Absa Car And Household Insurance

Absa Car And Household Insurance - Get The Best Of Both Worlds

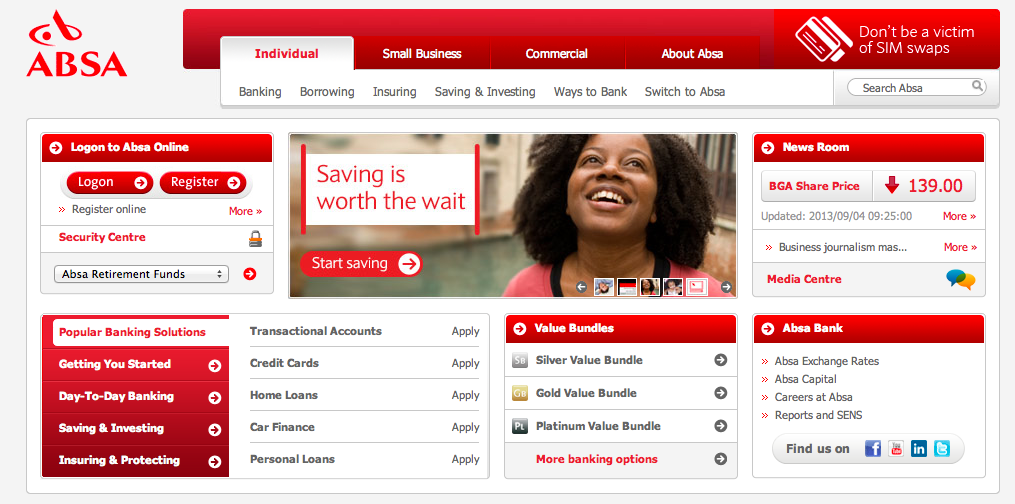

What Is Absa Car And Household Insurance?

Absa Car and Household Insurance is a comprehensive insurance policy offered by Absa, a leading South African bank. This policy is designed to protect your car, your home, and your belongings from a variety of risks, ranging from theft and fire to natural disasters and accidents. It also provides cover for medical expenses and legal liabilities. With Absa Car and Household Insurance, you get the best of both worlds – comprehensive cover for your car and your home, all in one convenient policy.

What Does Absa Car And Household Insurance Cover?

Absa Car and Household Insurance covers a range of risks, including theft, fire, explosion, malicious damage, natural disasters, and accidents. It also provides cover for medical expenses and legal liabilities. In addition, it offers optional cover for windscreen damage, legal protection, and car hire.

What Are The Benefits Of Absa Car And Household Insurance?

Absa Car and Household Insurance offers a range of benefits for customers. These include: comprehensive cover for your car and home; convenience of one policy for both; low monthly premiums; and the option to add additional cover. In addition, Absa provides access to a range of free services, such as roadside assistance, home and car security advice, and a 24-hour emergency helpline.

How Does Absa Car And Household Insurance Work?

The Absa Car and Household Insurance policy is designed to be easy to understand and straightforward to purchase. All you need to do is choose the cover that best suits your needs and budget, and then purchase the policy online or in-store. Once the policy is in place, you can make claims online or over the phone. Absa also provides access to a range of services and advice to help you protect your car and home.

What Are The Exclusions Of Absa Car And Household Insurance?

Absa Car and Household Insurance excludes certain risks from its cover. These include war, terrorism, and nuclear risks. The policy also excludes general wear and tear, intentional damage, and mechanical, electrical, or electronic breakdown. Please consult the policy document for a full list of exclusions.

Who Is Eligible For Absa Car And Household Insurance?

Absa Car and Household Insurance is available to individuals who are South African residents and aged 18 or over. The policy is also available to non-South African residents, provided they can provide proof of legal residence in South Africa. Please note that all applicants must pass an affordability assessment before their application can be approved.

absa logo | Money 101

Absa » Plett Direct

Absa Consulting S.A.S. - YouTube

Absa Car Insurance - Absa Vehicle Insurance, Quote , Reviews & contact

'All-online' insurance solution launched - htxt.africa