Aarp Long term Care Insurance Cost

AARP Long Term Care Insurance Cost: An In-Depth Look

What Is AARP Long Term Care Insurance?

AARP Long Term Care Insurance is an insurance policy designed to help you pay for long term care services in the event that you become unable to care for yourself due to an illness or injury. This type of insurance is designed to cover the costs of long term care services such as home health care, assisted living, and nursing home care. The insurance also covers other services such as medical equipment, transportation, and homemaker services. AARP Long Term Care Insurance is offered by AARP, a non-profit organization that provides services, support, and resources to those over the age of 50.

How Much Does AARP Long Term Care Insurance Cost?

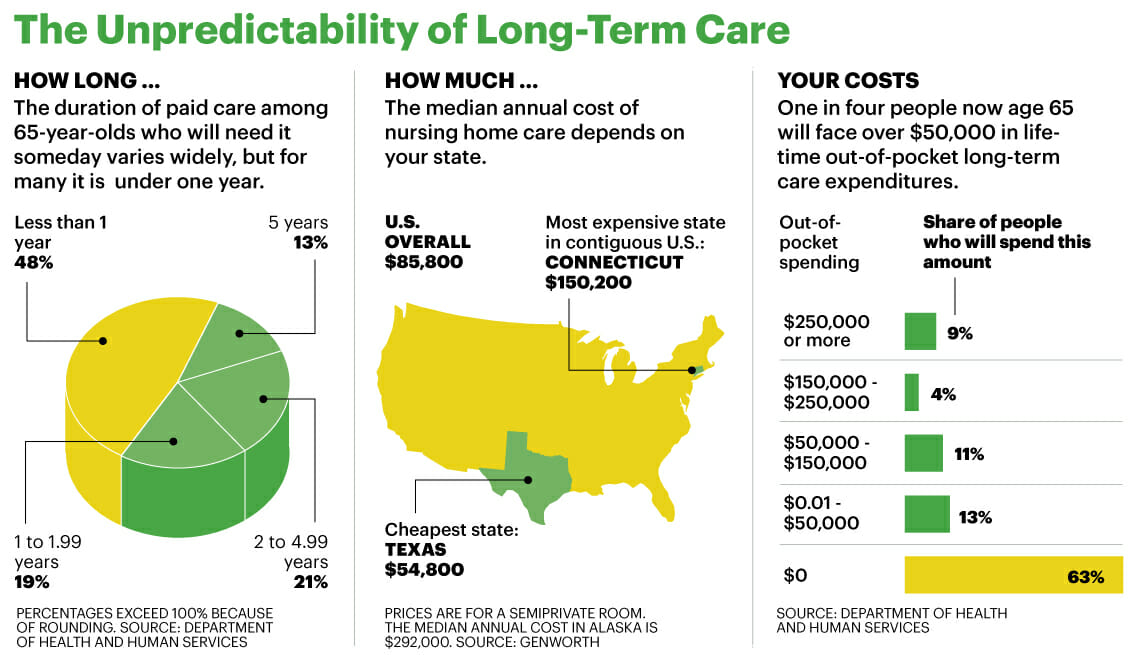

The cost of AARP Long Term Care Insurance varies depending on the type of policy you choose. The cost of the policy will also depend on factors such as your age, health, and the amount of coverage you choose. Generally, the cost of AARP Long Term Care Insurance can range from a few hundred dollars to a few thousand dollars per year. The cost of the policy will also vary depending on the state you live in and the type of policy you choose.

What Factors Impact the Cost of AARP Long Term Care Insurance?

The cost of AARP Long Term Care Insurance is impacted by several factors. The age of the policy holder is one of the most important factors, as premiums tend to be higher for those who are older. The health of the policy holder is also a major factor, as those with pre-existing conditions may have to pay higher premiums. The amount of coverage you choose will also impact the cost of the policy, as more coverage will cost more. Finally, the type of policy you choose can also impact the cost, as policies with more benefits will also cost more.

Is AARP Long Term Care Insurance Worth the Cost?

Whether or not AARP Long Term Care Insurance is worth the cost depends on your individual situation. The cost of the policy can be quite high, so it’s important to consider the benefits of the policy and the likelihood that you’ll need to use it. If you’re in good health and don’t anticipate needing long term care in the near future, then the cost may not be worth it. However, if you have a pre-existing condition or feel you may need long term care in the future, then the cost of the policy may be worth it for the peace of mind it provides.

How Can I Learn More About AARP Long Term Care Insurance?

If you’re interested in learning more about AARP Long Term Care Insurance, the best place to start is by visiting the AARP website. The website has a wealth of information about the policy, including details on the coverage, cost, and other important information. In addition, you can speak with an AARP representative who can answer your questions and provide advice on the best policy for your individual needs. Finally, you can also speak with an independent insurance agent or broker who can compare AARP’s policies to those of other insurance companies.

Long term care insurance cost aarp - insurance

Aarp Long Term Care Insurance Cost - Insurance Reference

Cost of Long Term Care | Buffer Benefits

AARP Burial Insurance Review for 2019 (Policy Details & Prices)

The Troubling AARP Long-Term Care Scorecard - Liberty Investor™