Average Car Insurance For Teens In Massecdhuesets

Average Car Insurance For Teens in Massecdhuesets

Teenagers in Massecdhuesets may feel like they are stuck between a rock and a hard place when it comes to car insurance. On one hand, they are subject to high insurance rates due to their inexperience as drivers and their higher chances of involvement in accidents. On the other hand, they are limited in their job prospects, meaning they have less money to pay for insurance. It’s a difficult situation that can be intimidating to navigate, but with some research, teenagers in Massecdhuesets can find the car insurance that best suits their needs and budget.

What is the Average Cost of Car Insurance for Teens in Massecdhuesets?

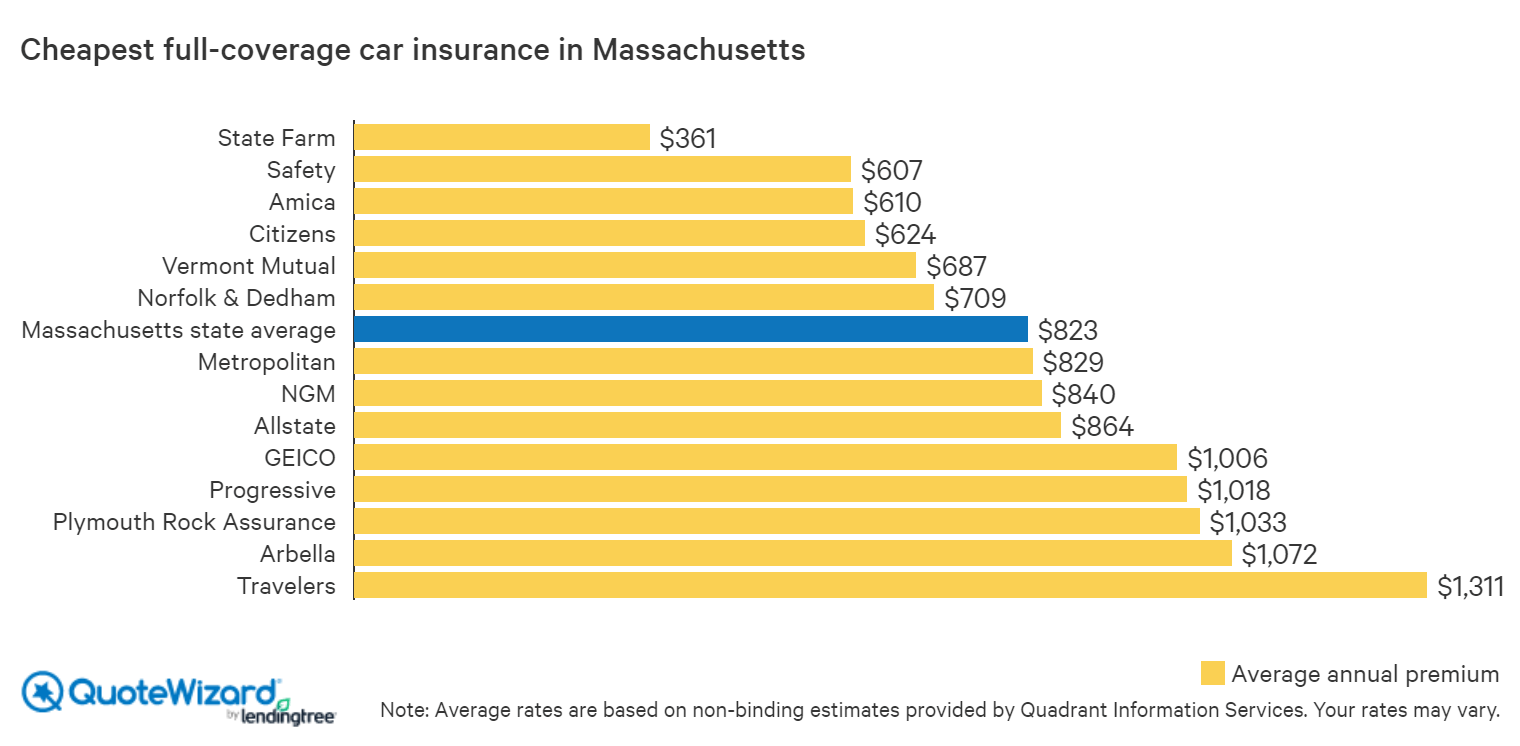

The average cost of car insurance for teens in Massecdhuesets is $2,939. This figure is higher than the national average of $2,305, and it reflects the fact that teens in Massecdhuesets are more likely to be involved in accidents. Insurance companies in Massecdhuesets must charge higher rates to make up for their greater risk. Of course, different insurance companies will charge different rates, and some may offer discounts to teens who take driver safety courses or maintain good grades in school.

What Factors Affect the Cost of Car Insurance for Teens?

There are a number of factors that can affect the cost of car insurance for teens in Massecdhuesets. The type of car they drive, their driving record, and their age are all factors that insurance companies consider when setting rates. For example, teens who drive older cars will likely pay less for insurance than those who drive newer cars. Insurance companies also take into account the area where the teen lives and drives, as some areas are more prone to accidents than others.

What Tips Can Help Teens Save Money on Car Insurance?

There are a few tips teens in Massecdhuesets can use to save money on car insurance. One of the best ways to save is to compare rates from multiple insurers. Teens should also take advantage of any discounts they are eligible for, such as those for good grades, taking driver safety courses, or maintaining a clean driving record. Teens should also make sure to shop around at least once a year to make sure they are still getting the best rate.

What Other Options are Available to Teens in Massecdhuesets?

In addition to shopping around, teens in Massecdhuesets can look into different types of coverage to make sure they are getting the best deal. For example, teens may want to consider opting for a higher deductible, as this can lower their premiums. They may also want to consider adding additional coverage such as comprehensive or collision coverage, which can help protect them in the event of an accident.

Conclusion

Teenagers in Massecdhuesets can find car insurance that fits their needs and budget. The best way to save money is to compare rates from multiple insurers and to take advantage of any discounts for which they may be eligible. Teens should also consider different types of coverage to make sure they are getting the best deal. With some research, teens can find the car insurance that best suits their needs.

2021 Car Insurance Rates by Age and Gender - NerdWallet

wiredridedesigns: Who Has The Cheapest Auto Insurance In Massachusetts

Common Automobile Insurance coverage Charges by Age and Gender

Massachusetts Car Insurance [Rates + Proven Guide]

![Average Car Insurance For Teens In Massecdhuesets Massachusetts Car Insurance [Rates + Proven Guide]](https://www.carinsurancecomparison.com/wp-content/uploads/dw/massachusetts-car-insurance-rates-by-company-vs-state-average-YJx1p.png)

Factors Influencing The Cost of Auto Insurance in Springfield, MA