Cost Of Long term Care Insurance By Age

Cost Of Long Term Care Insurance By Age

The Basics Of Long Term Care Insurance

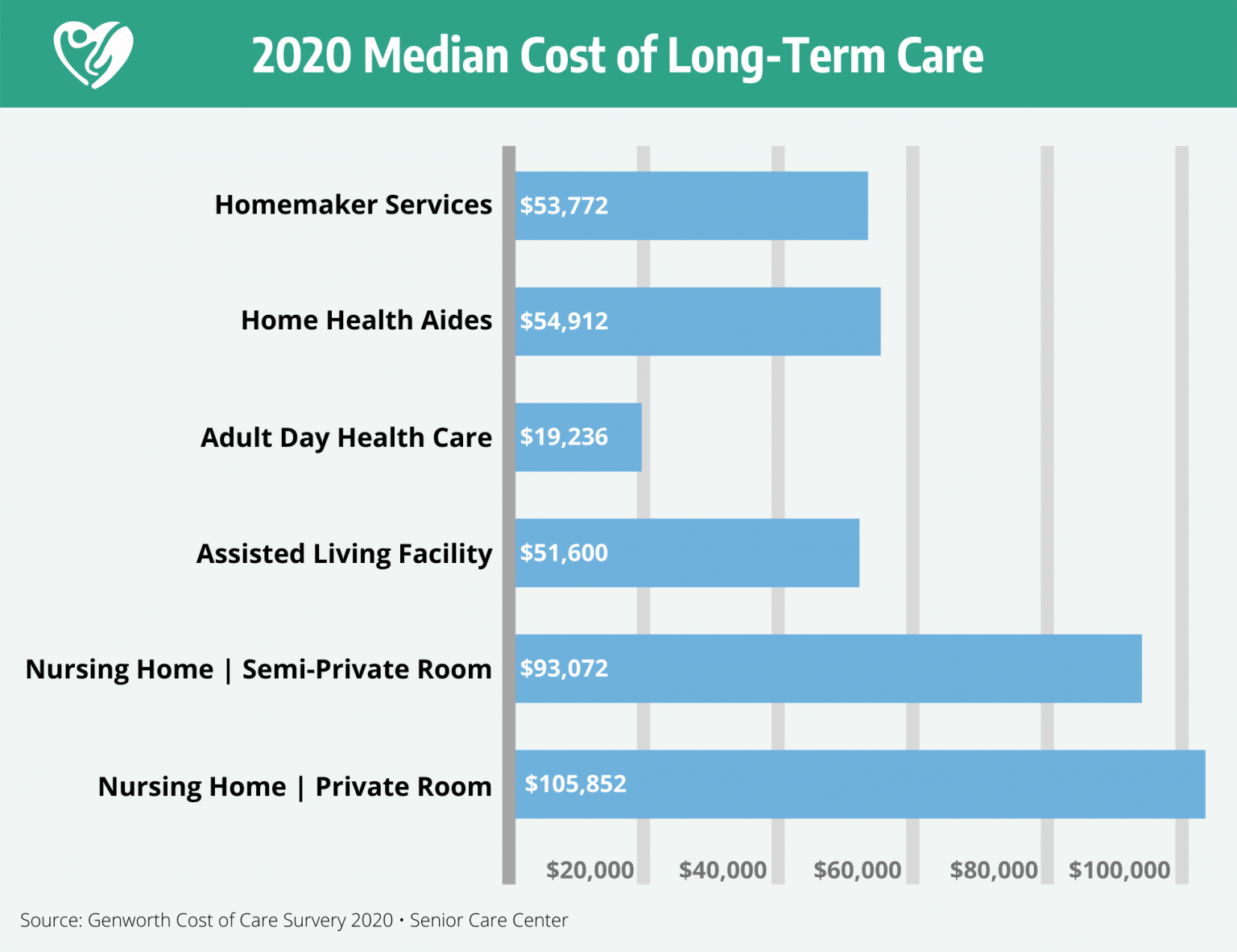

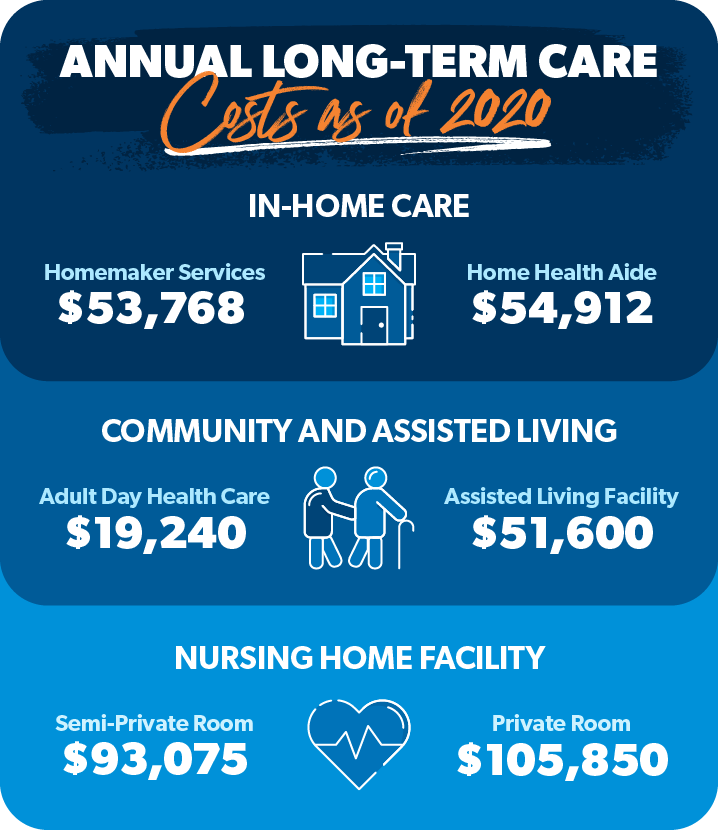

Long Term Care Insurance (LTCI) is a type of insurance policy that is designed to help you pay for the cost of long-term care services. This includes both in-home care and care in a nursing home or other assisted living facility. LTCI policies typically cover some or all of the costs associated with long-term care, including medical expenses, personal care costs, and other services. You can purchase long-term care insurance from a variety of different insurance companies, and the cost of such policies can vary greatly. It's important to understand the basics of long-term care insurance and how it works, so that you can make an informed decision when selecting an LTCI policy.

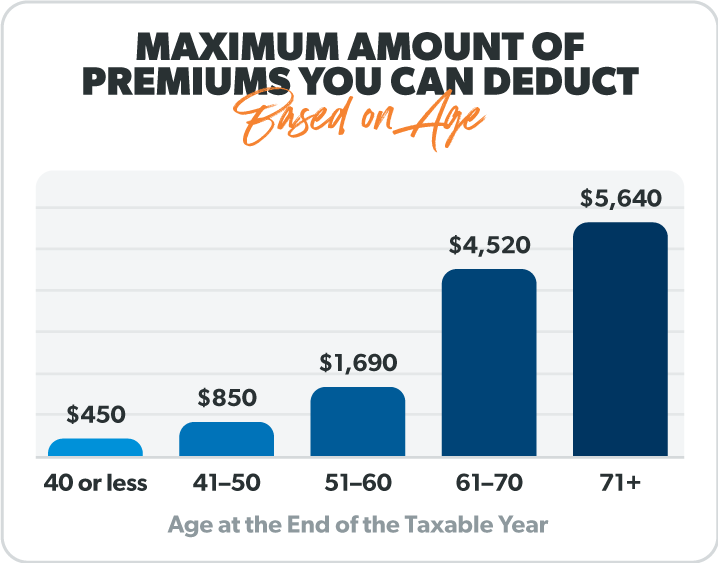

How Does Age Impact the Cost of Long Term Care Insurance?

When it comes to purchasing long-term care insurance, one of the main factors that will affect the cost of such policies is your age. Generally speaking, the younger you are when you purchase a policy, the lower the costs will be. This is because the younger you are, the less likely you are to need long-term care services. As you get older, the cost of your policy will typically increase, as the insurance company has to factor in the increased risk of needing long-term care. Additionally, some insurance companies may have age limits on their policies, so it's important to check with your insurer to make sure that you qualify for coverage.

The Cost of Long Term Care Insurance at Different Ages

The exact cost of long-term care insurance at different ages will vary depending on the insurer, the type of policy, and other factors. However, in general, you can expect the following approximate costs for long-term care insurance at different ages:

