Cheap Full Coverage Car Insurance Alabama

Monday, December 5, 2022

Edit

Cheap Full Coverage Car Insurance Alabama

What Is Full Coverage Car Insurance?

Full coverage car insurance is designed to provide protection against the financial losses associated with an accident or other related damage. It is a comprehensive policy that provides protection for your car, yourself, and other drivers. This type of insurance usually covers bodily injury, property damage, medical payments, and uninsured/underinsured motorist coverage. It also typically includes liability coverage for damage to other people's property and for personal injury protection. It may also include collision coverage and comprehensive coverage.

How Can I Get Cheap Full Coverage Car Insurance in Alabama?

Finding cheap full coverage car insurance in Alabama can be a challenge, but it's not impossible. The first step is to shop around and compare rates from different insurance companies. Make sure to get quotes from a variety of insurers, as some may offer better rates than others. Additionally, it's important to consider the type of coverage you need, as this can affect the cost. Additionally, there are some factors that can lower your premiums, such as maintaining a good driving record, having a good credit score, and bundling your insurance policies.

What Are the Benefits of Full Coverage Car Insurance in Alabama?

Full coverage car insurance in Alabama provides a great deal of protection to drivers and their vehicles. It can help cover the cost of repairs in the event of an accident, as well as provide liability coverage for any injuries that may be sustained by other drivers. It can also provide peace of mind knowing that you are covered in the event of an accident. Additionally, having full coverage can also help lower your insurance rates, as it shows that you are a responsible driver who takes the necessary steps to protect themselves and their car.

What Are the Requirements for Full Coverage Car Insurance in Alabama?

In order to be eligible for full coverage car insurance in Alabama, you must meet certain requirements. Generally, you must have a valid driver’s license and be at least eighteen years old. Additionally, you must have a clean driving record and have no history of traffic violations or accidents. You may also have to provide proof of financial responsibility, such as proof of income or a valid credit card. Finally, you must have adequate insurance coverage that meets the state’s minimum coverage requirements.

Additional Tips for Finding Cheap Full Coverage Car Insurance in Alabama

In addition to shopping around and comparing rates from different companies, there are a few other tips that can help you find the best deal on full coverage car insurance in Alabama. First, consider raising your deductible. This can help lower your premiums, as you will be responsible for more of the costs in the event of an accident. Additionally, ask your insurance company about discounts for things like having multiple cars insured, a good driving record, and bundling your policies. Finally, consider taking a defensive driving course, as this can demonstrate that you are a responsible driver and may help you get a better rate.

Conclusion

Finding cheap full coverage car insurance in Alabama can be challenging, but it is possible. By shopping around and comparing rates from different companies, you can find the best deal. Additionally, by considering factors such as your driving record and credit score, you can lower your premiums. Finally, taking steps such as raising your deductible and taking a defensive driving course can further help you get a good rate. With a little bit of research and effort, you can find the perfect full coverage car insurance policy for your needs.

