3rd Party Car Insurance Prices

3rd Party Car Insurance Prices – What You Should Know

What Exactly Is 3rd Party Car Insurance?

3rd party car insurance is a type of car insurance policy that covers you for any damage you cause to another person’s car or property. It is the most basic form of car insurance and is sometimes referred to as “third party only” insurance. It is usually the cheapest form of car insurance available, although it does not cover any damage to your own car. It is also the only type of insurance that is mandatory by law in most countries.

What Does 3rd Party Car Insurance Cover?

3rd party car insurance covers you for any damage caused to another person’s car or property. This includes any damage caused by an accident, fire, theft, or vandalism. It also covers any legal costs that may be incurred if you are found to be liable for the accident. While it does not cover any damage to your own car, it will cover any damage you cause to someone else’s car or property. It is important to note that this type of insurance does not provide coverage for any medical expenses incurred as a result of an accident.

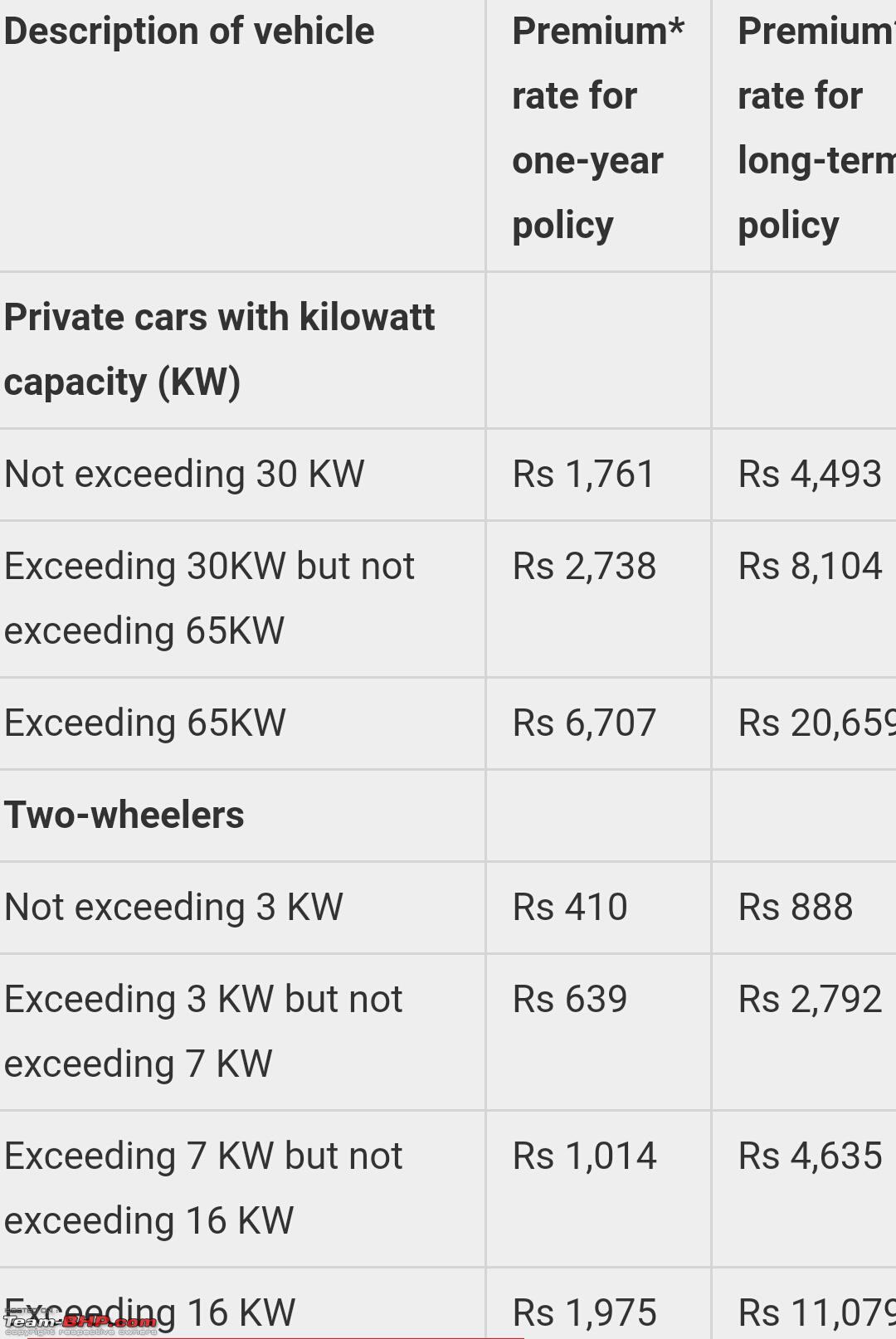

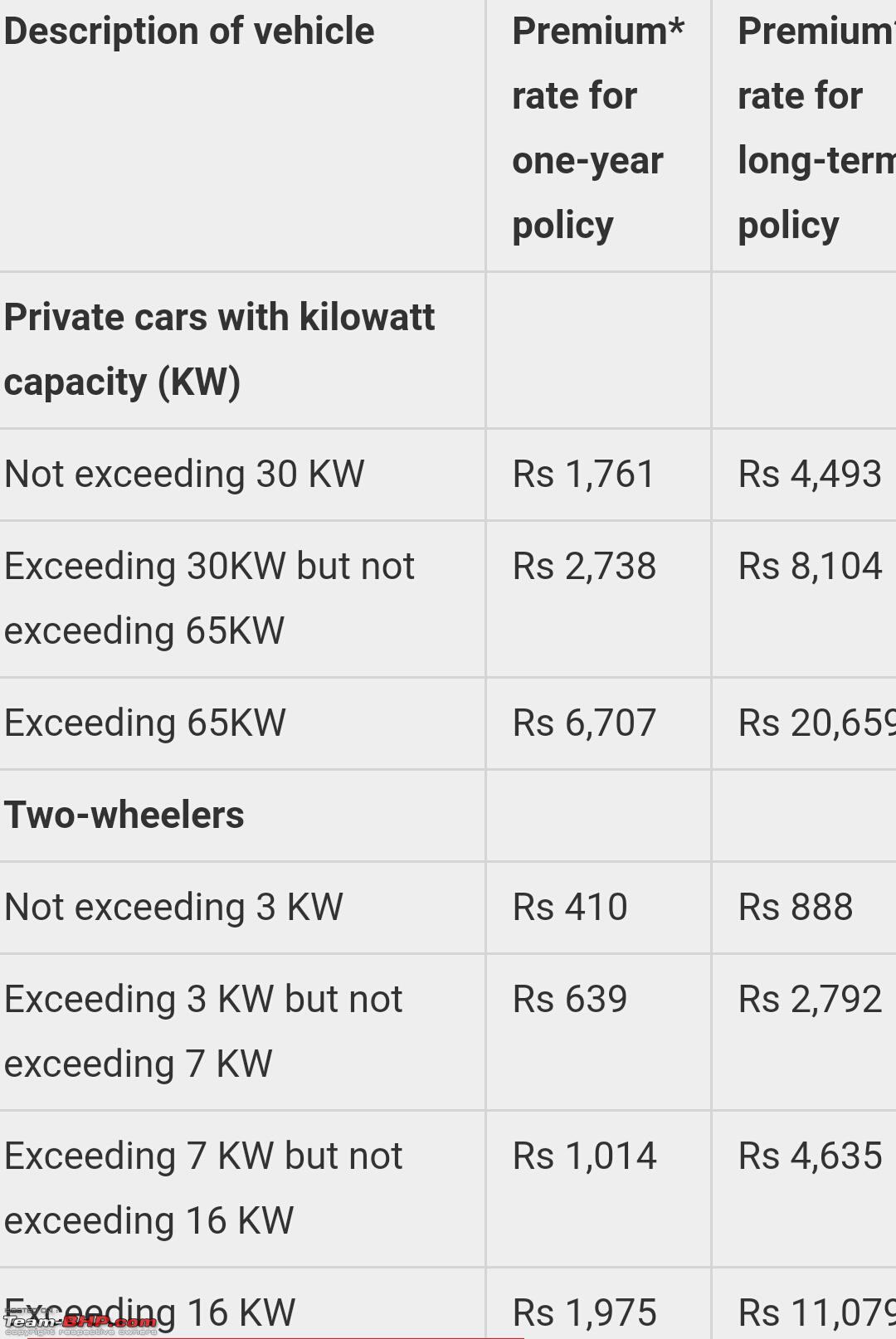

What Are the Costs of 3rd Party Car Insurance?

The cost of 3rd party car insurance varies depending on the type of car you drive, the age of the driver and their driving history, as well as the area you live in. Generally speaking, the cost of 3rd party car insurance is much lower than the cost of comprehensive or collision insurance. However, it is important to keep in mind that the cost of 3rd party car insurance is often higher than the cost of comprehensive insurance for young drivers, since young drivers are considered to be more of a risk.

What Are the Advantages of 3rd Party Car Insurance?

