Credit Score Needed For Triple A Auto Insurance

Understanding Credit Score Needed for Triple A Auto Insurance

What is Triple A Auto Insurance?

Triple A Auto Insurance, also known as the American Automobile Association (AAA), is a provider of motor vehicle insurance. It offers a variety of insurance coverage including liability, collision, comprehensive, and medical payments coverage. It is one of the most widely used and well-known providers of auto insurance in the US. It is known for offering competitive rates and great customer service.

How Does Credit Score Affect Your Insurance Premiums?

Your credit score is one of the most important factors when it comes to determining your insurance premiums. Insurance companies use credit scores to assess risk and determine how likely you are to make a claim on your policy. Generally, the higher your credit score, the lower your premiums will be. This is because insurers view those with higher credit scores as being less likely to file a claim. On the other hand, those with lower credit scores are seen as more likely to file a claim and therefore will be charged higher premiums.

What Credit Score Do You Need for Triple A Auto Insurance?

The exact credit score needed for Triple A Auto Insurance will depend on the specific insurance company. However, most companies use a score in the range of 500-850. Those with a score in the higher range of this range will likely get the best rates, while those with lower scores may see higher premiums. It is important to keep in mind that even if your credit score is lower than the minimum required, you may still be able to get approved for coverage.

Tips to Improve Your Credit Score

If you are looking to improve your credit score in order to get the best rate on your auto insurance, there are some steps you can take. First and foremost, make sure you make all of your payments on time. Paying your bills on time is one of the most important factors in determining your credit score. Additionally, it is a good idea to keep your credit utilization ratio low. This means that you should not use more than 30% of your available credit at any given time. Finally, be sure to regularly check your credit report for any errors or inaccuracies that may be negatively impacting your score.

Conclusion

In conclusion, it is important to understand the credit score needed for Triple A auto insurance. Generally, most companies require a score in the range of 500-850. Those with higher scores will likely get the best rates, while those with lower scores may see higher premiums. It is important to keep in mind that even if your credit score is lower than the minimum required, you may still be able to get approved for coverage. Additionally, there are steps you can take to improve your credit score. These include making all of your payments on time, keeping your credit utilization ratio low, and regularly checking your credit report for any errors or inaccuracies.

How a Bad Credit Score Affects Your Auto Loan Rate - International

Pin on Car buying

Political Calculations: April 2012

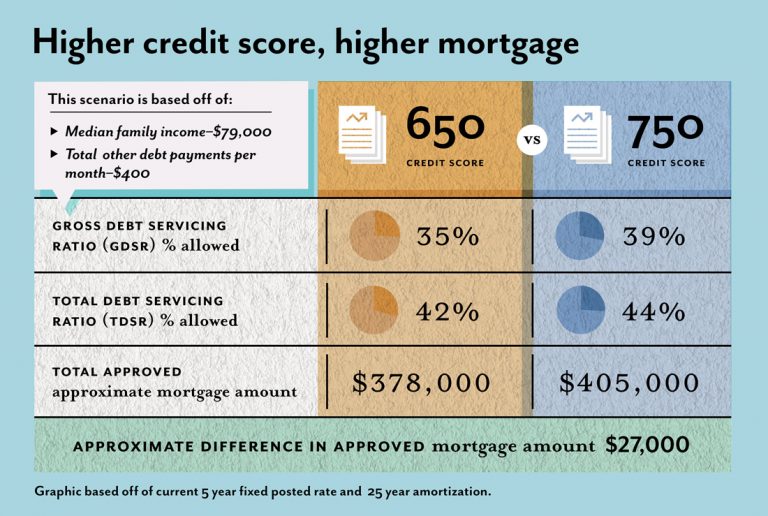

Credit Scores Determine Your Mortgage Amount | RateSpy.com

99 reference of Auto Insurance Credit Score Scale in 2020