Third Party Insurance For Car Price List

Friday, December 12, 2025

Edit

Third Party Insurance For Car Price List

What is Third Party Car Insurance?

Third party car insurance is a type of insurance policy that provides financial protection against any legal liability that may arise due to an accident caused by the insured car. It is the most basic type of car insurance policy and covers only the damage caused to a third party or their property. It does not cover any damages to the insured car or the driver. It is mandatory in India for all vehicles to have a third party car insurance policy.

What Does Third Party Car Insurance Cover?

Third party car insurance covers the damages caused to a third party or their property due to an accident caused by the insured car. It covers the cost of medical expenses for the third party, any damages to the other party’s car, and any legal costs that may arise due to the accident. It also covers any injury caused to the third party due to the accident. However, it does not cover any damages to the insured car or the driver.

What is the Difference Between Comprehensive and Third Party Insurance?

The main difference between comprehensive and third party insurance is the scope of coverage. Comprehensive insurance covers both the damage caused to a third party as well as the insured car. It also covers the cost of repairs or replacement of the insured car. Third party insurance, however, covers only the damage caused to a third party or their property due to an accident caused by the insured car. It does not cover any damages to the insured car or the driver.

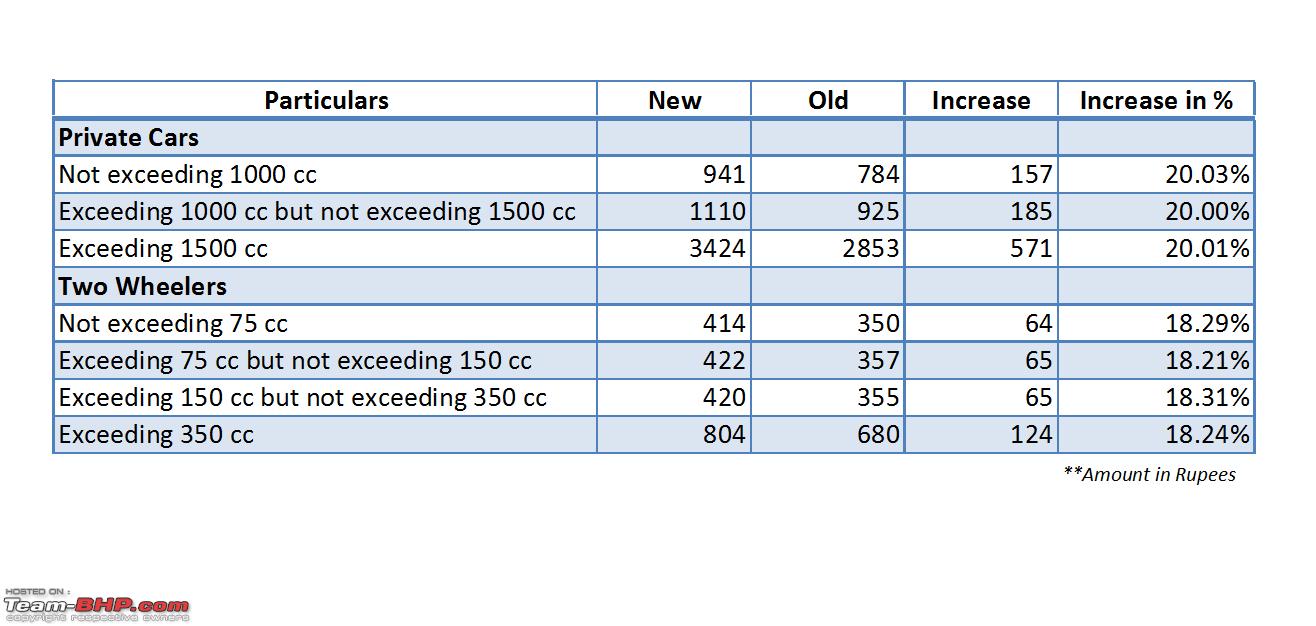

What is the Price of Third Party Car Insurance?

The price of third party car insurance depends on various factors such as the type of car, age of the car, and the geographical location. Generally, the premium for third party car insurance is lower than that of a comprehensive insurance policy. The price of third party car insurance also varies from company to company. It is advisable to compare the prices of different companies before buying a policy.

Are There Any Add-Ons for Third Party Insurance?

Yes, there are various add-ons for third party insurance such as personal accident cover, No-claim bonus protection, and Return to invoice cover. These add-ons provide additional coverage to the insured car and its driver. They also provide financial protection in case of any legal liability.

What is the Process to Buy Third Party Car Insurance?

The process to buy third party car insurance is quite simple. All you have to do is to choose the right insurance provider, compare the prices of different companies, and select the policy that best suits your needs. You can buy third party car insurance online or through an insurance agent. After buying the policy, you will have to make the necessary payments and you will be able to use the policy.

Exclusive | Third party insurance premium on commercial vehicle could

Third Party Insurance Price Uae - akuapprovesing

IRDAI notifies third-party motor insurance premiums for FY23 | Mint

Third Party Insurance Premium to go up W.e.f 1st April 2013 - Team-BHP

Third Party Property Car Insurance | iSelect