Direct Line Breakdown Cover Options

Friday, November 11, 2022

Edit

Direct Line Breakdown Cover Options

What Is Breakdown Cover?

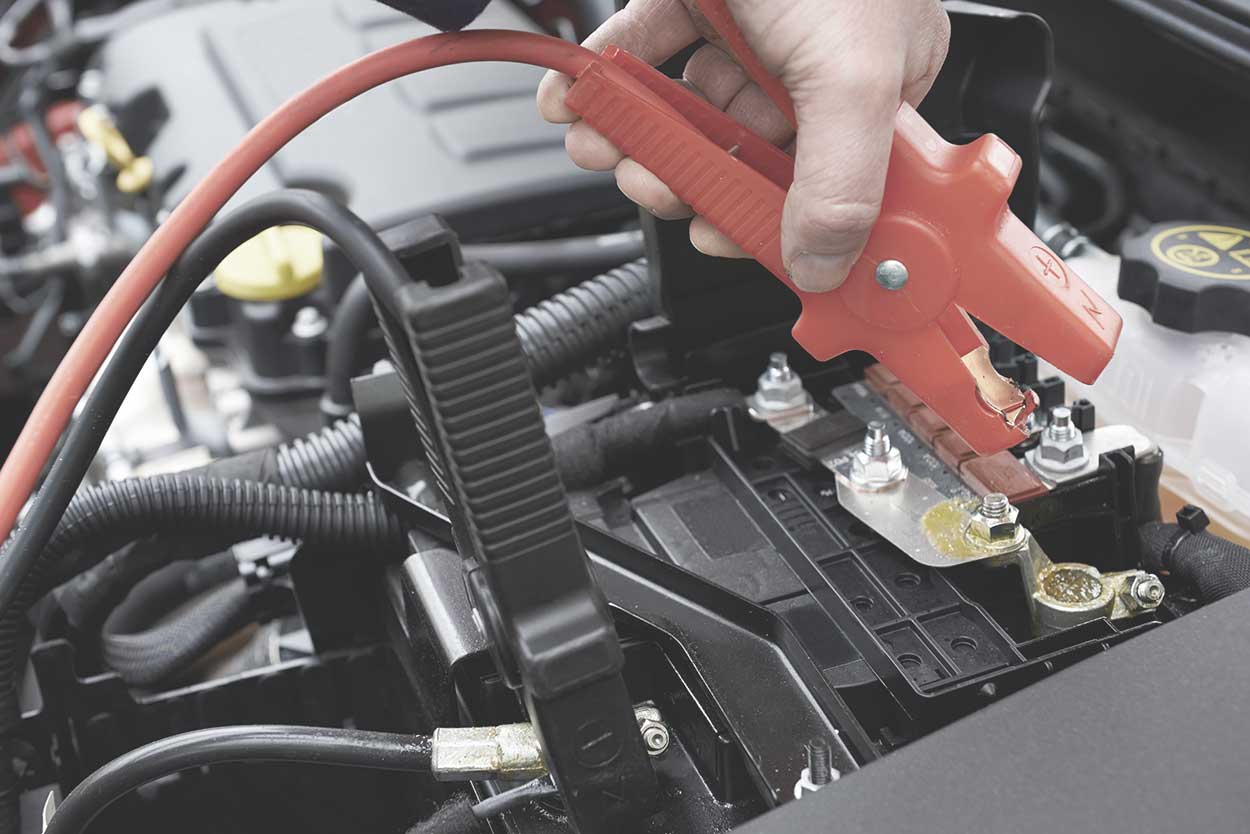

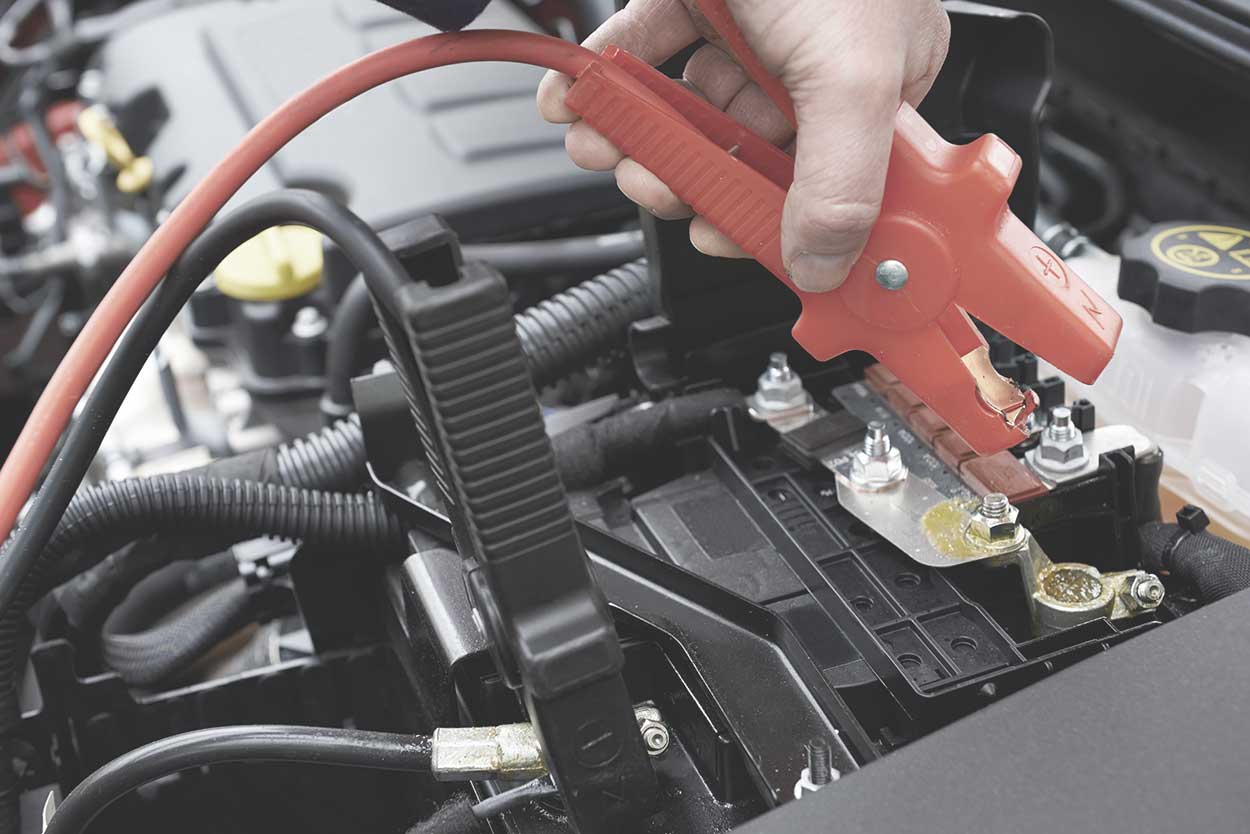

Breakdown cover is a type of insurance that is designed to help drivers in the event that their car breaks down. It can provide assistance in the form of towing, roadside repairs, or even replacement vehicles if the original car cannot be fixed. Breakdown cover is often sold as an additional insurance policy, but some companies offer it as part of their standard policies. Direct Line is one of the companies that offer breakdown cover as an add-on to their insurance policies.

What Does Direct Line Breakdown Cover Include?

Direct Line breakdown cover includes a range of services. This includes roadside assistance, towing, recovery, and replacement car hire. The roadside assistance service includes the option to have the car towed to a nearby garage if it cannot be fixed at the roadside. The recovery service allows for the car to be taken to a garage of the customer's choice. The replacement car hire service allows customers to hire a car while their own car is being fixed.

What Does Direct Line Breakdown Cover Not Include?

Direct Line breakdown cover does not include any cover for accidents or medical expenses. This means that if the customer is involved in an accident, or suffers any injury or illness while using the car, then they will not be covered. It also does not include any cover for any damage to the car caused by the breakdown.

How Much Does Direct Line Breakdown Cover Cost?

The cost of Direct Line breakdown cover varies depending on the level of cover chosen. The basic level of cover starts from around £50 per year, with higher levels of cover costing more. Customers can also add additional levels of cover, such as European cover, for an additional cost.

What Is The Claims Process For Direct Line Breakdown Cover?

The claims process for Direct Line breakdown cover is straightforward. Customers simply need to call the Direct Line breakdown cover helpline and provide details of the breakdown. The helpline will then arrange for roadside assistance or a replacement car, depending on the level of cover chosen. If the car cannot be fixed at the roadside, then the helpline will arrange for it to be taken to a garage of the customer's choice.

What Is The Cancellation Policy For Direct Line Breakdown Cover?

The cancellation policy for Direct Line breakdown cover is straightforward. Customers can cancel the policy at any time without incurring any additional charges. If the customer cancels the policy before it expires, then they will be refunded the unused portion of the premium. The customer must also provide proof of cancellation to the Direct Line helpline.

Choosing the Best Breakdown Cover UK | My Car Credit

Direct Line Customer Service Contact Number: 0345 246 3761

Your Vehicle Is More Likely To Breakdown This Summer – Purchase