Long Term Care Policies And Procedures Online

Long Term Care Policies And Procedures Online

What Is Long Term Care Insurance?

Long-term care insurance, or LTC insurance, is a policy designed to cover the costs associated with long-term care, such as in-home care, assisted living, and nursing home care. The policy pays for the cost of services and supplies that are not usually covered by regular health insurance plans. It also provides financial protection for individuals who may not qualify for Medicare or Medicaid.

Long-term care insurance is designed to provide a level of financial protection for people who may need long-term care services, such as home health aides, skilled nursing care, or adult day care. The policy pays for services that may be needed over an extended period of time, such as several months or years. Policies vary in terms of the amount of coverage they provide and the types of services they cover.

How Does Long Term Care Insurance Work?

Long-term care insurance works by providing a benefit to individuals who need to receive long-term care services. The policy pays for the cost of services, such as home health aides, skilled nursing care, and adult day care. The policy also pays for supplies and equipment related to long-term care. The policy is designed to provide financial protection for individuals who may not qualify for Medicare or Medicaid.

Long-term care insurance policies typically have a premium that is paid either monthly or annually. The premium may vary based on the amount of coverage, the type of services covered, and other factors. The policy also has a maximum benefit amount, which is the total amount that the policy will pay out over the life of the policy. The policy also has a waiting period, which is the amount of time that must pass before the policy will begin to pay out benefits.

What Are the Benefits of Long Term Care Insurance?

The primary benefit of long-term care insurance is that it can provide financial protection for individuals who may need long-term care services. The policy pays for the cost of services, such as home health aides, skilled nursing care, and adult day care. The policy also pays for supplies and equipment related to long-term care. This can provide a level of financial security for individuals who may not qualify for Medicare or Medicaid.

Long-term care insurance can also provide peace of mind for individuals who are concerned about the cost of long-term care services. The policy can be tailored to fit individual needs and can provide the financial security that is necessary to ensure that long-term care services are available when they are needed.

Where Can I Find Long Term Care Insurance Policies And Procedures Online?

Long-term care insurance policies and procedures can be found online through a variety of websites. Many websites provide detailed information about the policies, including the types of services that are covered, the maximum benefits, and the waiting period. In addition, many websites offer tools to help individuals compare different policies and find the one that best fits their needs.

In addition, many websites offer information about state and federal laws that may affect the purchase of long-term care insurance. This can help individuals make informed decisions about the policies they purchase.

Finally, many websites provide information about long-term care providers and the services they offer. This can help individuals choose the provider that best meets their needs.

