What Does Liability Car Insurance Cover

What Does Liability Car Insurance Cover?

Why It’s Important

Liability car insurance is an important form of coverage to have as it helps to protect you, as a driver, from being liable to pay for damages or injuries that you may cause while driving. It is especially important in states that have a minimum amount of liability car insurance coverage that is required to legally drive on the road. This ensures that you are able to meet the financial responsibility requirements of your state in the event of an accident.

In addition to providing financial protection for you, liability car insurance also helps to protect others who may be involved in an accident with you. This includes other drivers, passengers, and pedestrians who may suffer property damage or injuries as a result of an accident that you are responsible for. Without liability car insurance, you may be liable for these damages and be held accountable for them.

What Does Liability Car Insurance Cover?

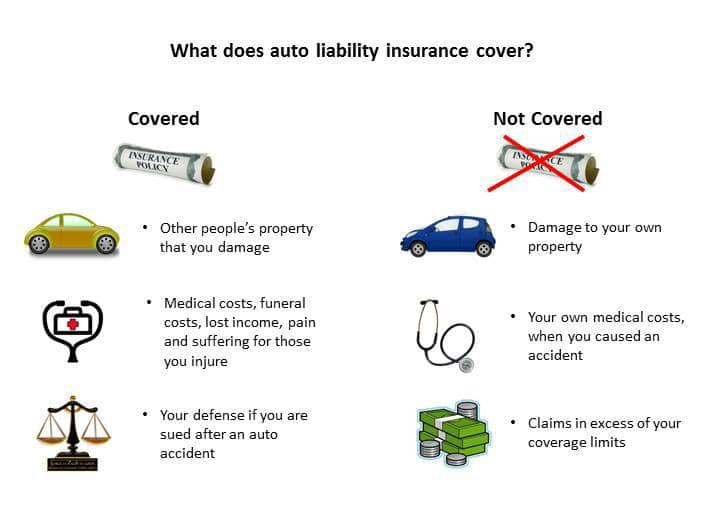

Liability car insurance typically covers the costs associated with the repair of property damage and medical expenses for those injured in an accident that you are responsible for. This includes any other vehicles and property that may be damaged in an accident, as well as the medical expenses for any injured parties. Liability car insurance does not provide any coverage for your vehicle or any other property that you may own, as this is not covered under the terms of your policy.

It is important to understand the limits of your liability car insurance, as this will determine how much financial protection you are provided with in the event of an accident. Most states require a minimum amount of liability car insurance to be carried in order to legally drive on the road. This amount is usually determined by the state in which you live and is typically set at a certain dollar amount.

What Are The Different Types Of Liability Car Insurance?

There are three main types of liability car insurance that you can purchase in order to meet the requirements of your state. The first type is bodily injury liability, which is the coverage for any medical expenses for those injured in an accident that you are responsible for. The second type is property damage liability, which is the coverage for the repair of any property damaged in an accident that you are responsible for. The third type is personal injury protection, which is the coverage for any medical expenses for yourself or any passengers in your vehicle in the event of an accident.

In addition to these three types of liability car insurance, there are also additional coverage options that you may consider purchasing. These include uninsured/underinsured motorist coverage, which pays for any damages or injuries that you may suffer as a result of an accident caused by an uninsured or underinsured driver. Other coverage options include comprehensive coverage, which covers your vehicle in the event of theft, vandalism, or other non-collision related damage, and collision coverage, which pays for the repair of any damage to your vehicle caused by a collision.

How Much Does Liability Car Insurance Cost?

The cost of liability car insurance will vary depending on several factors, such as the type of coverage you purchase, the amount of coverage you purchase, and the deductible you choose. Your driving record and the type of vehicle you drive can also affect the cost of your premium. Generally, the more coverage you purchase and the higher the deductible you choose, the more expensive your premium will be.

It is important to shop around and compare rates from different insurance companies in order to get the best deal on your liability car insurance. Different insurance companies offer different coverage options and discounts, so it is important to compare all of the available options in order to find the one that is right for you.

Conclusion

Liability car insurance is an important form of coverage to have in order to protect you, as a driver, from being liable for any damages or injuries that you may cause while driving. It is important to understand the different types of liability car insurance and the coverage that each type provides in order to ensure that you are adequately protected in the event of an accident. The cost of liability car insurance will vary depending on several factors, so it is important to shop around and compare rates from different insurance companies in order to get the best deal.

What Does Liability Car Insurance Cover? | Direct Auto

Auto Liability Insurance - What It Is and How to Buy

What Does Liability Car Insurance Typically Cover?—Allstate

All the Different Types of Car Insurance Coverage & Policies Explained

Car insurance infographic | 20 Miles North Web Design