Cheap Plpd Auto Insurance Michigan

Sunday, January 8, 2023

Edit

Cheap Plpd Auto Insurance Michigan

Finding Cheap Plpd Auto Insurance in Michigan

Are you looking for cheap PLPD auto insurance in Michigan? If so, you’ve come to the right place. Michigan has some of the most affordable auto insurance rates in the country, and finding the best PLPD coverage can be a great way to save even more. PLPD stands for “Personal Liability and Property Damage”, and it is a type of liability coverage that pays for damages caused to another person or their property in an accident. In Michigan, PLPD auto insurance is required for all drivers, so it’s important to find the right coverage for your needs.

What is PLPD Auto Insurance?

PLPD auto insurance is a type of liability coverage that pays for damages caused by an accident. It covers things like property damage, medical bills, and legal fees if you are found to be at fault in an accident. It does not cover damages to your own vehicle, which is why it is important to also have comprehensive and collision coverage. PLPD coverage is usually much more affordable than other types of coverage, so it can be a great way to save money on your auto insurance policy.

How Much Does PLPD Auto Insurance Cost in Michigan?

The cost of PLPD auto insurance in Michigan can vary greatly depending on a variety of factors. Your age, driving record, and the type of vehicle you drive can all affect the cost of your coverage. In general, however, PLPD auto insurance in Michigan is quite affordable. According to the Michigan Department of Insurance, the average cost of PLPD auto insurance in the state is $755 per year.

Where to Get Cheap PLPD Auto Insurance in Michigan

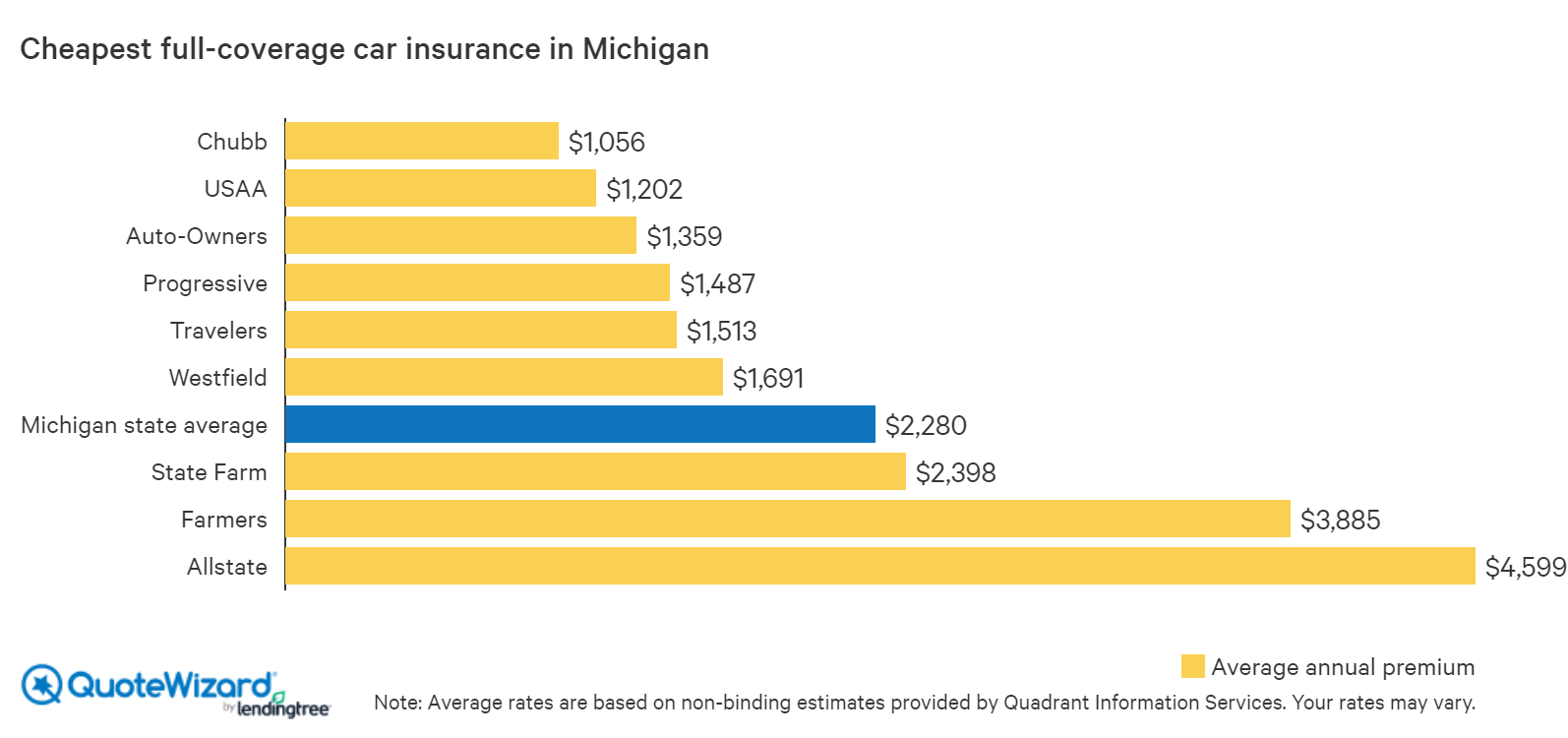

When shopping for cheap PLPD auto insurance in Michigan, it’s important to compare rates from multiple companies. Many of the major auto insurance companies offer PLPD coverage in the state, including State Farm, Allstate, and Progressive. You can also shop online for the best rates. Websites like Compare.com and Insurify can help you compare rates from multiple companies, so you can find the coverage that best fits your budget.

Tips for Finding Cheap PLPD Auto Insurance in Michigan

There are a few things you can do to ensure you’re getting the best rate on your PLPD auto insurance in Michigan. First, make sure you’re taking advantage of any discounts that may be available. Many companies offer discounts for good drivers, bundling policies, and taking a defensive driving course. You should also consider raising your deductible, which can reduce your premium. Finally, make sure you’re shopping around and comparing rates from multiple companies to ensure you’re getting the best deal.

Conclusion

Finding cheap PLPD auto insurance in Michigan can be a challenge, but with a little research and comparison shopping, you can find the coverage that best fits your needs and budget. Be sure to take advantage of any discounts available, and compare rates from multiple companies to get the best deal. With the right coverage, you can be sure you’re protected in the event of an accident.

Cheap plpd auto insurance michigan - insurance

Cheapest Plpd Car Insurance In Michigan - jukkahdesign

Cheapest Car Insurance in Michigan | QuoteWizard

Cheap Car Insurance in Michigan | Auto Insurance

Plpd Car Insurance | Life Insurance Blog