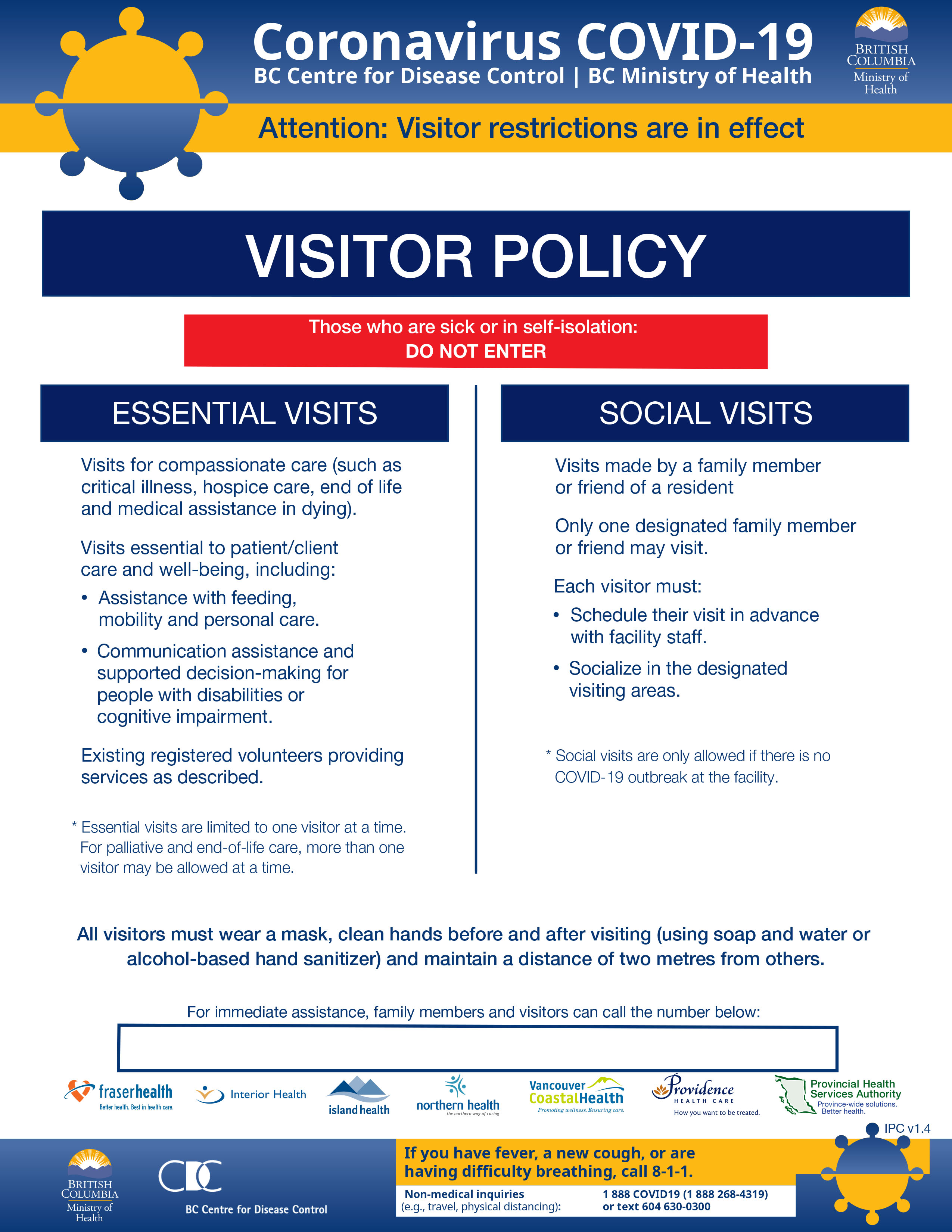

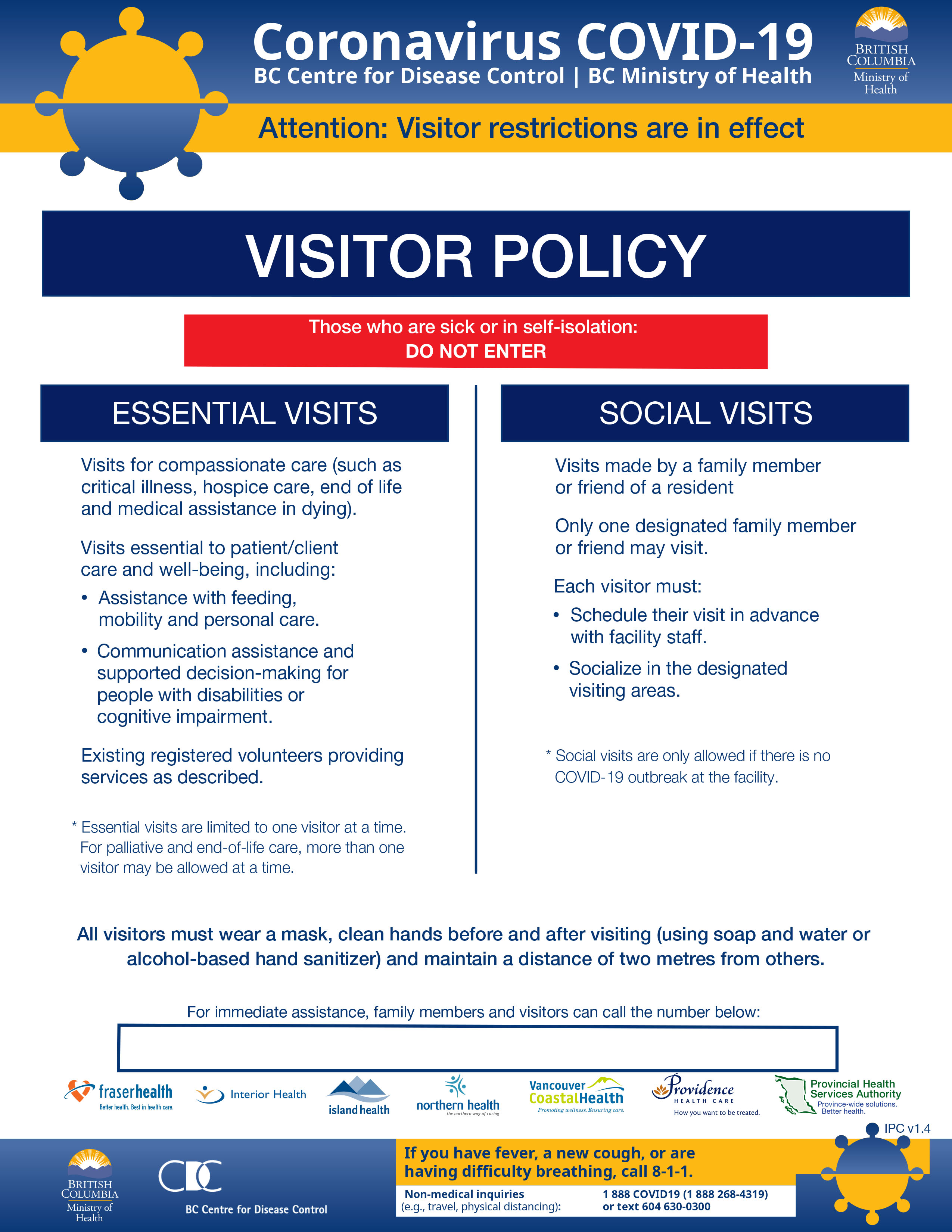

Long-term care and assisted living information during COVID-19 - Fraser

