Car Insurance For Teens Price

Car Insurance For Teens: What You Need To Know

Shopping for car insurance for teens can be a difficult task. Not only do you have to find the best possible coverage at a price that fits your budget, but you also have to consider the fact that teens can be more likely to have an accident than other drivers. It's important to understand the different factors that can influence the cost of car insurance for teens, so you can make sure you're getting the right coverage for your teen driver.

Factors That Affect Car Insurance For Teens

When it comes to car insurance for teens, there are several factors that can affect the cost. The age of the driver, the type of car they are driving, the amount of coverage they need, and the state they live in are all important factors. Additionally, the driving record of the teen can also have an impact on the cost of the insurance. Many insurance companies offer discounts to drivers who have a clean driving record, so if your teen has been accident-free for the past few years, they could qualify for a discount.

How To Get The Best Price For Car Insurance For Teens

When shopping for car insurance for teens, it's important to compare rates from multiple providers. Don't just settle for the first price you come across – shop around to make sure you're getting the best deal. Additionally, you should look into any discounts your teen may qualify for, such as good student discounts, safe driving discounts, and multi-car discounts. You may also want to consider raising the deductible on the policy to lower the overall cost.

Additional Ways To Save On Car Insurance For Teens

In addition to shopping around and looking into discounts, there are a few other ways to save on car insurance for teens. Many insurance companies offer discounts to teens who complete a driver's education course, so if your teen hasn't taken one yet, it's worth looking into. Additionally, if your teen is driving an older model car, you may be able to get a lower rate by opting for liability-only coverage instead of full coverage.

The Importance Of Having The Right Coverage

It's important to remember that car insurance for teens should include the right type and amount of coverage. Liability coverage is a must, and you should also consider adding comprehensive and collision coverage if your teen is driving a newer car. The last thing you want is for your teen to be stuck with a huge repair bill after an accident, so make sure you have the right level of coverage.

Making Sure Your Teen Is Covered

Shopping for car insurance for teens can be a daunting task, but it's important to make sure your teen is covered. Make sure you do your research and compare rates from multiple providers so you can get the best possible deal. Additionally, look into any discounts your teen may qualify for, and make sure you have the right level of coverage to protect your teen and your wallet.

