Non Standard Auto Insurance Market

The Growing Non-Standard Auto Insurance Market

What is Non-Standard Auto Insurance?

Non-standard auto insurance refers to an insurance policy that is tailored for higher risk drivers. This type of policy is usually purchased when a driver is considered to be high risk due to a lack of driving experience, a high number of traffic violations, or a history of accidents. Non-standard auto insurance typically costs more than a standard policy, as the higher risk of the driver is taken into account.

Why is Non-Standard Auto Insurance Growing?

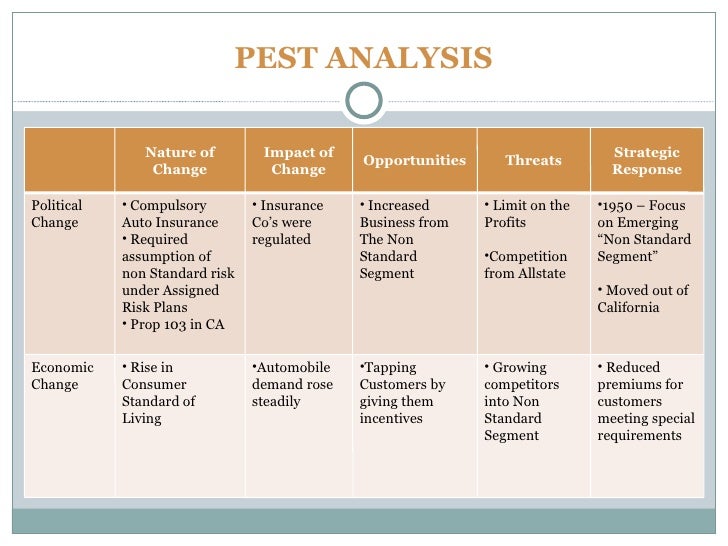

The non-standard auto insurance market is growing due to the increasing number of drivers who are considered to be high risk. This can be attributed to a variety of factors including the rise in the number of young drivers, the increased number of traffic violations, and the growing number of uninsured motorists. As a result, more and more insurance companies are offering non-standard policies to accommodate these higher risk drivers.

What are the Benefits of Non-Standard Auto Insurance?

Non-standard auto insurance policies offer a number of benefits to higher risk drivers. For example, these policies typically offer more flexible coverage options, such as allowing for higher deductibles and offering lower premiums. Additionally, non-standard auto policies often cover a wider range of vehicles, including classic cars, motorcycles, and ATVs. Finally, many non-standard policies also offer discounts for drivers who have taken defensive driving courses or have had no at-fault accidents in the past.

What are the Disadvantages of Non-Standard Auto Insurance?

The main disadvantage of non-standard auto insurance is that it is more expensive than a standard policy. Additionally, non-standard policies often include more restrictions, such as limiting the number of miles that can be driven and the types of vehicles that can be insured. Furthermore, non-standard policies typically have higher deductibles, which means that the driver is responsible for paying a higher amount before the insurance company will cover the costs of any repairs or damages.

How to Find the Best Non-Standard Auto Insurance?

When searching for the best non-standard auto insurance, it is important to compare different policies and companies. Drivers should look for policies that offer the most coverage for the least amount of money. Additionally, drivers should make sure to read the policy documents carefully to ensure that they are getting the coverage they need. Finally, drivers should also take advantage of any discounts that may be available, such as those for defensive driving courses or good driving records.

Conclusion

The non-standard auto insurance market is growing due to an increasing number of high risk drivers. Non-standard policies offer a number of benefits, such as more flexible coverage options and discounts. However, these policies also have some drawbacks, such as higher premiums and more restrictions. To find the best non-standard auto insurance, drivers should compare different policies and companies, read the policy documents carefully, and take advantage of any available discounts.

Non-Standard Auto Insurance | California Heritage Insurance Services

Non Standard Auto Insurance - Auto Insurance Lynn Haven Fl Jessica Lyng

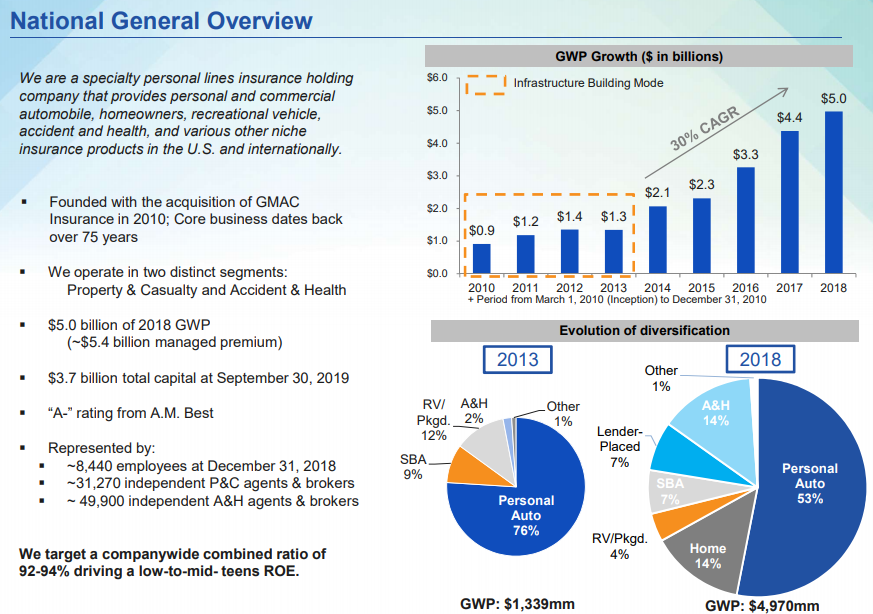

NGHC - too cheap to ignore? Or too good to be true? - Bireme Capital

SafeAuto Insurance Review - Quote.com®

Progressive Corporation.Sssg