New India Assurance Third Party Car Insurance Price

Wednesday, February 18, 2026

Edit

New India Assurance Third Party Car Insurance Price

Overview

The New India Assurance Car Insurance policy is designed to provide comprehensive coverage for cars against any damage caused by an accident, theft, fire, or natural disaster. It also provides coverage for third-party liabilities, including any damage or injury caused to the other person or property during an accident. The New India Assurance Car Insurance policy is provided by New India Assurance, a leading insurance provider in India. The policy provides coverage for both private and commercial vehicles, and the coverage level and premium amount varies depending on the type of vehicle and the coverage level opted for.

Benefits of New India Assurance Car Insurance

The New India Assurance Car Insurance policy provides a wide range of benefits, including coverage for third-party liabilities, personal accident cover, and 24-hour roadside assistance. The policy also provides an additional discount on premiums when the insured vehicle is fitted with an anti-theft device. The policy also provides an additional discount for customers who have no claims for a period of three years or more, as well as additional discounts for customers who have multiple vehicles on the same policy.

Coverage levels provided by New India Assurance

New India Assurance provides three different levels of coverage: Basic, Standard, and Comprehensive. The Basic coverage provides coverage for third-party liabilities, while the Standard and Comprehensive coverage levels also provide coverage for own damage and personal accident cover, respectively. The level of coverage and the premium amount varies depending on the type of vehicle and the coverage level opted for.

