Cheapest Liability Only Insurance Oregon

Cheapest Liability Only Insurance Oregon

What Is Liability Only Insurance?

Liability only insurance is a type of auto insurance coverage that helps protect you financially in the event of an accident. Liability only insurance is often referred to as "basic," "state minimum," or "bare bones" coverage because it is only designed to cover the other driver's expenses if you are found to be at fault for an accident. Liability only insurance does not cover any damage to your vehicle or medical expenses for you or your passengers, so it is usually the least expensive type of auto insurance.

Why Get Liability Only Insurance in Oregon?

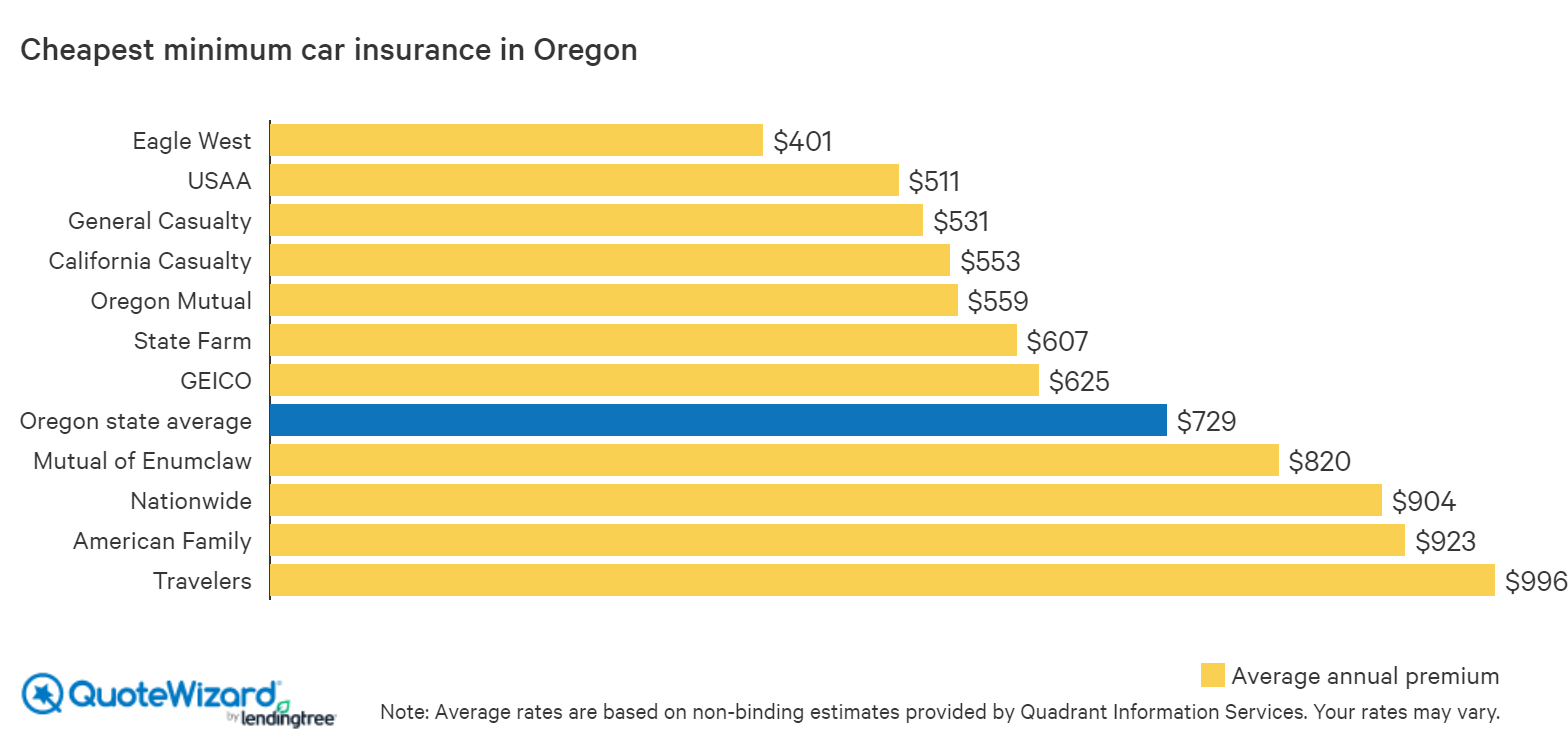

Oregon is a great state to get liability only insurance because it has some of the lowest insurance rates in the United States. In addition, Oregon has some of the most lenient laws when it comes to liability only insurance. The state requires drivers to have a minimum of $25,000 per person, $50,000 per accident, and $20,000 in property damage coverage. This is significantly lower than most other states, so it can be a great way to save money on your auto insurance premium.

