Average Cost Of Sr22 Insurance In Sc

What Is The Average Cost Of SR22 Insurance In South Carolina?

If you are looking for SR-22 insurance in South Carolina, you may be wondering what the average cost of SR22 insurance in South Carolina is. SR-22 insurance is required for drivers who have been convicted of a serious traffic violation, such as driving under the influence (DUI) or reckless driving. It is important to be aware of the average cost of SR22 insurance in South Carolina, as it can help you determine how much you will need to budget for your insurance.

How SR-22 Insurance Works

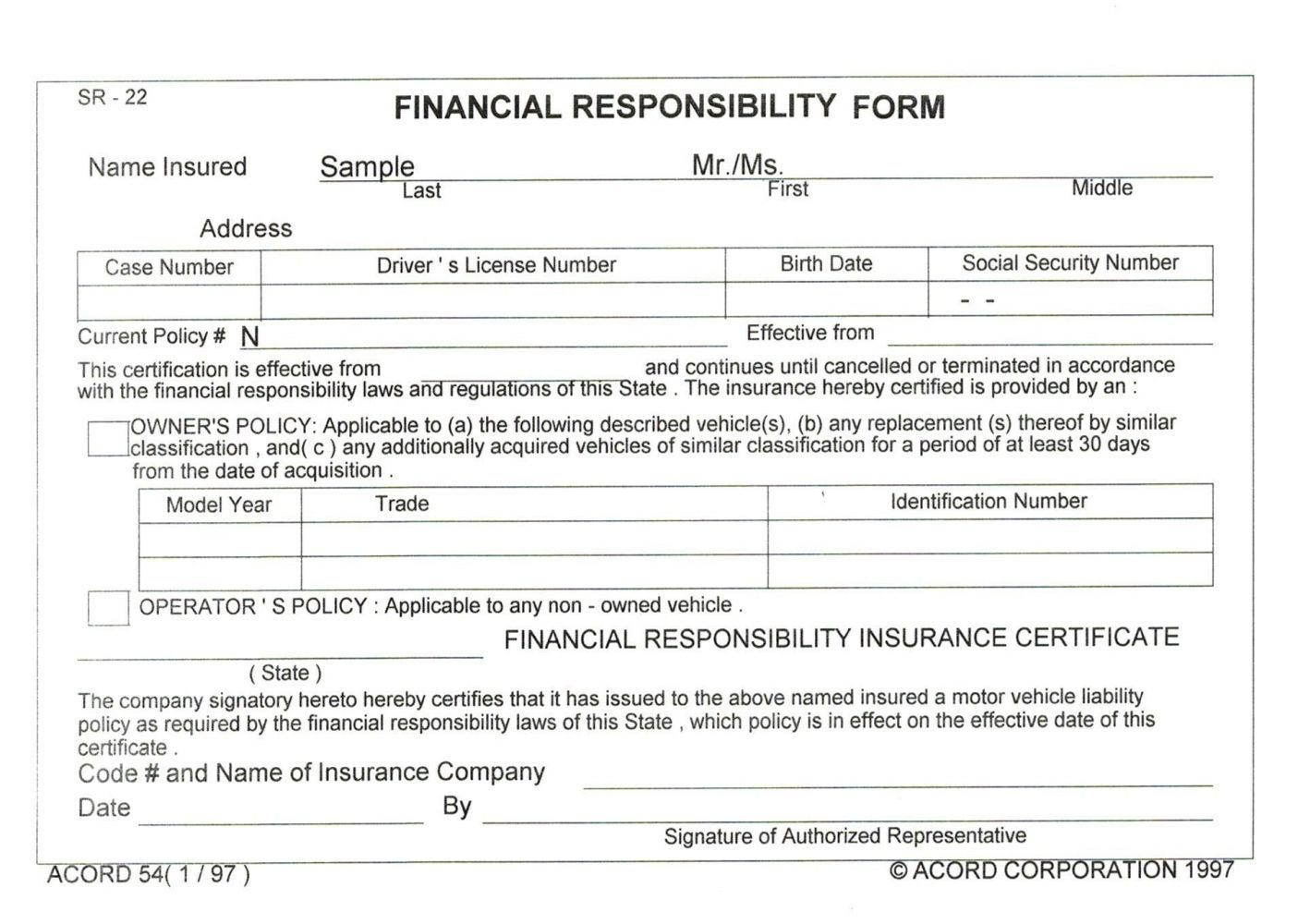

SR-22 insurance is a type of financial responsibility insurance that is required by the state of South Carolina for drivers who have been convicted of certain traffic violations. This type of insurance is also known as “high-risk insurance” and can be required for up to three years following a conviction. Once the driver has been convicted of a traffic offense, they must file an SR-22 with the state in order to have their license reinstated. This insurance is typically more expensive than traditional insurance, as it is designed to protect the state from any potential financial liability arising from the driver’s actions.

Factors That Affect SR-22 Insurance Rates

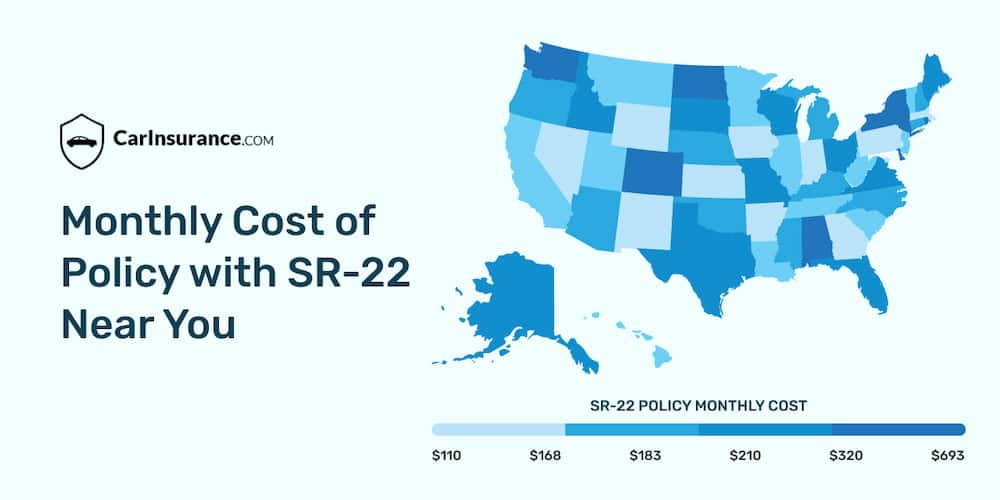

The average cost of SR-22 insurance in South Carolina is affected by several factors, including the type of violation, the driver’s age and driving history, and the amount of coverage that is purchased. The type of violation that the driver has committed will also have an effect on the cost of the insurance, as more serious violations, such as DUI or reckless driving, can result in higher rates. Age and driving history will also play a role in the cost of SR-22 insurance, as younger drivers and those with more moving violations on their record are typically charged higher premiums than more experienced, responsible drivers.

How To Find Affordable SR-22 Insurance

There are several ways to find affordable SR-22 insurance in South Carolina. A good starting point is to shop around and compare rates from different insurance providers. Additionally, it is important to look for discounts from insurance providers, such as discounts for students, good drivers, or those who have taken a defensive driving course. Finally, it may be helpful to contact an independent insurance agent who is familiar with the SR-22 process and can help you find the best rates for your situation.

Conclusion

The average cost of SR-22 insurance in South Carolina can vary significantly depending on the type of violation, the driver’s age and driving history, and the amount of coverage purchased. It is important to shop around and compare rates from different insurance providers in order to find the most affordable SR-22 insurance. Additionally, it is helpful to look for discounts and contact an independent insurance agent who is familiar with the SR-22 process. By understanding the average cost of SR22 insurance in South Carolina, you can be better prepared to budget for your insurance.

What is SR22 Insurance - Detailed Guide | CarInsurance.com

Average Cost Of Sr22 Insurance - Low Cost SR22 Auto Insurance - Average

The CHEAPEST, non Owner SR22 Insurance! Only $15 | maricehatmaker's Blog

SR-22 Fairfield OH: Get Insured Fast! Call us Today

Getting The Best Sr-22 Insurance Options For 2022 - Benzinga To Work