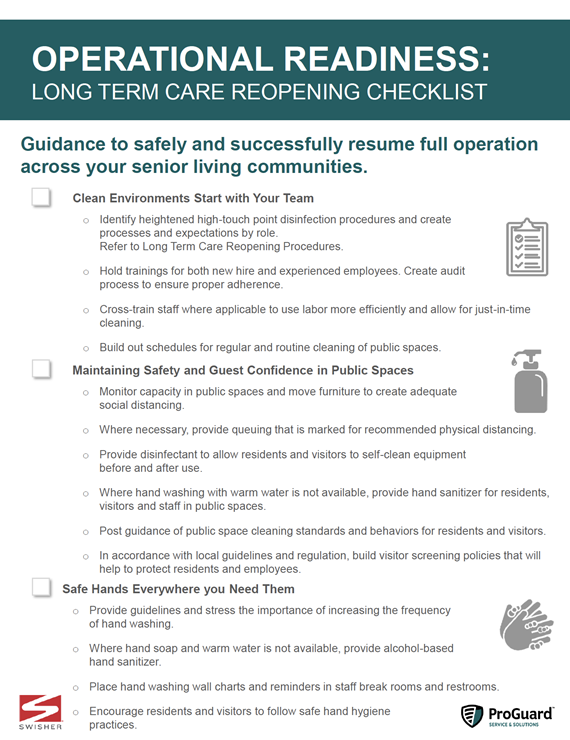

Operational Readiness: Long Term Care Reopening Checklist- Corporate

Home Health Care Agency Policy And Procedure Manual Pdf - Home Care

