Cheap Full Coverage Auto Insurance Florida

Sunday, March 5, 2023

Edit

Cheap Full Coverage Auto Insurance Florida

What is Full Coverage Auto Insurance?

Full coverage auto insurance is a combination of several different types of car insurance coverage. It typically includes liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, and sometimes coverage for other damages. Liability coverage is the most important type of coverage as it provides protection for you and your vehicle if you are responsible for an accident. Collision coverage pays for damage done to your car if you are involved in an accident. Comprehensive coverage provides protection for your car if it is damaged by something other than an accident, such as fire, theft, or vandalism. Uninsured/underinsured motorist coverage provides coverage for medical expenses if you are involved in an accident with an uninsured or underinsured driver. Finally, medical payments coverage pays for your medical bills if you are in an accident.

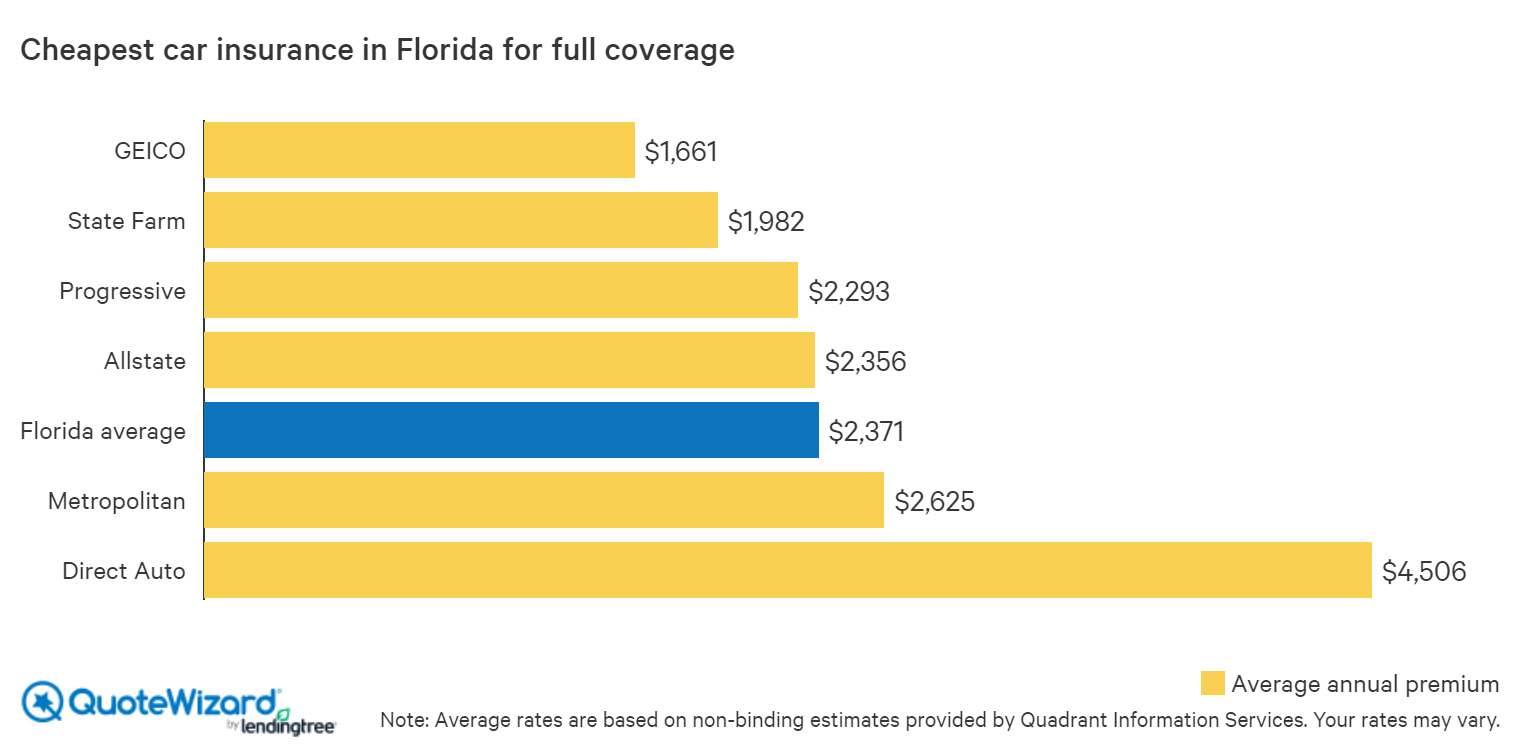

What is the Cheapest Full Coverage Auto Insurance in Florida?

The cheapest full coverage auto insurance in Florida is based on a number of factors, such as the type of vehicle you drive, the amount of coverage you need, and your driving record. Additionally, the insurance company you choose can also affect the rate you pay. Shopping around and comparing rates from different companies is the best way to find the cheapest full coverage auto insurance in Florida.

What are the Benefits of Full Coverage Auto Insurance Florida?

Full coverage auto insurance in Florida provides many benefits to drivers. It provides protection for your vehicle if it is damaged or destroyed in an accident, as well as liability coverage in case you are responsible for an accident. It also helps protect you from uninsured or underinsured drivers. Additionally, it helps to pay for medical expenses if you are injured in an accident. Finally, full coverage auto insurance can help you save money on your car insurance premiums by providing discounts for safe drivers and those with a good driving record.

How to Get the Best Rates for Full Coverage Auto Insurance Florida?

The best way to get the best rates for full coverage auto insurance in Florida is to shop around and compare rates from different companies. Additionally, you can save money by increasing your deductible, maintaining a good credit score, and taking advantage of any discounts available. Additionally, you can also save money by bundling your auto insurance with other types of insurance, such as home and life insurance.

What are the Requirements for Full Coverage Auto Insurance in Florida?

The requirements for full coverage auto insurance in Florida vary by company, but typically include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. Additionally, you may need to meet certain requirements to qualify for discounts, such as a good driving record or a clean credit history.

Conclusion

Cheap full coverage auto insurance in Florida is available if you shop around and compare rates from different companies. Additionally, you can save money on your premiums by increasing your deductible, maintaining a good credit score, and taking advantage of any discounts available. Finally, make sure that you meet the requirements for full coverage auto insurance in Florida.

Who Has the Cheapest Auto Insurance Quotes in Florida?

Average Full Coverage Car Insurance | Life Insurance Blog

Car Insurance Florida For New Drivers - IAE NEWS SITE

PPT - Cheap full coverage auto insurance PowerPoint Presentation, free

Cheap Full Coverage Auto Insurance With No Down Payment - YouTube