How To Find The Cheapest Liability Only Insurance in Oregon

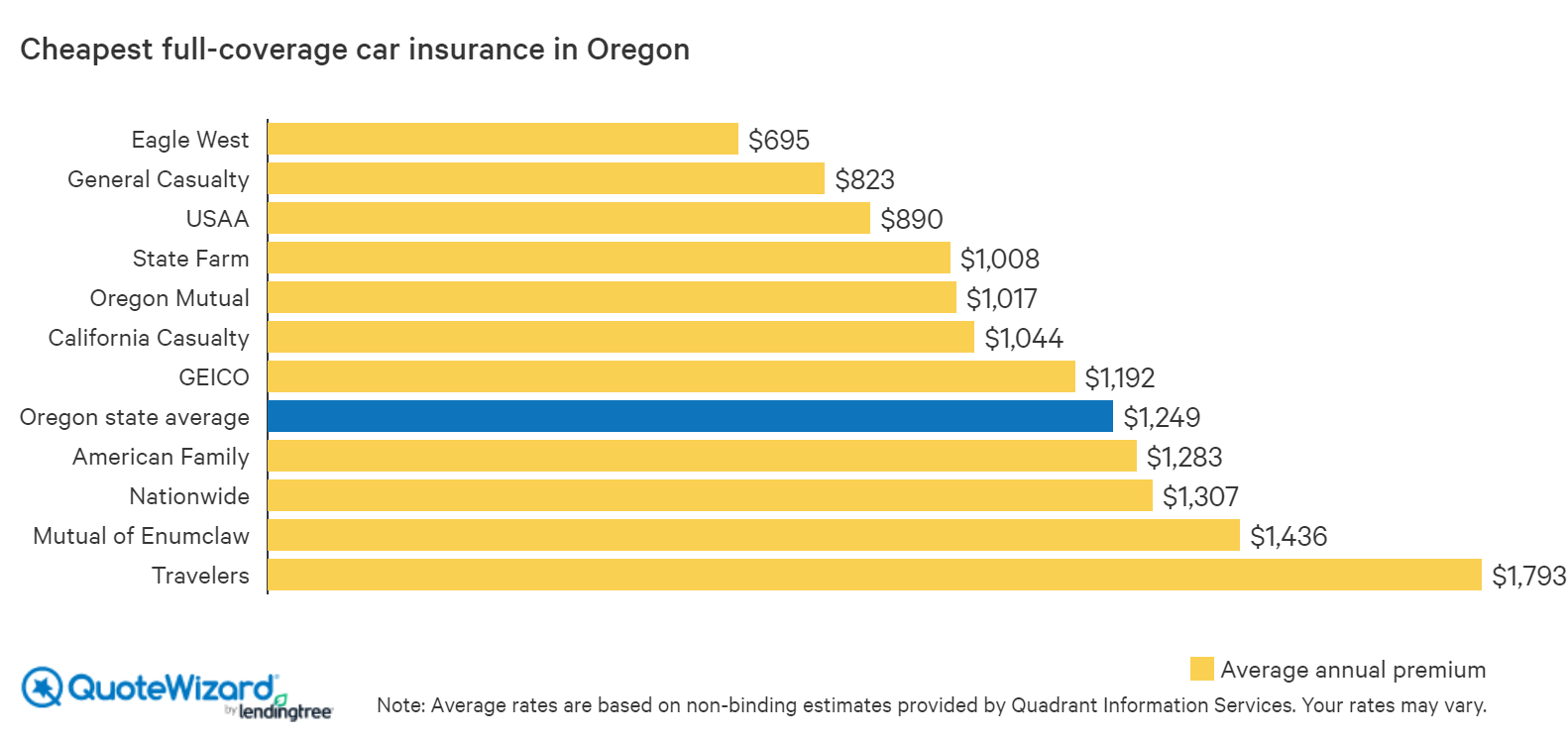

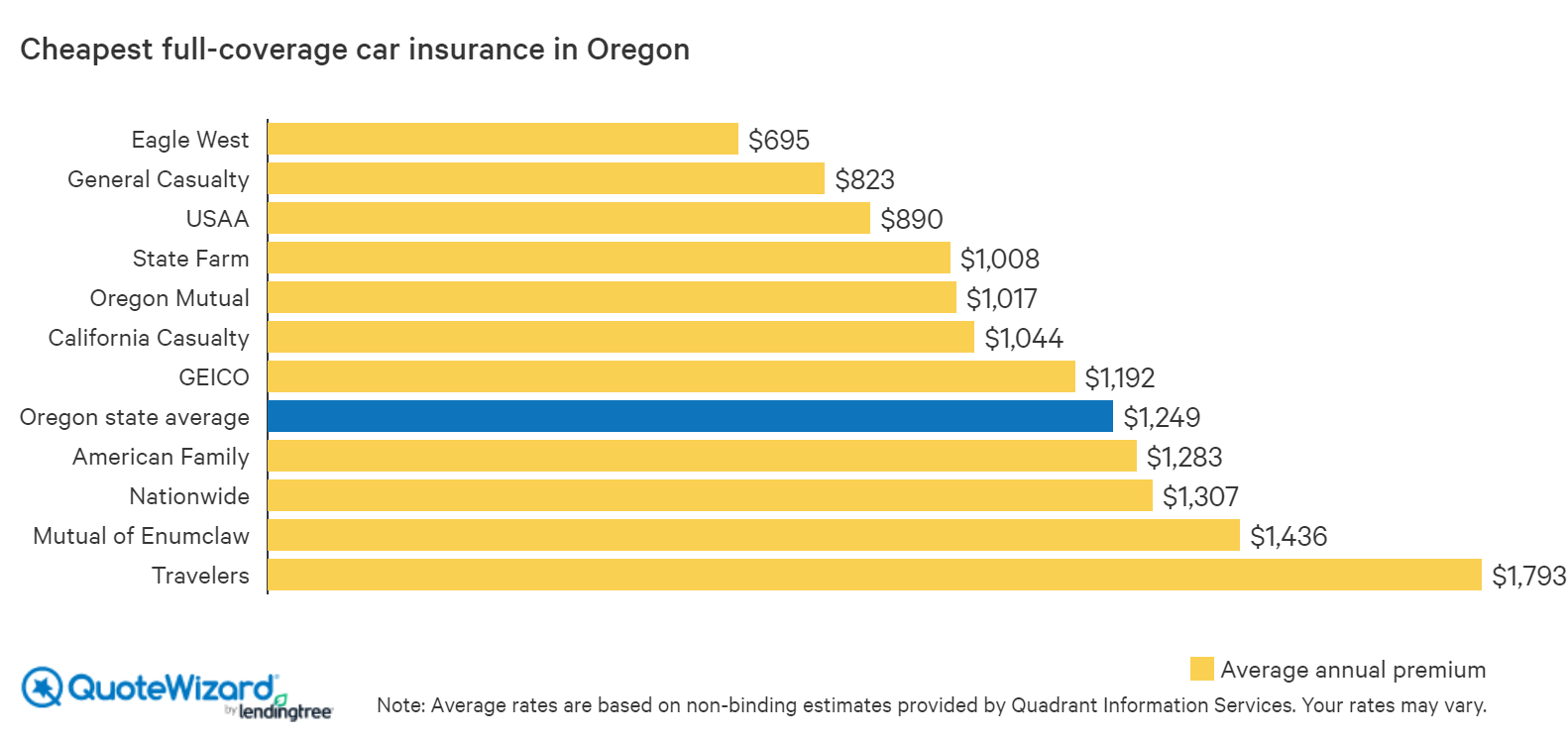

The best way to find the cheapest liability only insurance in Oregon is to shop around. Different insurance companies offer different rates, so it is important to get quotes from multiple companies and compare them. You can also look for discounts such as a good driver discount or a multi-policy discount. Additionally, you can look for companies that offer special discounts for students, veterans, or members of certain professions. Finally, you can look for insurance companies that offer low down payments or flexible payment plans.

The Benefits of Liability Only Insurance

Liability only insurance is a great way to save money on auto insurance. It is typically much cheaper than comprehensive or collision coverage and it provides the minimum amount of coverage required by the state of Oregon. This can be a great option for drivers who are on a budget and need to save money on their auto insurance premiums. Additionally, it can be a great option for drivers who rarely drive their vehicles or only drive short distances.

The Drawbacks of Liability Only Insurance

The biggest drawback of liability only insurance is that it does not provide any coverage for your own vehicle or medical expenses if you are involved in an accident. This means that if you are found to be at fault for an accident, you will have to pay for any damage to your own vehicle as well as any medical expenses for yourself or your passengers. This can be a huge financial burden, so it is important to consider this when deciding if liability only insurance is the right option for you.

Conclusion

Liability only insurance is a great option for drivers who are looking for a cost-effective way to meet the minimum insurance requirements in Oregon. It is typically much cheaper than comprehensive or collision coverage and it provides the minimum amount of coverage required by the state. However, it does not provide any coverage for your own property or medical expenses if you are involved in an accident, so it is important to take this into consideration when making your decision.

Where to Find Cheap Car Insurance in Oregon | QuoteWizard

Where to Find Cheap Car Insurance in Oregon | QuoteWizard

Who Has The Cheapest Auto Insurance Quotes in Portland, OR? - ValuePenguin

Cheap Car Insurance in Oregon 2019

Cheapest insurance in oregon - insurance