Auto Insurance Rates By Miles Driven

Auto Insurance Rates By Miles Driven

What Is Auto Insurance?

Auto insurance is a type of insurance coverage that is designed to provide financial protection for individuals who own and drive motor vehicles. Auto insurance policies are typically composed of several different types of coverage, each of which provides protection from different types of losses that may be incurred as a result of owning and driving a motor vehicle. Common types of auto insurance coverage include liability, collision, comprehensive, and medical payments.

Liability coverage is designed to cover losses that are caused by the policyholder’s negligence, such as damage to another person’s property or the bodily injuries that they may suffer as a result of an accident. Collision insurance is designed to cover losses that are caused by the policyholder’s vehicle being involved in a collision, such as damage to their own vehicle. Comprehensive coverage is designed to cover losses that are caused by non-collision related events such as theft, vandalism, or weather-related damage. Medical payments coverage is designed to cover medical expenses that are incurred by the policyholder or their passengers in the event of an accident.

How Are Auto Insurance Rates Calculated?

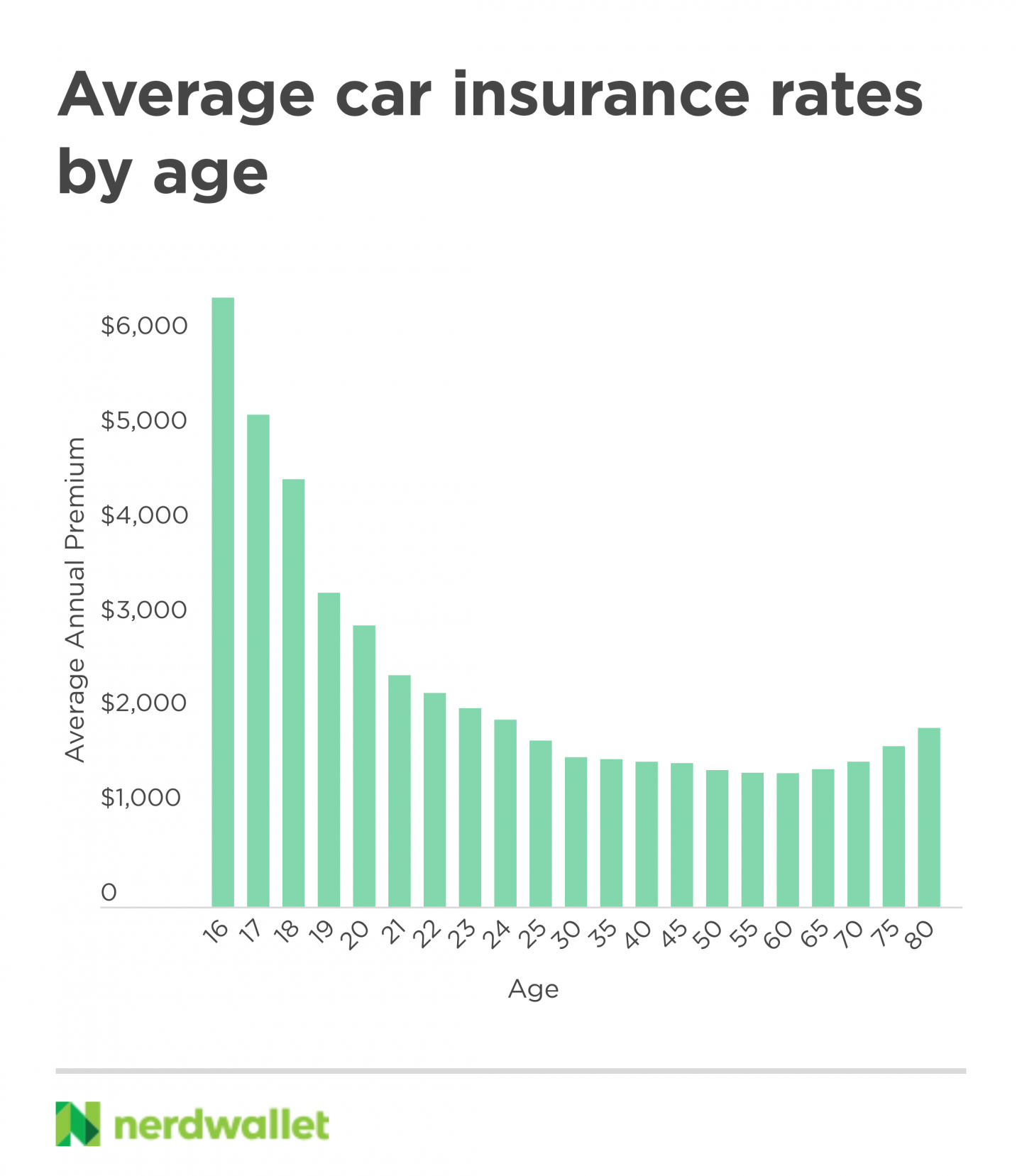

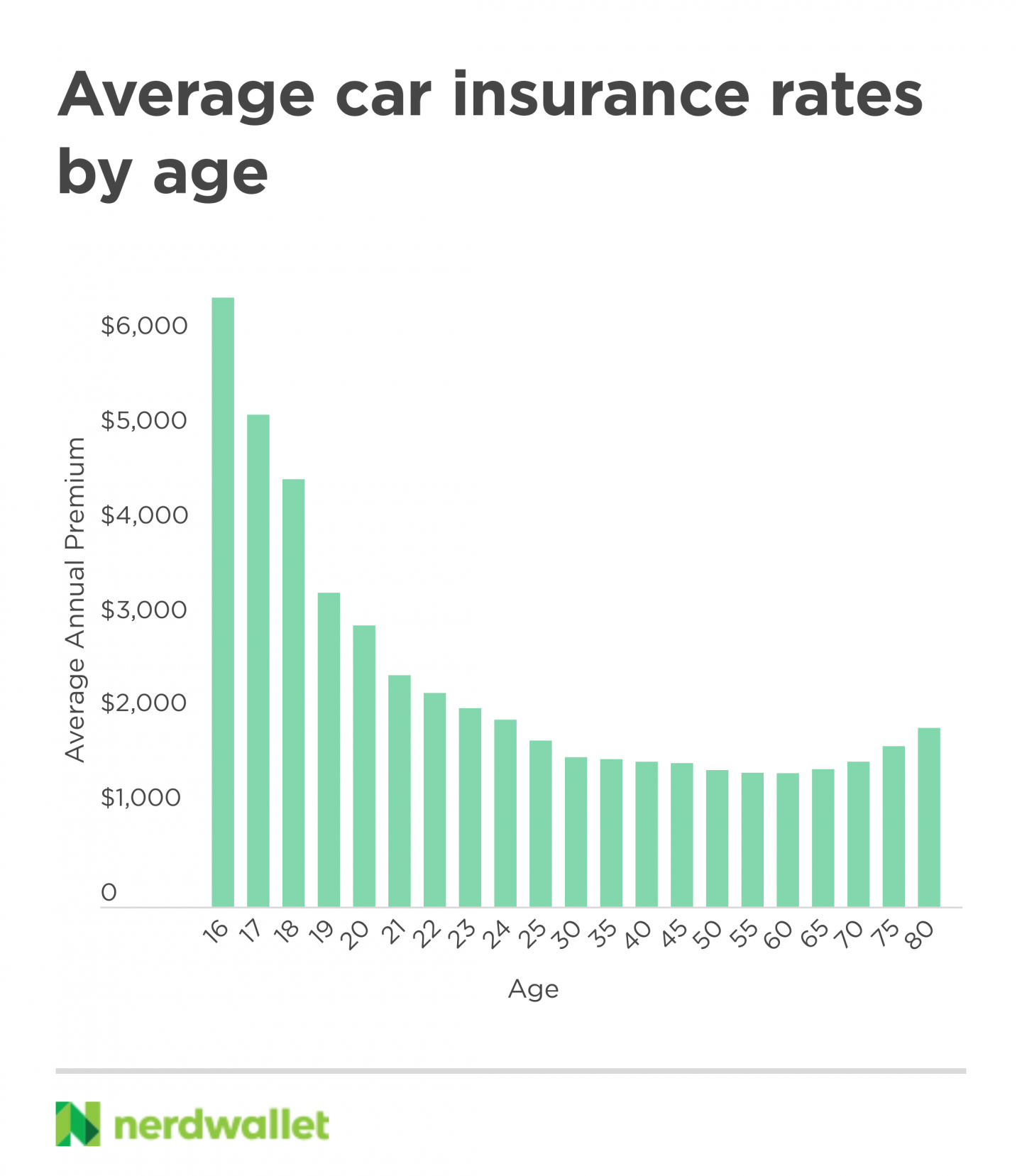

Auto insurance rates are calculated based on several factors, including the type of coverage purchased, the age, sex, and driving record of the policyholder, the type and age of the vehicle being insured, and the amount of miles driven per year. Generally, the more experienced and responsible a driver is, the lower their auto insurance rates will be. In addition, insurance companies may also factor in the likelihood that the driver will be involved in an accident or theft, as well as the amount of time that the driver is on the road.