- Age 40 - $750 per year

- Age 50 - $1,000 per year

- Age 60 - $1,500 per year

- Age 70 - $2,500 per year

- Age 80 - $4,000 per year

These are just rough estimates, and the cost of LTCI policies can vary greatly depending on the insurer, the type of policy, and other factors. It's important to shop around and compare policies from different insurers before selecting an LTCI policy.

The Benefits of Long Term Care Insurance

Long-term care insurance can provide many benefits to policyholders. It can help cover the costs of long-term care services, which can be very expensive. It can also help ensure that you receive the care that you need in a timely manner. Additionally, long-term care insurance can provide peace of mind to policyholders, as they know that their care costs will be taken care of. All of these benefits make long-term care insurance a worthwhile investment for many people.

Conclusion

The cost of long-term care insurance can vary greatly depending on your age and other factors. Generally speaking, the younger you are when you purchase a policy, the lower the cost will be. It's important to shop around and compare policies from different insurers before selecting an LTCI policy. Additionally, it's important to understand the benefits of long-term care insurance and how it can help you pay for the cost of long-term care services.

A Complete Guide To Long-Term Care Insurance in 2021 - Senior Care Center

How Much Does Long-Term Care Insurance Cost? | RamseySolutions.com

Why People Don’t Buy Long-Term-Care Insurance - WSJ

Long Term Care Insurance Cost By Age - Lifetime Solutions Plus :: 5

How Much Does Long-Term Care Insurance Cost? | RamseySolutions.com