. For example, sports cars or luxury cars are usually seen as more risky than a mid-size sedan. As a result, they usually cost more to insure. If a 20 year old is looking to save money on car insurance, they should consider driving a more economical car.

How Does Driving Record Affect Car Insurance for 20 Year Olds?

The driving record of a 20 year old can also have an impact on the cost of their car insurance. Insurance companies generally look for drivers with clean records, as they are seen as less risky. If a 20 year old has a clean driving record, they may be entitled to a discount on their car insurance. On the other hand, if they have a history of speeding tickets or other moving violations, they may be charged higher rates.

How Much Does Coverage Affect Car Insurance for 20 Year Olds?

The amount of coverage that a 20 year old chooses can also have an effect on their car insurance rates. The more coverage they choose, the more expensive their policy will be. However, if a 20 year old chooses a higher level of coverage, they can protect themselves from greater financial losses in the event of an accident. It's important for 20 year olds to carefully consider their coverage needs before choosing a policy.

How Can 20 Year Olds Save Money on Car Insurance?

There are a few ways that 20 year olds can save money on car insurance. One way is to shop around and compare rates from different insurance companies. Another way is to take advantage of any discounts that may be available. For example, some insurance companies offer discounts for good students or for drivers who have taken a driver safety course. Additionally, 20 year olds can take steps to improve their driving record, such as avoiding speeding tickets and other moving violations.

Conclusion

Car insurance for 20 year olds can be expensive, but there are ways to save money. 20 year olds should shop around for the best rates and consider any discounts that may be available. They should also take steps to improve their driving record and choose the right amount of coverage for their needs. By doing so, they can save money on car insurance and protect themselves from potential financial losses.

Average Full Coverage Car Insurance For 20 Year Old

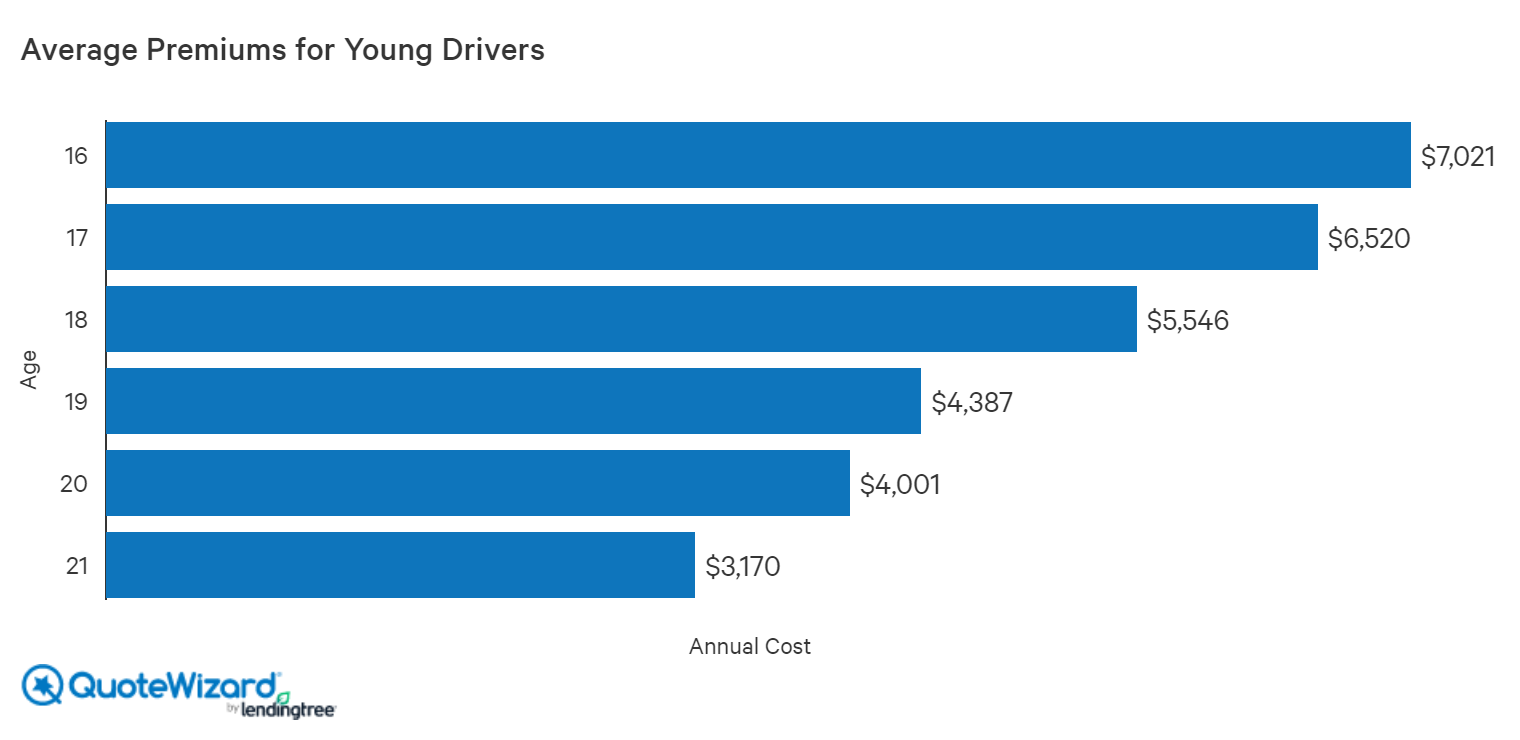

Car Insurance for a 20-year-old | QuoteWizard

Cheapest Car Insurance 20 Year Old Male ~ wow

The Best Average Cost Of Car Insurance 2022 - Dakwah Islami

Free Car Insurance Quotes (from 100+ Companies) | The Zebra