Public Liability And Property Damage Insurance

What is Public Liability and Property Damage Insurance?

Public liability and property damage insurance (PLPD) is a type of insurance coverage designed to protect individuals and businesses from financial losses that may arise from unexpected events. PLPD can provide coverage for legal costs, medical expenses, and property damage caused by an accident. It is an important form of protection for businesses and individuals, as it can help to reduce financial hardship in the event of an unexpected incident.

PLPD insurance can help protect you from the financial costs associated with third-party claims due to negligence or your legal liabilities. This type of insurance can help cover the costs of medical treatment, legal expenses, and property damage caused by an accident or other incident. It can also provide protection for businesses and individuals in the event of a lawsuit.

Who Needs Public Liability and Property Damage Insurance?

Public liability and property damage insurance is important for anyone who owns a business or property. It is important for landlords as it can provide coverage for any property damage caused by tenants. It is also important for businesses that provide services or products to the public. This type of coverage can help protect against financial losses in the event of a lawsuit or other claims due to negligence or legal liabilities.

Anyone who owns a business or property should consider purchasing PLPD insurance. This type of coverage can help protect against financial losses that can arise from property damage or legal liabilities. It is important to remember that even if you do not own a business, you may still be liable for any property damage caused by you or your actions.

What Does Public Liability and Property Damage Insurance Cover?

Public liability and property damage insurance can provide coverage for legal costs, medical expenses, and property damage caused by an accident. It can also provide coverage for the cost of repairing or replacing property that was damaged due to an accident or incident. This type of insurance can also provide coverage for any legal fees associated with defending yourself against a lawsuit.

PLPD insurance can also provide protection against financial losses due to third-party claims such as bodily injury, property damage, and personal injury. This type of coverage can also provide coverage for any legal fees associated with defending yourself against a lawsuit.

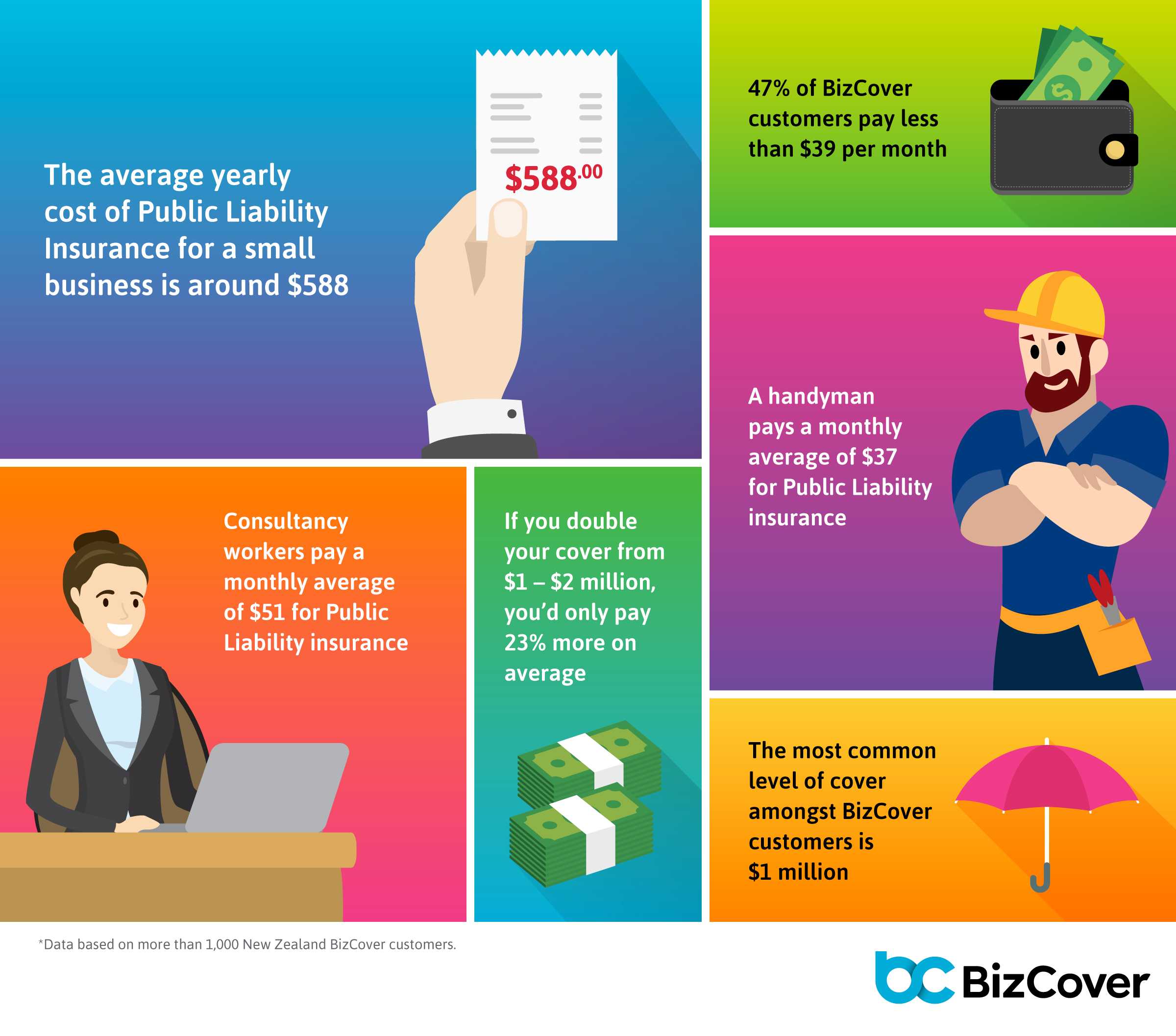

How Much Does Public Liability and Property Damage Insurance Cost?