One of the factors that can have a significant impact on auto insurance rates is the number of miles driven per year. Insurance companies consider the number of miles driven to be an indicator of the likelihood of an accident, and thus they typically charge higher rates for drivers who drive more than the average number of miles per year. In some cases, insurance companies may even offer discounts to drivers who drive fewer miles.

How Is Miles Driven Used To Calculate Auto Insurance Rates?

When calculating auto insurance rates, insurance companies take into account the number of miles driven per year by the policyholder. The more miles that are driven, the higher the auto insurance rates will be since the insurance company considers the likelihood of an accident or theft to be higher for drivers who drive more miles. In some cases, insurance companies may even offer discounts to drivers who drive fewer miles, as this can be seen as a sign that the driver is less likely to be involved in an accident or theft.

When calculating rates, insurance companies may also consider the type of vehicle being driven. For example, drivers of luxury vehicles may be charged higher rates due to the perceived risk associated with these vehicles. In addition, drivers of higher-performance vehicles may also be charged higher rates due to the fact that these vehicles are typically driven at higher speeds and may be more likely to be involved in an accident.

What Is The Impact Of Miles Driven On Auto Insurance Rates?

The number of miles driven per year can have a significant impact on auto insurance rates. Generally speaking, the more miles that are driven, the higher the auto insurance rates will be. This is due to the fact that insurance companies consider the number of miles driven to be an indicator of the likelihood of an accident or theft, and thus charge higher rates for drivers who drive more than the average number of miles per year.