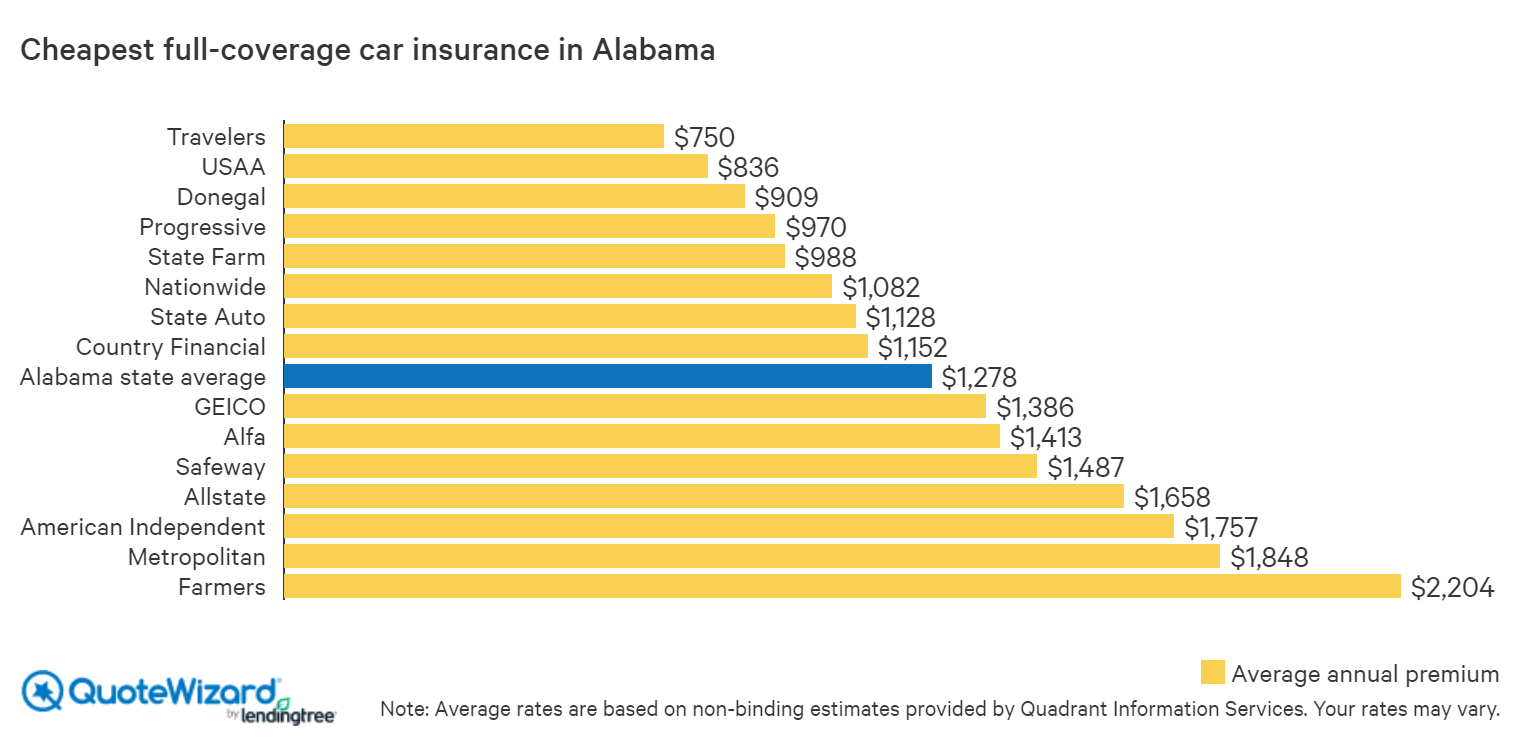

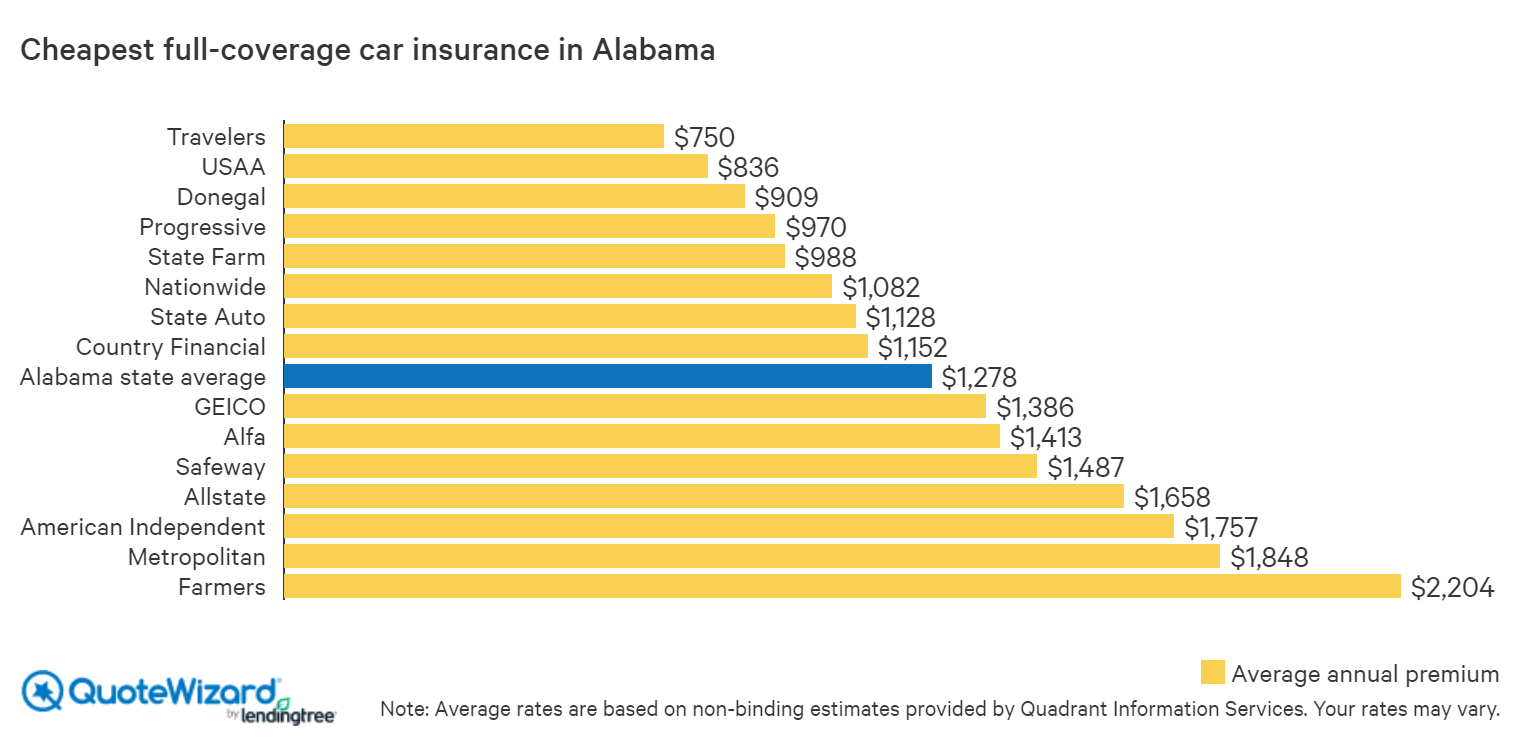

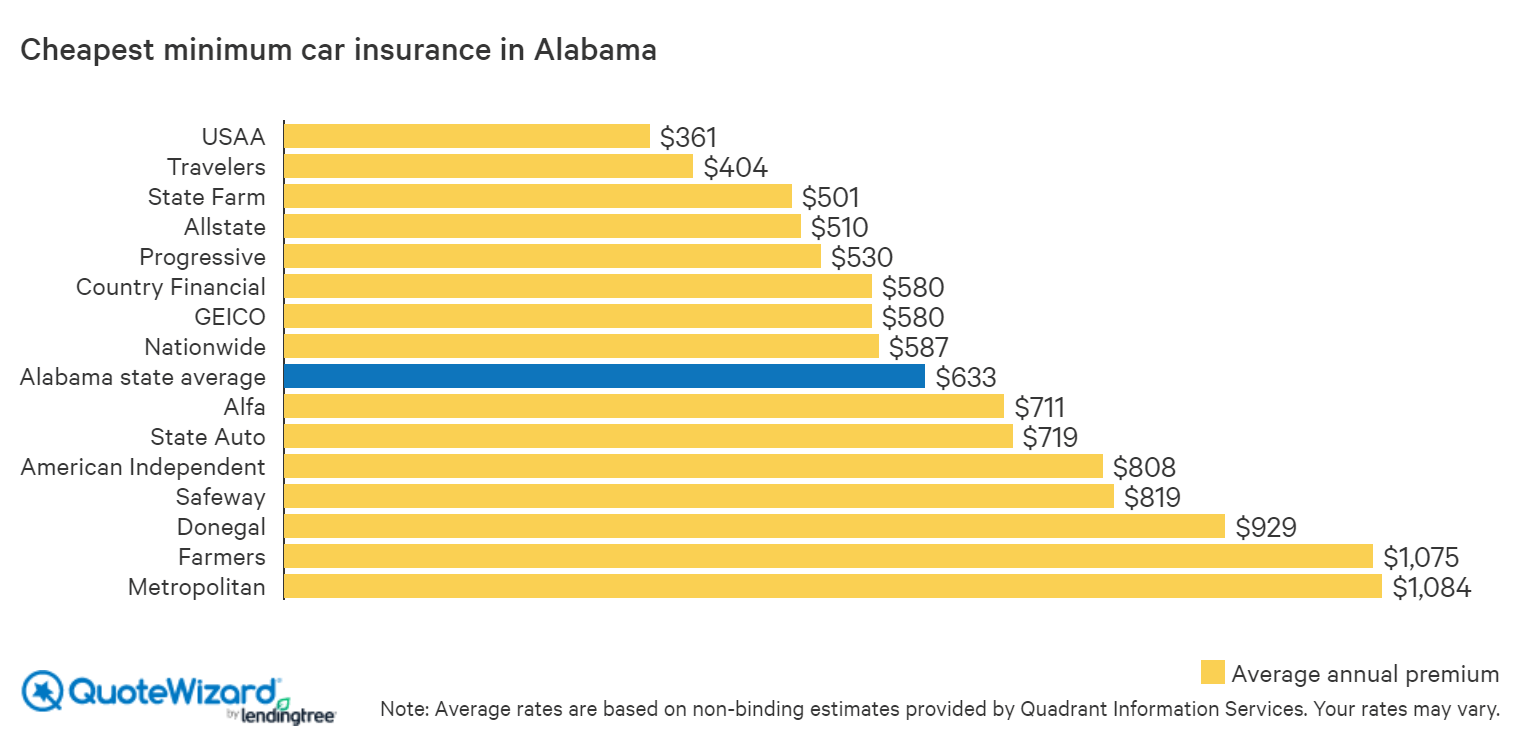

