Cheap Full Coverage Auto Insurance For Bad Credit

Cheap Full Coverage Auto Insurance For Bad Credit

Introduction

Having a bad credit score can really hamper your ability to get a good deal on auto insurance. The problem is that insurance companies use credit scores to determine how likely you are to make claims. A low credit score could mean you’re seen as more likely to make a claim, and so your premiums could be higher. But that doesn’t mean you should give up on finding cheap full coverage auto insurance for bad credit. There are still ways to get a good deal, even with a less-than-perfect credit score.

Shop Around

The best way to find cheap full coverage auto insurance for bad credit is to shop around. You may be tempted to go with the first company you find, but it’s worth taking the time to compare policies and quotes from several different insurers. You may be surprised at the difference in prices, and you may even find a company that offers special discounts for people with bad credit.

Look for Discounts

Another way to get cheap full coverage auto insurance for bad credit is to look for discounts. Many insurance companies offer discounts for people with good driving records, for people who take defensive driving courses, and for people who have multiple vehicles insured. You may also be able to get a discount if you bundle your auto insurance with your home insurance. Be sure to ask about any discounts you may qualify for.

Pay in Full

Paying your premium in full can also help you get cheap full coverage auto insurance for bad credit. Most insurance companies offer discounts for customers who pay their premiums in full, so if you can afford to do this then it could result in some significant savings. Paying in full may also mean you don’t have to worry about late payment fees, which can add to the cost of your policy.

Raise Your Deductible

Raising your deductible is another way to get cheap full coverage auto insurance for bad credit. A higher deductible means you’ll be responsible for more of the cost of any claims you make, but it also means you’ll get a lower premium. Of course, you should only raise your deductible if you can afford to pay the higher amount if you ever need to make a claim.

Conclusion

Getting cheap full coverage auto insurance for bad credit isn’t impossible, but it may take some effort. Shopping around and looking for discounts can help you find the best deal, and raising your deductible could also result in some savings. Paying your premium in full can also help you get a cheaper policy, so it’s worth considering if you can afford it.

How to Get Cheap Full Coverage Auto Insurance Plan by Helvin Hills - Issuu

PPT - Cheap Full Coverage Car Insurance For All People PowerPoint

Cheap Full Coverage Auto Insurance With No Down Payment - YouTube

Cheap Full Coverage Car Insurance Pa - change comin

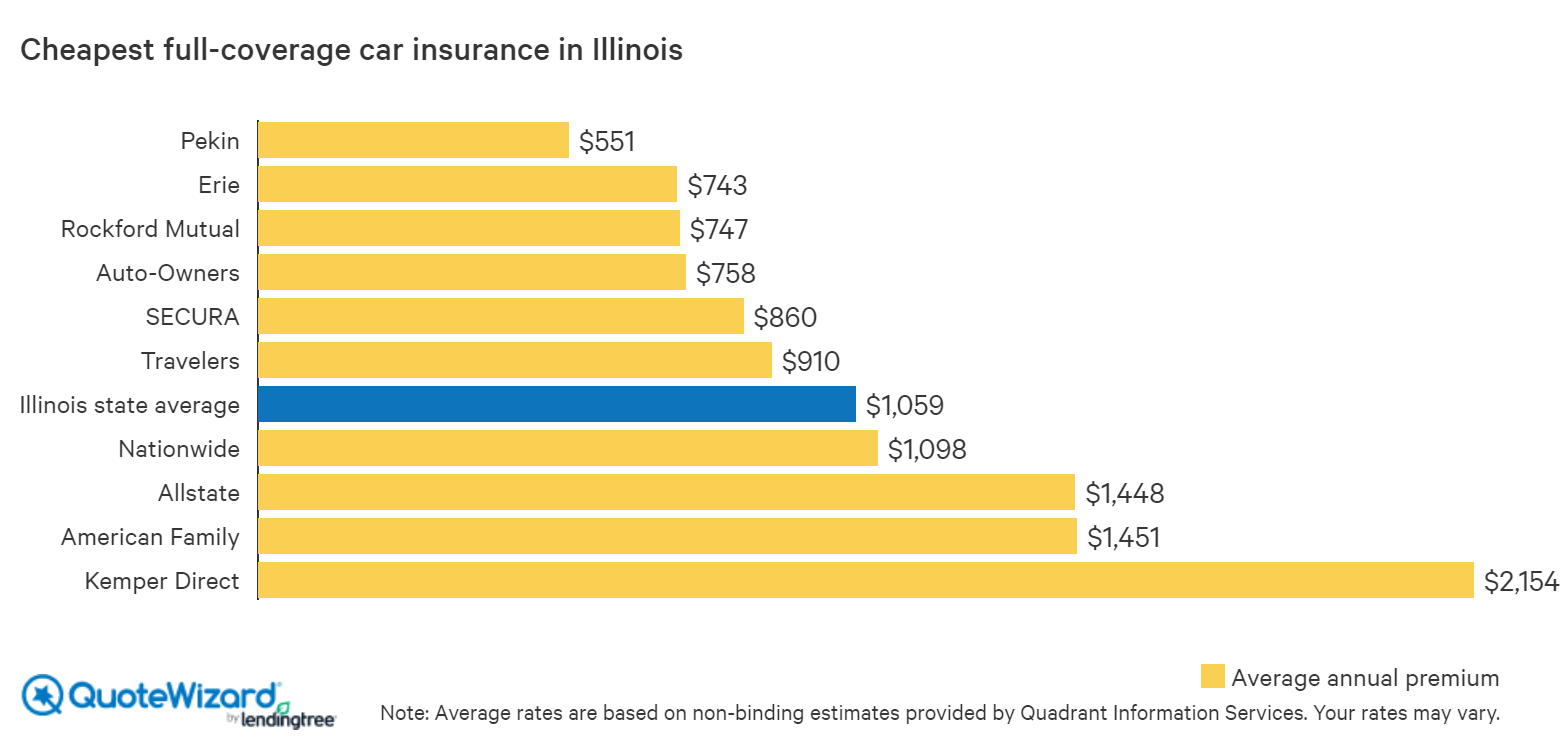

Find Cheap Car Insurance in Illinois | QuoteWizard