Does Usaa Auto Insurance Have Gap Coverage

Does USAA Auto Insurance Have Gap Coverage?

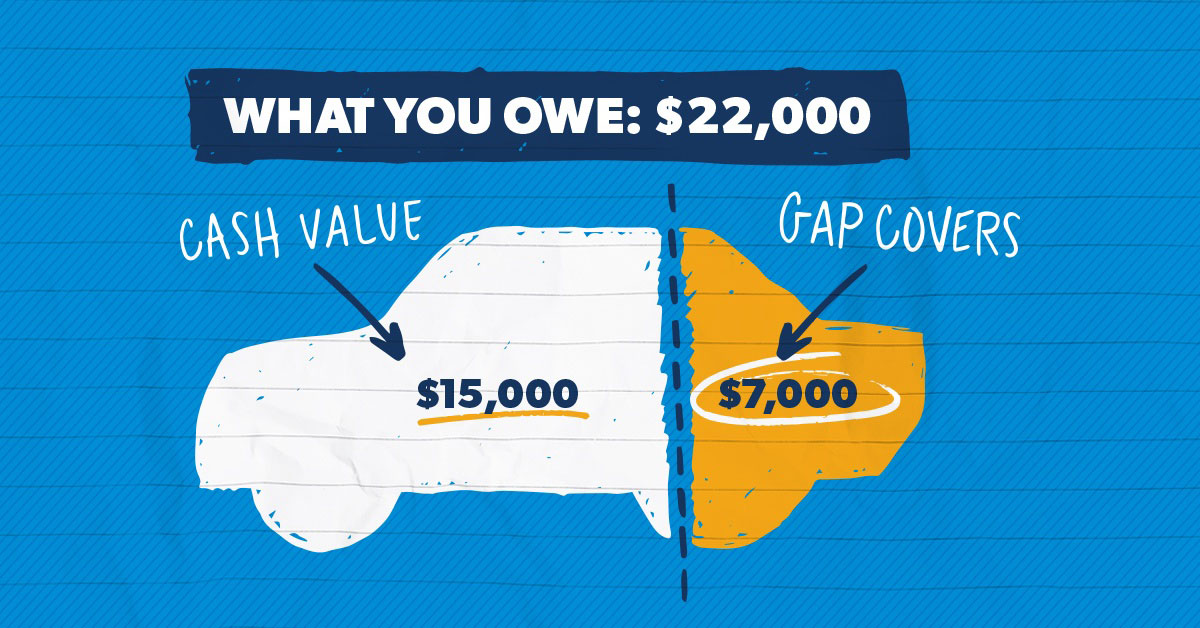

Gap coverage, or Guaranteed Auto Protection, is an important type of auto insurance that can provide you with financial protection in the event of a total loss. This type of insurance is especially important if you are financing a new vehicle purchase or have a loan or lease on a current vehicle. If your vehicle is stolen or damaged beyond repair, gap insurance can help you avoid the financial burden of paying off the remaining balance on your loan or lease.

USAA is an insurance company that offers a variety of auto insurance products, including gap coverage. USAA offers two types of gap coverage: Loan/Lease Gap Coverage and Finance Gap Coverage. Both of these types of coverage can pay the difference between what you owe on your vehicle and what the insurance company pays out in the event of a total loss.

Loan/Lease Gap Coverage

Loan/Lease Gap Coverage from USAA is designed to provide financial protection if your vehicle is totaled or stolen. This type of gap coverage will pay the difference between what your insurance company pays out on a claim and what you owe on your loan or lease. This type of coverage is especially beneficial for those who are financing a new car purchase or have an existing loan or lease on a current vehicle.

Loan/Lease Gap Coverage from USAA is available for both new and used vehicles. The amount of coverage you receive depends on the terms of your loan or lease agreement. USAA also offers an optional Loan/Lease Payoff Coverage, which pays the outstanding balance on your loan or lease in the event of a total loss.

Finance Gap Coverage

Finance Gap Coverage from USAA is designed to provide additional financial protection if your vehicle is totaled or stolen. This type of coverage pays the difference between what your insurance company pays out on a claim and the outstanding balance on your loan or lease. This type of coverage is especially beneficial for those who are financing a new car purchase or have an existing loan or lease on a current vehicle.

Finance Gap Coverage from USAA is available for both new and used vehicles. The amount of coverage you receive depends on the terms of your loan or lease agreement. USAA also offers an optional Finance Payoff Coverage, which pays the outstanding balance on your loan or lease in the event of a total loss.

Conclusion

USAA offers two types of gap coverage, Loan/Lease Gap Coverage and Finance Gap Coverage, that can provide financial protection if your vehicle is stolen or damaged beyond repair. This type of coverage is especially important if you are financing a new vehicle purchase or have a loan or lease on a current vehicle. USAA offers optional Loan/Lease Payoff Coverage and Finance Payoff Coverage, which will pay the outstanding balance on your loan or lease in the event of a total loss.

Gap Insurance: Usaa Gap Insurance Coverage

Understanding Auto Insurance “Gap Coverage“

How Much Is Insurance : How Much Car Insurance Do I Need? Your

Usaa Supplemental Health Insurance | Health Insurance

How Does Gap Insurance Work? | RamseySolutions.com