Can You Buy Gap Insurance From Geico

Can You Buy Gap Insurance From Geico?

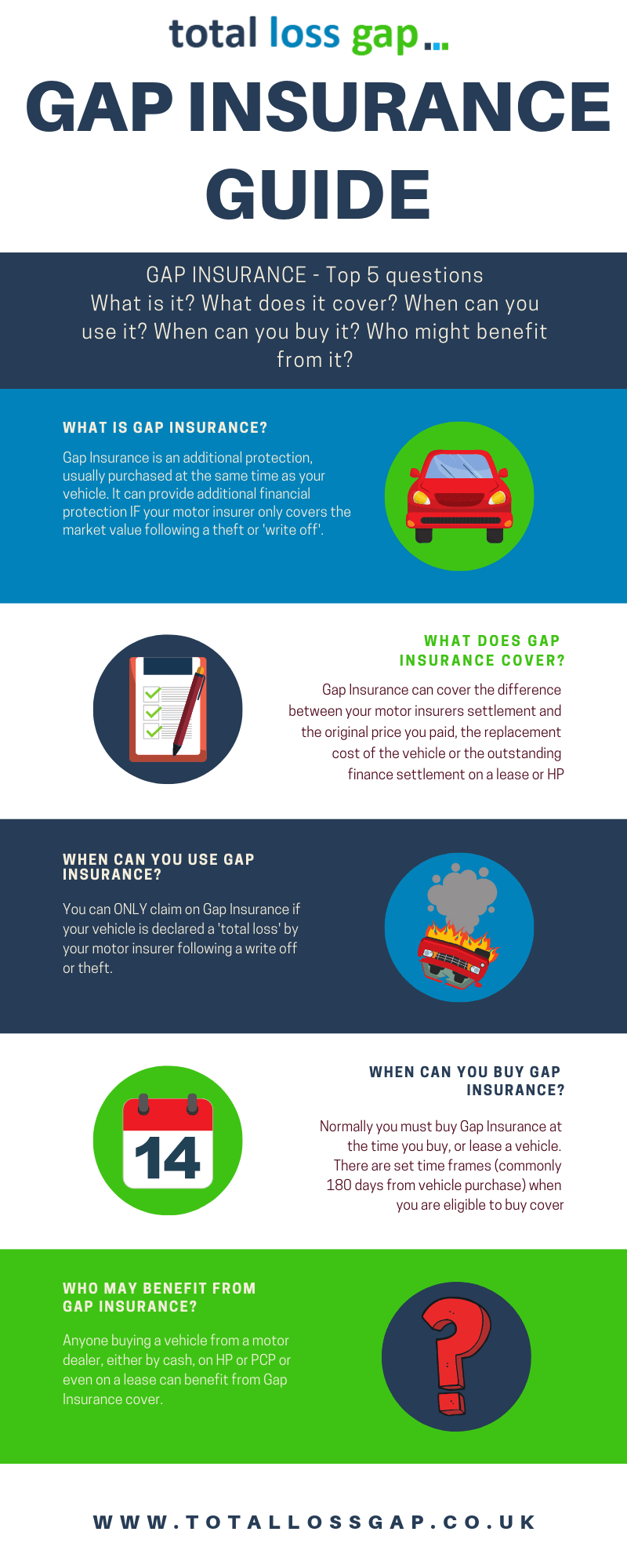

What is Gap Insurance?

Gap insurance, also known as loan/lease coverage, is a type of auto insurance that specifically covers the difference between the actual cash value of a car and the remaining balance of a loan or lease. If a car is totaled or stolen, and an insurance payout is less than the remaining balance on the car loan, gap insurance would cover the difference. This ensures that the loan is fully paid and the consumer will not be financially responsible for the remaining balance.

Why Do You Need Gap Insurance?

Gap insurance is important for car owners who are still making payments on their car loan or lease. It provides additional protection should the car be totaled or stolen. The amount of coverage varies, but it can often cover up to 25% more than the actual cash value of the car. Without gap insurance, a car owner could end up owing more money on the car loan than the insurance payout. Gap insurance can help protect the consumer from having to pay an unaffordable balance on a car they no longer own.

Can You Buy Gap Insurance From Geico?

Yes, Geico offers gap insurance for car owners who are still making payments on their car loan or lease. This type of coverage is available for both new and used vehicles. The amount of coverage will vary depending on the car and the remaining balance owed on the loan. Geico’s gap insurance coverage is also transferable if a car is sold or transferred to a new owner.

How Much Does Gap Insurance Cost?

The cost of gap insurance coverage can vary depending on the type of car and the remaining balance owed on the loan. Generally, gap insurance cost between $20 and $30 per month, although this can vary depending on the specific policy. Geico offers several different types of gap insurance coverage and customers can choose the coverage that best meets their needs.

How to Get Gap Insurance From Geico

Getting gap insurance from Geico is easy and can be done online or over the phone. Customers can also visit a local Geico office to discuss coverage. To get started, customers can get a quote for their gap insurance coverage online or over the phone. Customers can then purchase the policy and have it added to their existing auto insurance policy. Geico also offers customers the ability to make payments on their gap insurance coverage.

Conclusion

Gap insurance is an important type of coverage for car owners who are still making payments on their car loan or lease. Geico offers gap insurance for both new and used vehicles, and the cost of coverage can vary depending on the type of car and the remaining balance owed on the loan. Getting gap insurance from Geico is easy and customers can get a quote online or over the phone. Geico also offers the ability to make payments on their gap insurance coverage.

Gap Insurance Geico - Financial Report

Do You Have To Buy Gap Insurance - When It S Advisable To Purchase Gap

Gap Insurance Geico See Auto Insurance Options From Geico, Plus

Gap Insurance Geico Should You Get In An Accident, You'll Be Able To

Is It Worth Getting Gap Insurance On A Pcp - TRAVELVOS