Car Insurance Low Deposit Ireland

Car Insurance Low Deposit Ireland: What You Need to Know

What is Low Deposit Car Insurance?

Low deposit car insurance is a type of auto insurance policy that allows drivers to pay a lower upfront cost when they first take out a policy. Instead of paying the full premium, motorists can put down a smaller deposit and then spread the remaining cost over a period of time. This type of insurance is ideal for drivers who are on a tight budget, or don’t have the funds available to pay for their insurance in one go. It’s also useful for drivers who are looking to save money on their insurance costs.

What Are the Benefits of Low Deposit Insurance?

The biggest benefit of low deposit insurance is that it can help drivers to save money. By paying less up front, drivers can reduce their overall insurance costs and spread the cost of their premiums over a longer period of time. This makes it easier to budget for insurance, and means that drivers can get the coverage they need without putting too much strain on their wallets. Low deposit insurance can also be a great option for drivers who are unable to pay their full premiums in one go.

What Are the Drawbacks of Low Deposit Insurance?

The main drawback of low deposit insurance is that it can often be more expensive in the long run. This is because insurers will often charge higher interest rates on payment plans, so drivers who opt for low deposit insurance may end up paying more for their coverage than they would if they paid the full premium up front. Drivers should also bear in mind that if they miss any payments, their policy could be cancelled.

What Are the Requirements for Low Deposit Insurance in Ireland?

In order to be eligible for low deposit car insurance in Ireland, drivers must be able to provide proof of their identity, address and no-claims discount. They must also be able to demonstrate that they have a good driving record and no history of making fraudulent claims. Drivers must also be able to show that they are able to make the necessary payments.

What Are the Different Types of Low Deposit Insurance?

There are two main types of low deposit car insurance: pay-as-you-go (PAYG) and pay-in-advance (PIA). With PAYG insurance, drivers pay a lower upfront deposit and then pay the remainder of their premiums in monthly instalments. With PIA insurance, drivers pay the full premium up front and then receive a discount on their premiums. Both types of insurance can help drivers to save money on their insurance costs.

How Can Drivers Find the Best Low Deposit Insurance Deals in Ireland?

In order to find the best low deposit insurance deals in Ireland, drivers should shop around and compare quotes from different insurers. It’s also worth checking for any discounts or promotions that insurers may be offering. Drivers should also bear in mind that the cheapest policies may not always offer the best value for money, so it’s important to compare the features and benefits of each policy before making a decision.

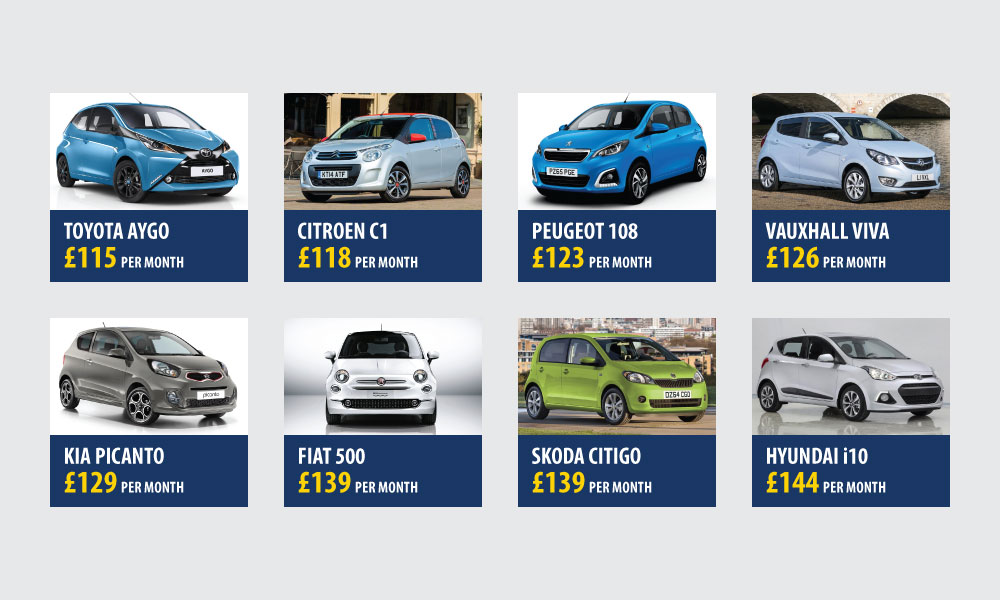

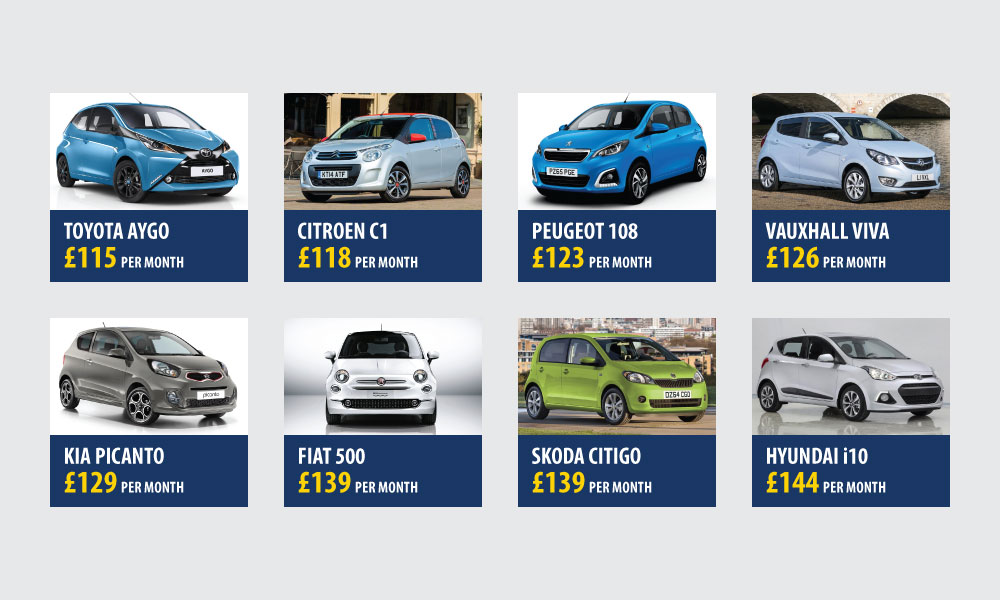

LOW DEPOSIT, LOW INSURANCE CARS FOR YOUNG DRIVERS - CVC Direct Business

Car Finance With Bad Credit No Deposit Ireland - Credit Walls

Cheap Car Insurance Ireland by Paul Keegan

Car Insurance Ireland Get Top Grade Service at Affordable Prices

Getting car insurance in Ireland - TTI Trends