Auto Loan Credit Life Insurance

What is Auto Loan Credit Life Insurance?

Auto loan credit life insurance, also known as loan repayment insurance, is a type of life insurance that pays off a person’s outstanding auto loan if they pass away. It’s an optional policy that can be purchased as part of an auto loan. It’s designed to provide financial relief to the borrower’s family and help cover expenses associated with the loan should the borrower pass away. It can be used to cover the remaining loan balance or provide additional funds for funeral expenses.

How Does Auto Loan Credit Life Insurance Work?

When an individual takes out an auto loan, they have the option to purchase credit life insurance. This type of insurance is designed to cover the remaining balance of the loan. For example, if an individual has a five-year loan with a remaining balance of $20,000, the credit life insurance would cover that remaining balance in the event of their death. This type of policy is typically taken out by the borrower, not the lender, and is paid for in monthly premiums.

Who is Eligible for Auto Loan Credit Life Insurance?

Most lenders will offer credit life insurance to borrowers who meet certain criteria. Generally, the borrower must be 18 years of age or older, have a valid driver’s license, and have good credit. Some lenders may require the borrower to be a U.S. citizen or a permanent resident. In addition, the borrower must have a steady source of income and be able to afford the premiums associated with the policy.

How Much Does Auto Loan Credit Life Insurance Cost?

The cost of credit life insurance will vary depending on the lender and the type of loan. Generally, the cost is based on the size of the loan and the borrower’s age and gender. The premiums are usually paid as part of the monthly loan payment and can range from a few dollars to hundreds of dollars per month. The cost of the policy can also depend on the amount of coverage purchased and the length of the loan.

Are There Any Benefits to Auto Loan Credit Life Insurance?

Auto loan credit life insurance can provide some benefits to borrowers, especially those with families. If the borrower passes away, the policy will cover the remaining balance of the loan, so their family won’t be burdened with this expense. In addition, the policy can provide additional funds for funeral expenses, which can be a great relief for the family. It can also provide peace of mind for the borrower, knowing that their family is taken care of in the event of their death.

Conclusion

Auto loan credit life insurance can be an invaluable tool for borrowers who are looking for additional protection. It can provide financial relief to the borrower’s family and help cover expenses associated with the loan should the borrower pass away. It’s important to remember that the cost of this type of policy can vary greatly, so it’s important to shop around and compare rates before purchasing a policy. Ultimately, it’s a matter of personal preference and financial responsibility.

What is credit life insurance on a car?

What Is Credit Life Insurance On A Car / Credit Card State Farm Vehicle

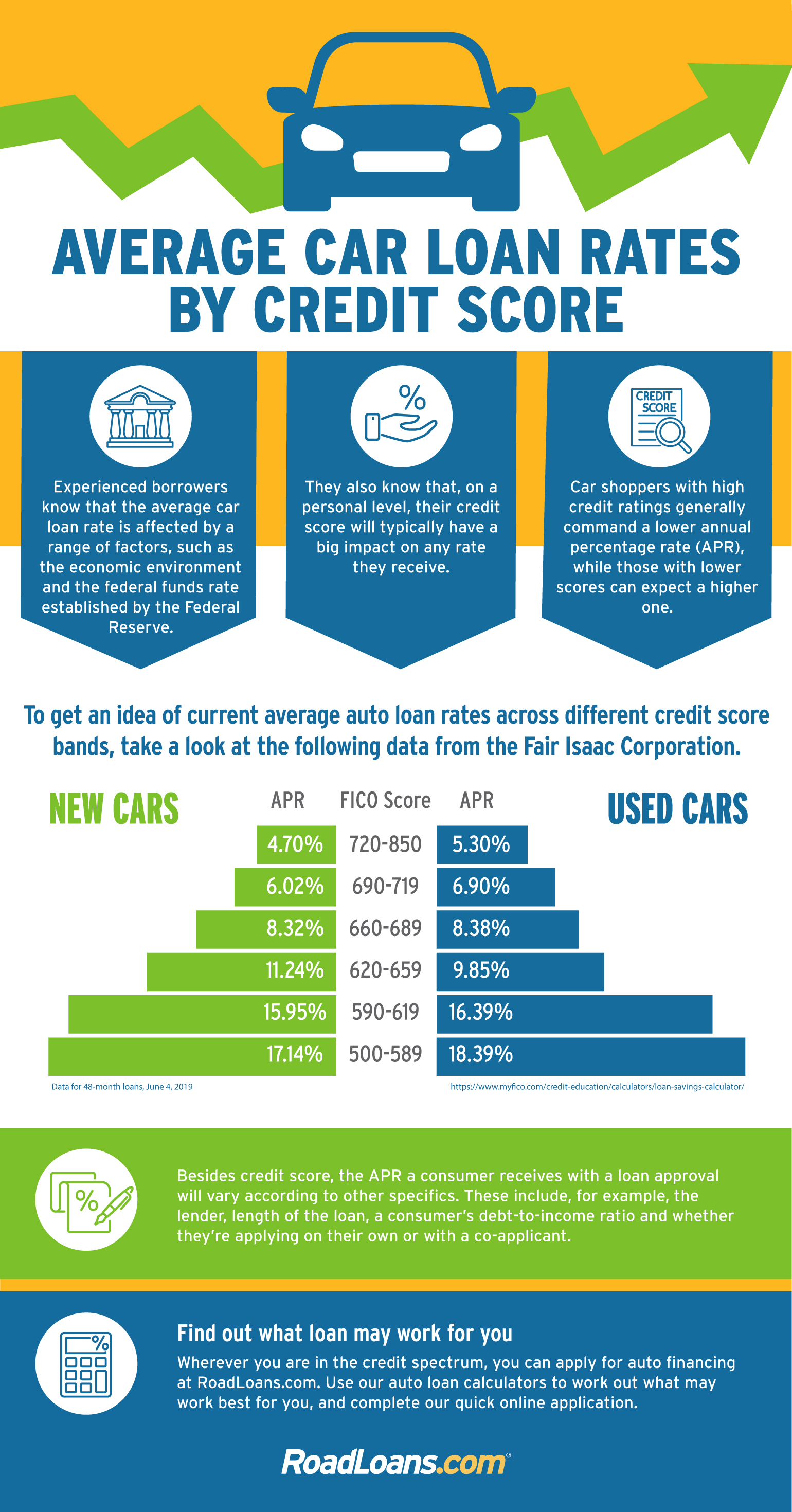

Check out average auto loan rates according to credit score | RoadLoans

Loan Options | The Good Guys Corner

1000+ images about Auto Loan Infographics on Pinterest | Cars, Full