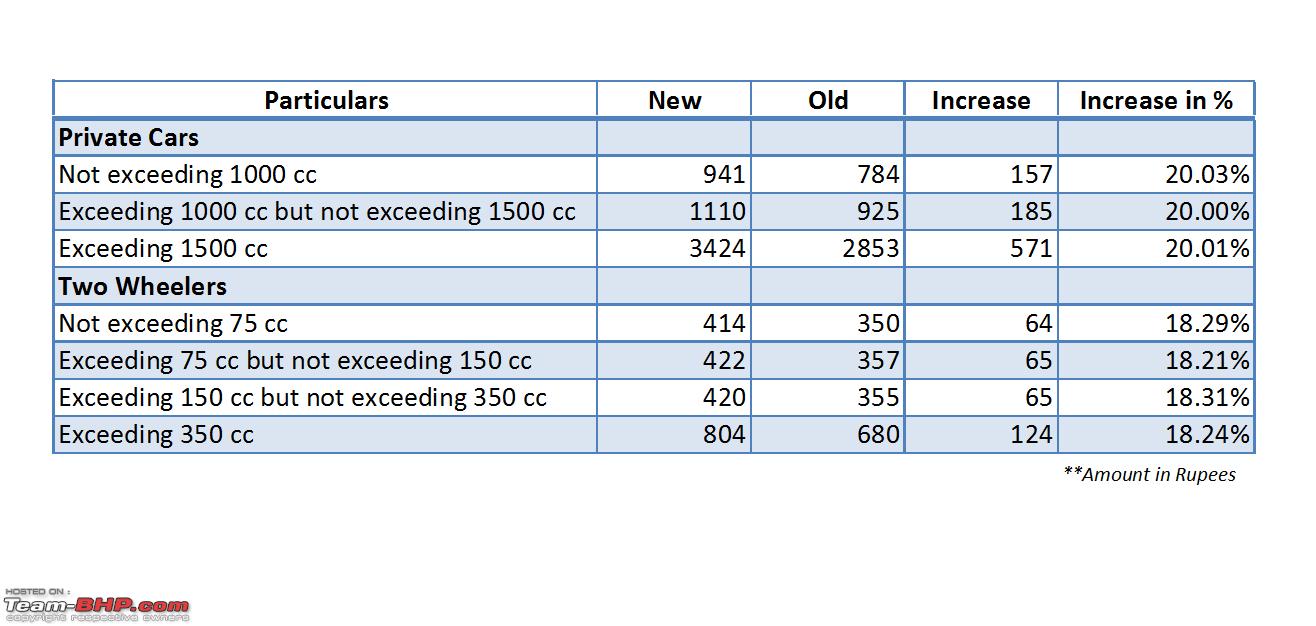

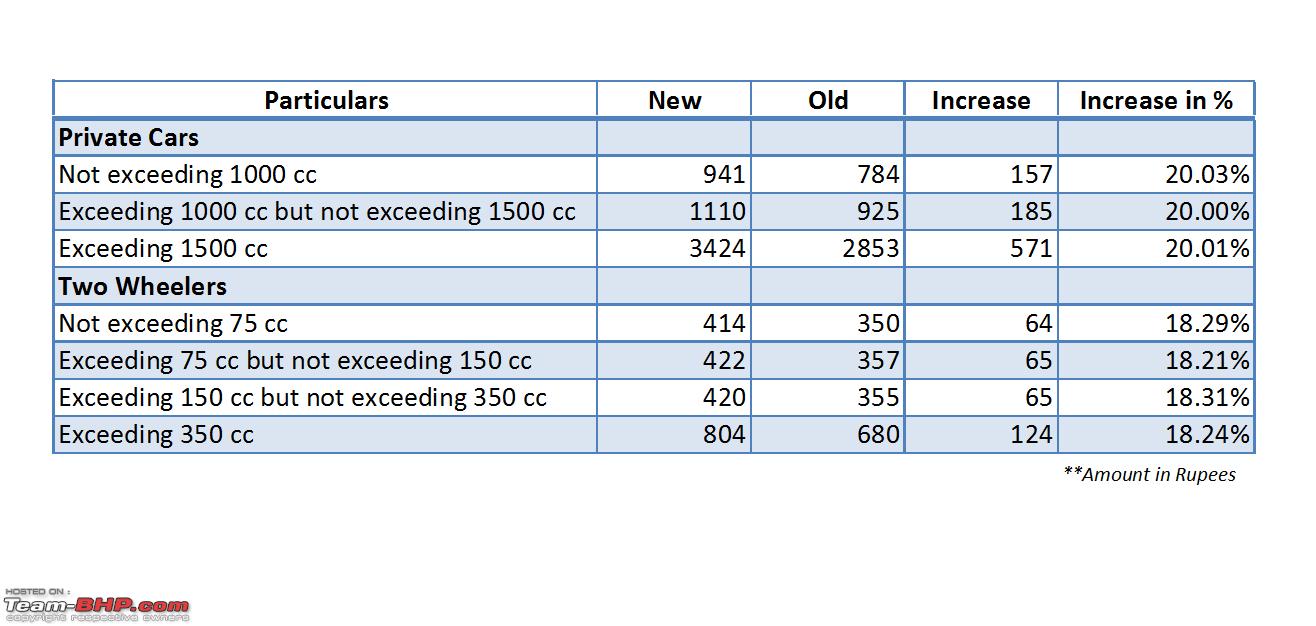

Third Party Car Insurance Price

The price of the New India Assurance Third Party Car Insurance policy depends on the type of vehicle and the coverage level opted for. The premium rates for the Basic coverage are very low, while the rates for the Standard and Comprehensive coverage are slightly higher. The premium rates also vary depending on the age of the vehicle, the make and model of the vehicle, the city of registration, and the driving history of the insured.

Discounts available

New India Assurance provides various discounts on the premium amount to its customers. Customers who have no claims for a period of three years or more are eligible for an additional discount on their premiums. Customers who have multiple vehicles on the same policy are also eligible for an additional discount. Customers who install an anti-theft device in their vehicles are eligible for an additional discount on their premiums.

How to buy New India Assurance Third Party Car Insurance

The New India Assurance Third Party Car Insurance policy can be purchased online or through the company's toll-free customer service number. Customers can also visit the company's website to get more information about the policy, the coverage levels, and the premium rates. Customers can also compare the different policies and the premium rates offered by different insurers to find the best policy for their needs.

Third Party Insurance Premium to go up W.e.f 1st April 2013 - Team-BHP

Third Party Property Car Insurance | iSelect

New India Car Insurance - Renewal, Reviews & Premium Calculator

Third Party Car Insurance Quote - krisadesigns

New India Assurance Family Floater Mediclaim Policy Wordings