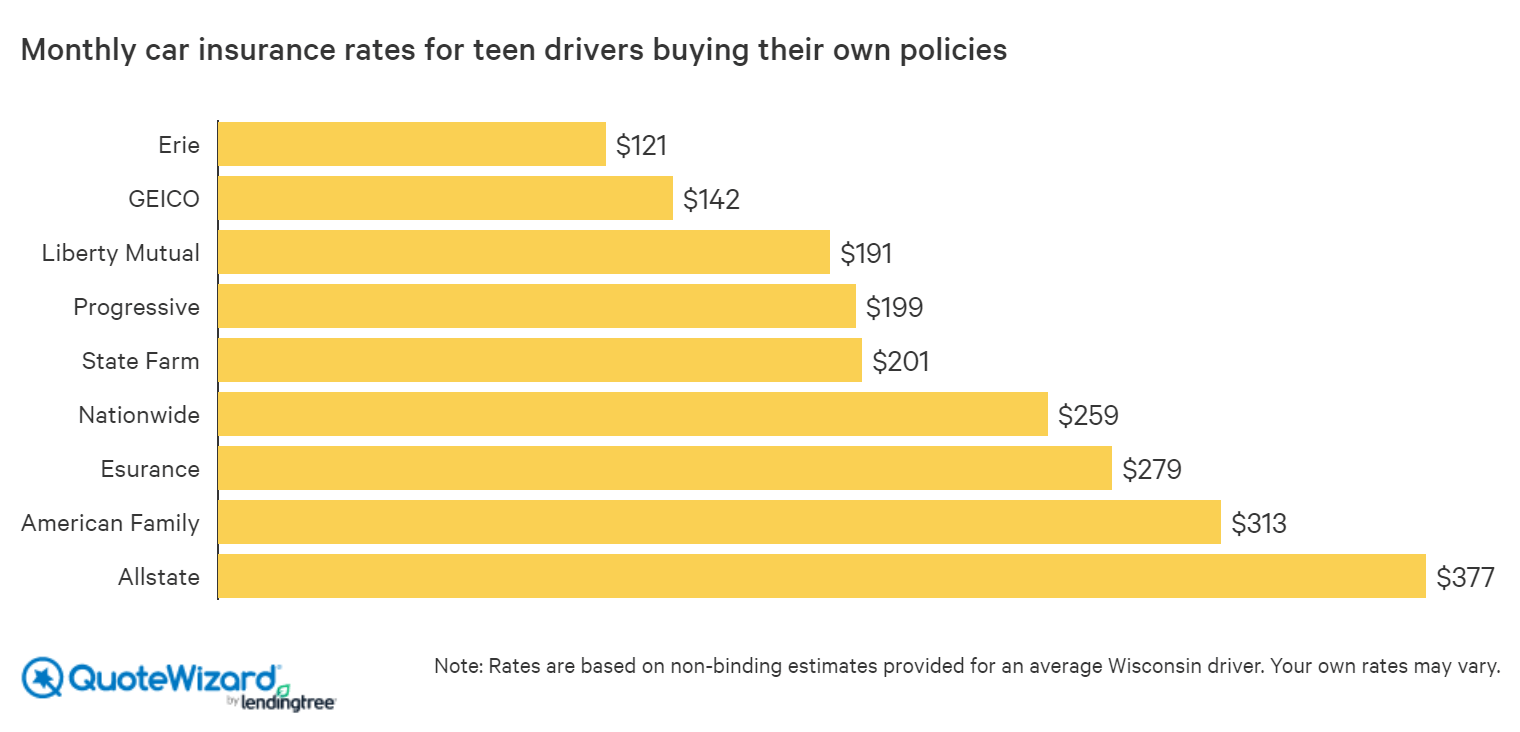

Best Car Insurance for Teens | QuoteWizard

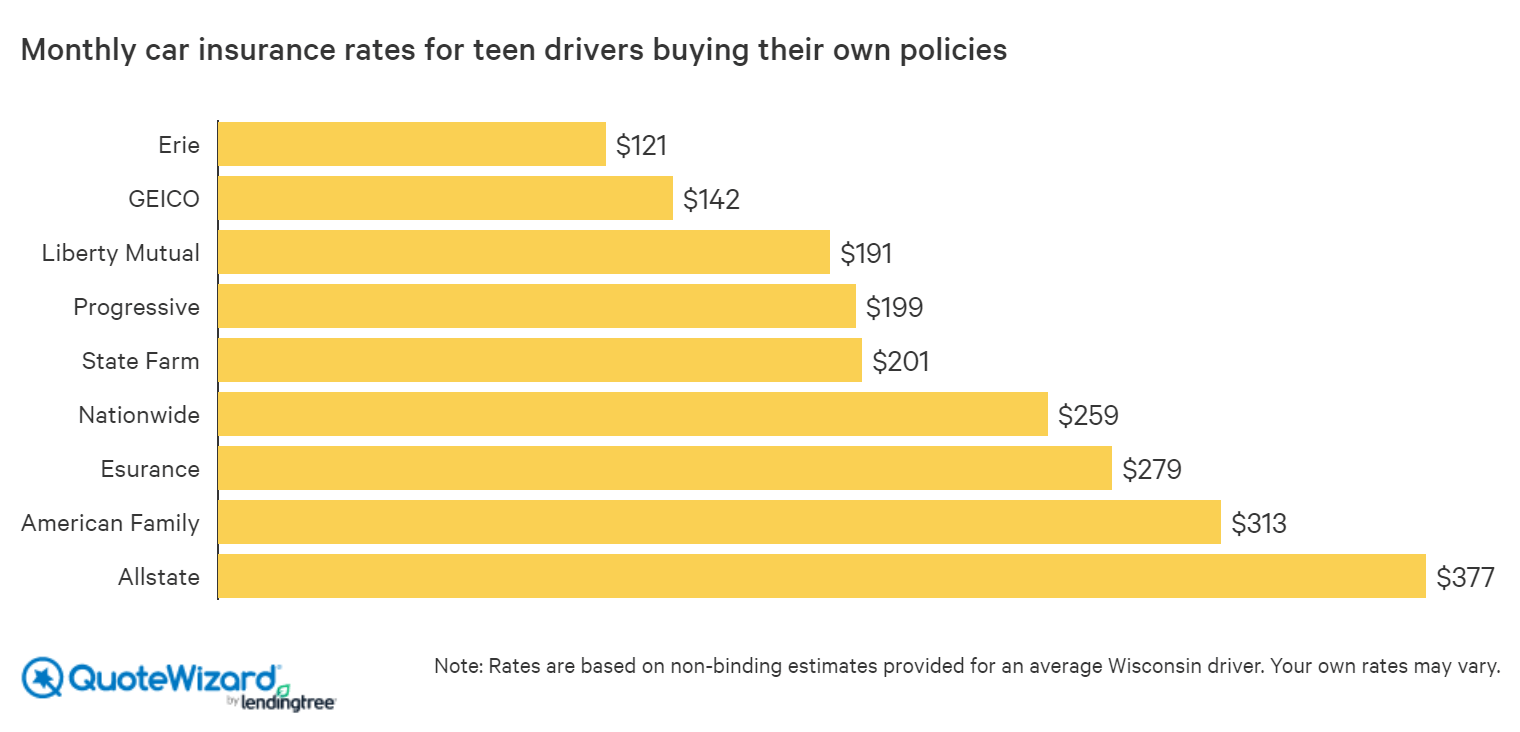

Average Cost of Car Insurance for Young Drivers 2020 | NimbleFins

Teenage Car Insurance Average Cost Per Month ~ artfirstdesign

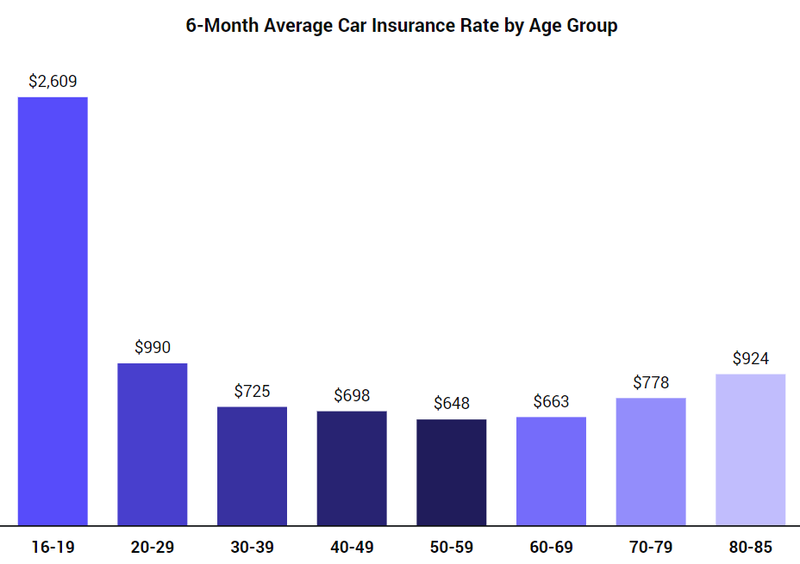

How I saved more than $1,000 on car insurance for my teenager - ValChoice

Discount Car Insurance for Teens | Auto insurance quotes, Car insurance