The main advantage of 3rd party car insurance is that it is usually the cheapest form of car insurance available. It is also the only type of insurance that is legally required in most countries. In addition, 3rd party car insurance provides coverage for any damage caused to another person’s car or property, which is often an important consideration in the event of an accident. Finally, 3rd party car insurance is often the only type of insurance that will cover legal costs in the event of an accident.

What Are the Disadvantages of 3rd Party Car Insurance?

The main disadvantage of 3rd party car insurance is that it does not cover any damage to your own car. In addition, the cost of 3rd party car insurance can often be higher than the cost of comprehensive or collision insurance for young drivers. Finally, 3rd party car insurance does not provide coverage for any medical expenses incurred as a result of an accident.

In Conclusion

3rd party car insurance is the most basic form of car insurance and is usually the cheapest option available. It is important to keep in mind, however, that it does not cover any damage to your own car, and the cost of 3rd party car insurance can often be higher than the cost of comprehensive or collision insurance for young drivers. In addition, 3rd party car insurance does not provide coverage for any medical expenses incurred as a result of an accident. Ultimately, it is important to consider all of these factors when deciding which type of car insurance is right for you.

3rd-party insurance prices hiked for the nth time (June 2019) - Team-BHP

Third Party Insurance Price Uae - akuapprovesing

What is third party insurance | Online insurance, Compare insurance

Do's And Don'ts of Buying 3rd Party Insurance Online

Buy Third Party Insurance Online For Car : Third Party Only Car