In some cases, insurance companies may offer discounts to drivers who drive fewer miles. This is done in order to reward drivers who are less likely to be involved in an accident or theft. Additionally, insurance companies may take into account the type of vehicle being driven, as drivers of higher-performance vehicles may be charged higher rates due to the fact that these vehicles are typically driven at higher speeds and may be more likely to be involved in an accident.

Conclusion

Auto insurance rates are calculated based on several factors, including the type of coverage purchased, the age, sex, and driving record of the policyholder, the type and age of the vehicle being insured, and the amount of miles driven per year. The more miles that are driven, the higher the auto insurance rates will be since the insurance company considers the likelihood of an accident or theft to be higher for drivers who drive more miles. In some cases, insurance companies may even offer discounts to drivers who drive fewer miles, as this can be seen as a sign that the driver is less likely to be involved in an accident or theft.

It is important to understand the factors that can affect auto insurance rates in order to ensure that you are getting the best possible rate. By understanding the factors that can affect the cost of your auto insurance, you can make sure that you are getting the best rate possible and that you are adequately protected against potential losses.

2021 Car Insurance Rates by Age and Gender - NerdWallet

average car insurance rate in california best car 2018

The Best and Cheapest Car Insurance Rates | The Lazy Site

How mileage impacts auto insurance rates in all 50 states - Clark Howard

How Your Daily Commute Can Drive Up Your Auto Insurance Rates