What Is Liability Insurance Auto

What Is Liability Insurance Auto?

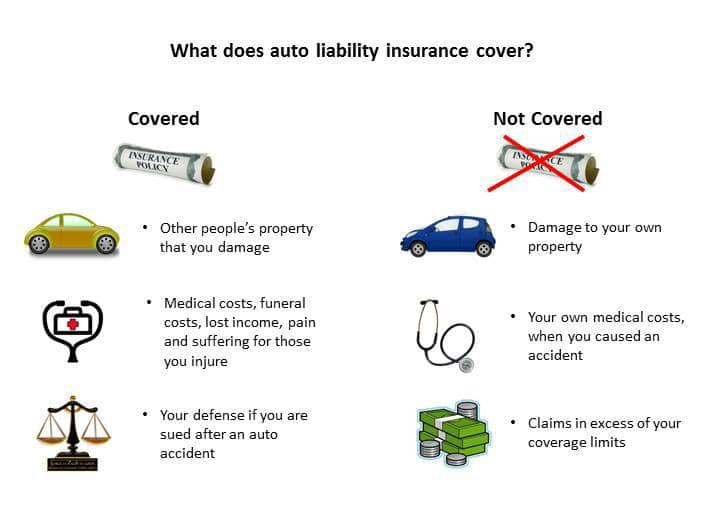

Liability insurance auto is a form of insurance coverage that provides protection against financial losses that may occur as a result of an accident or incident involving a motor vehicle. Liability insurance is typically required by law in most states, and it provides protection for both the insured driver and any other party involved in an accident. This type of insurance is usually required by law in order to be able to legally operate a vehicle, and it covers medical bills, property damage, and other financial losses that may occur as a result of an accident caused by the policyholder. Liability insurance is also a great way to protect yourself from the high costs associated with lawsuits that may arise from car accidents.

Types of Liability Insurance Auto

There are two main types of liability insurance auto: bodily injury liability and property damage liability. Bodily injury liability covers medical bills, lost wages, and other financial losses that may occur as a result of an accident caused by the policyholder. Property damage liability covers damage to another person's property, including vehicles, as a result of an accident caused by the policyholder. In addition, some states require drivers to carry additional types of liability insurance such as uninsured motorist and personal injury protection, which can provide coverage for medical bills and other losses even if the policyholder is not at fault for the accident.

How Much Liability Insurance Auto Is Required?

The amount of liability insurance auto coverage required by law can vary from state to state. Generally, states require drivers to carry a certain amount of bodily injury and property damage liability coverage. For example, in some states, drivers must carry at least $25,000 per person and $50,000 per accident in bodily injury liability coverage, and $25,000 in property damage liability coverage. It is important to note that the minimum coverage requirements do not necessarily provide adequate coverage for all losses, and it is recommended that drivers carry more than the minimum amount of coverage in order to protect themselves financially.

Additional Liability Insurance Auto Coverage

In addition to the minimum coverage requirements, there are a variety of additional liability insurance auto coverage options available. Uninsured motorist coverage can provide protection if the policyholder is involved in an accident with an uninsured driver. Personal injury protection can provide coverage for medical bills, lost wages, and other losses even if the policyholder is not at fault for the accident. Collision and comprehensive coverage can provide protection for damage to the policyholder’s vehicle as a result of an accident or other incident. Finally, rental car coverage can provide coverage for rental cars if the policyholder’s vehicle is damaged as a result of an accident.

What Are the Benefits of Liability Insurance Auto?

The primary benefit of liability insurance auto is that it provides financial protection in the event of an accident. It can help to cover medical bills, lost wages, vehicle repair costs, and other losses. Additionally, it can provide peace of mind knowing that you are protected if you are involved in an accident. Finally, it is important to note that liability insurance auto may be required by law in order for you to legally operate a vehicle.

Conclusion

Liability insurance auto is a form of insurance coverage that provides protection against financial losses that may occur as a result of an accident or incident involving a motor vehicle. It is typically required by law in most states, and it provides protection for both the insured driver and any other party involved in an accident. There are two main types of liability insurance auto: bodily injury liability and property damage liability, and some states require drivers to carry additional types of liability insurance such as uninsured motorist and personal injury protection. The benefits of liability insurance auto include financial protection in the event of an accident, peace of mind, and compliance with the law.

What Is Liability Insurance? | Allstate

Learn the Different Types of Car Insurance Policies

What Is Car Insurance Liability? | Visual.ly

Page for individual images • Quoteinspector.com

Auto Liability Insurance - What It Is and How to Buy