Gap Insurance With Carmax Financing

Gap Insurance With Carmax Financing

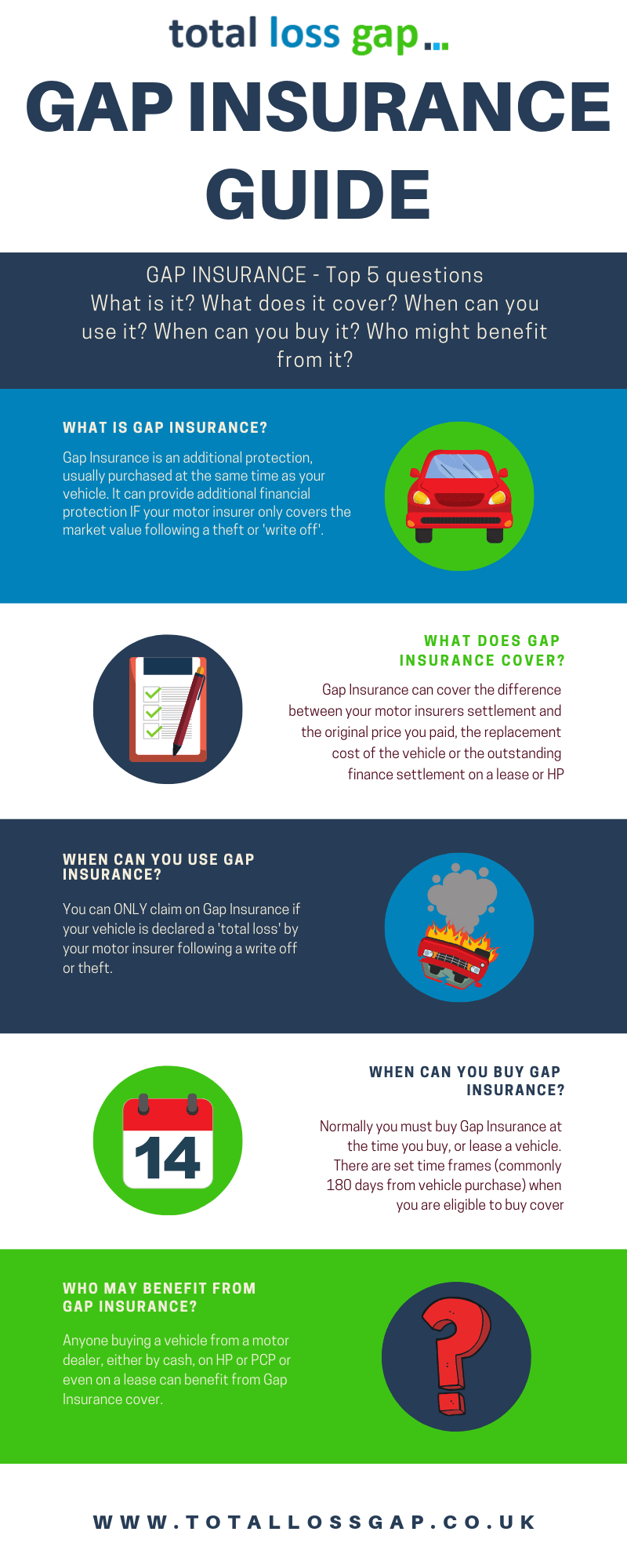

What is Gap Insurance?

Gap insurance, also known as Guaranteed Auto Protection, is a type of insurance that covers the difference between what you owe on your car loan or lease and the cars current cash value in the event it’s totaled or stolen. This type of insurance is important for drivers who have financed their car with a loan or a lease, since it can prevent them from having to pay for damages that the auto insurance company doesn’t cover. For example, if your car is totaled and your auto insurance company only pays you the current cash value of your car, you could be left with an outstanding balance on your loan or lease. But if you have gap insurance, it can pay the difference between the current cash value and what you owe.

How Does Gap Insurance Work with CarMax Financing?

Gap insurance with CarMax Financing works much like it does with any other type of auto loan. If your car is totaled or stolen, your gap insurance will cover the difference between the current cash value of your car and what you owe on your loan or lease. This type of insurance is especially important for people who have financed their car with a loan or a lease, since it can prevent them from having to pay for damages that the auto insurance company doesn’t cover. CarMax Financing offers several gap insurance options, so you can choose the one that best fits your needs.

What are the Benefits of Gap Insurance With CarMax Financing?

The main benefit of gap insurance with CarMax Financing is that it can help you avoid having to pay for damages that the auto insurance company doesn’t cover. If your car is totaled or stolen, gap insurance can pay the difference between the current cash value and what you owe on your loan or lease. In addition, gap insurance with CarMax Financing can also help you save money in the long run, since it can help you avoid having to pay for expensive repairs or replacement costs. Finally, gap insurance can give you peace of mind, knowing that you won’t be left with a large bill if something happens to your car.

What are the Disadvantages of Gap Insurance With CarMax Financing?

One of the main disadvantages of gap insurance with CarMax Financing is that it can be expensive. Since gap insurance covers the difference between what you owe and the current cash value of your car, it can be a significant cost. In addition, gap insurance with CarMax Financing is only available for cars that are financed through the company, so if you have a loan or lease from another lender, you won’t be able to get gap insurance from CarMax. Finally, it’s important to remember that gap insurance will only cover the difference between the current cash value of your car and what you owe, so if you owe more than the current cash value of your car, you still may be left with an outstanding balance.

Should I Get Gap Insurance With CarMax Financing?

Whether or not you should get gap insurance with CarMax Financing depends on your individual needs and situation. If you have financed your car with a loan or a lease and are concerned about having to pay for damages that the auto insurance company doesn’t cover, gap insurance can be a good option. However, it’s important to remember that gap insurance can be expensive, so you should weigh the cost against the potential benefits before making a decision. Ultimately, the decision to get gap insurance with CarMax Financing is a personal one and should be based on your individual needs and situation.

Carmax Gap Insurance / Why Your Down Payment Matters Carmax : You can

Do you need gap insurance for your car? How does it work?

Gap Car Insurance Tips - Can I Buy Gaping Coverage Without Paying More

GAP Insurance - Explained in a Complete Guide | TotalLossGap