Find Cheap Car Insurance in Alabama | QuoteWizard

Cheap Car Insurance in Alabama 2019

Find Cheap Car Insurance in Alabama | QuoteWizard

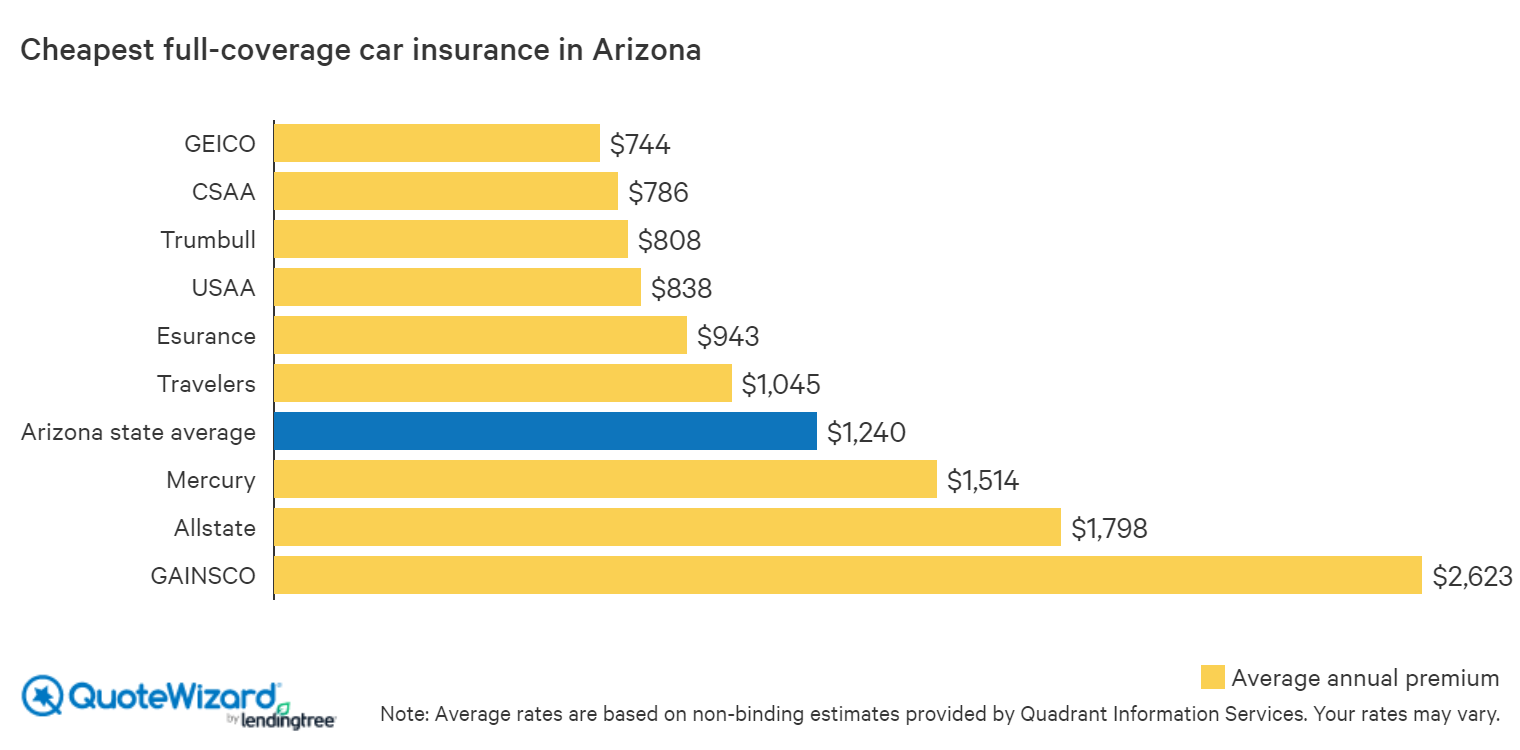

Cheap Car Insurance in Arizona | QuoteWizard