HEALTH CARE POLICIES AND PROCEDURES in Word and Pdf formats - page 3 of 11

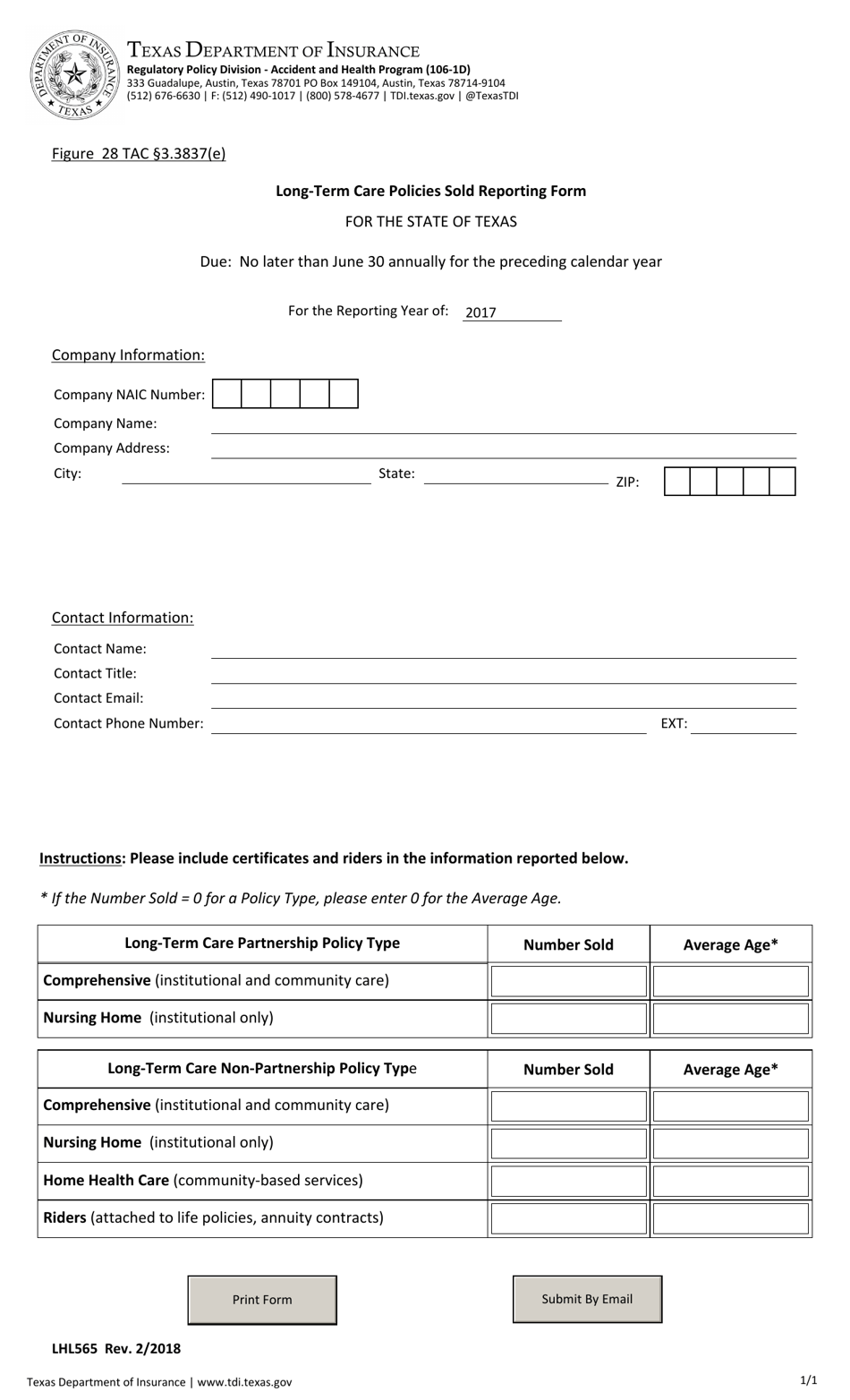

Form LHL565 Download Fillable PDF or Fill Online Long-Term Care