The cost of PLPD insurance can vary depending on the type of coverage you choose and the amount of coverage you need. The cost of coverage can also vary depending on the type of business or property you own and the amount of risk associated with it. You should always compare different policies and rates before purchasing a policy to ensure that you are getting the best coverage at the best price.

Public liability and property damage insurance is an important form of protection for businesses and individuals. It can help to reduce financial hardship in the event of an unexpected incident and provide coverage for legal costs, medical expenses, and property damage. It is important to compare different policies and rates before purchasing a policy to ensure that you are getting the best coverage at the best price.

PPT - BID DOCUMENTS AND CONTRACT DOCUMENTS * The difference between bid

What does public liability insurance cover? - Trade Direct Insurance

Public liability insurance infographic

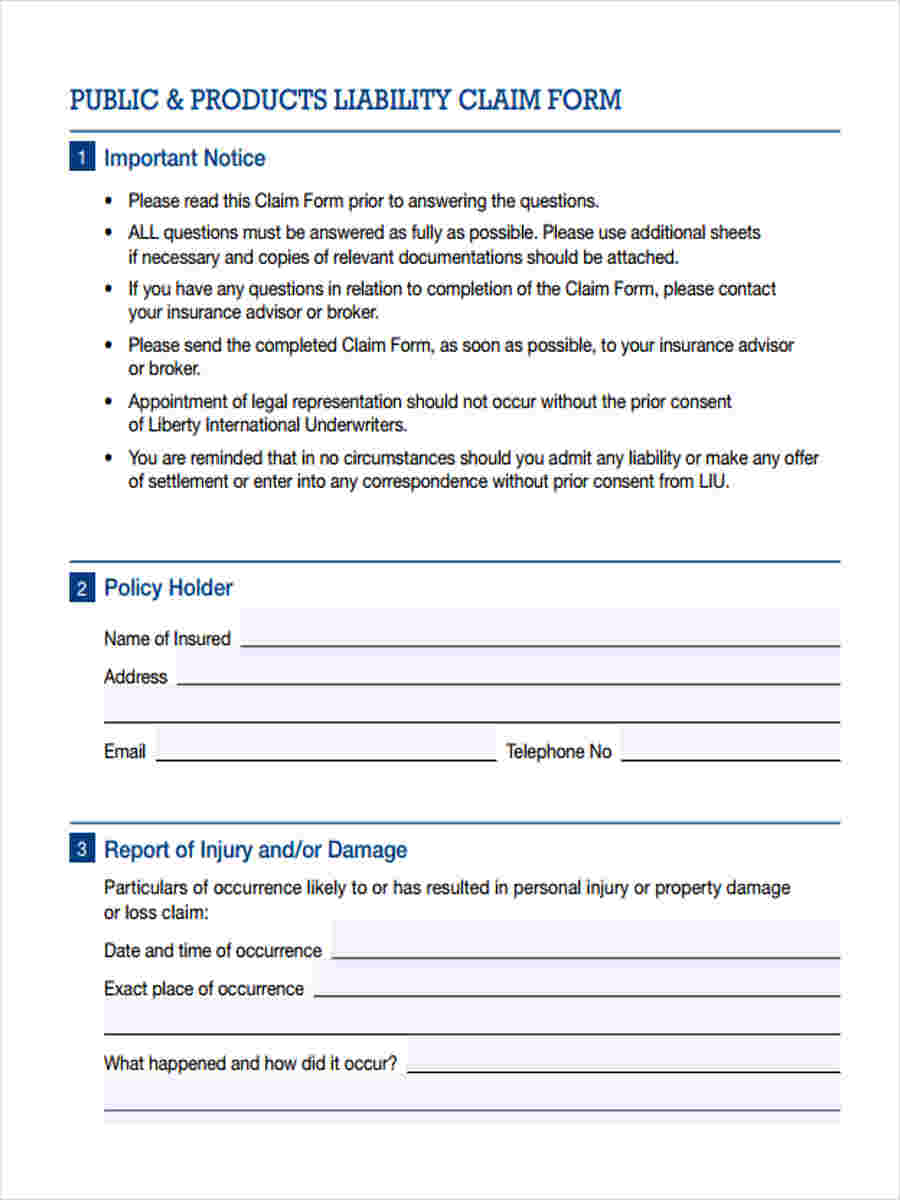

FREE 10+ Liability Claim Forms in PDF | Ms Word

What does Public Liability Insurance Cost? | BizCover NZ