Average Monthly Cost For Full Coverage Car Insurance

The Average Monthly Cost For Full Coverage Car Insurance

Introduction

Full coverage car insurance is the combination of two distinct types of auto insurance policies – liability and collision. Liability insurance covers the costs of an accident that is deemed to be your fault and covers the other driver’s damages. Collision insurance covers the cost of damage to your vehicle, whether it is in an accident or a single-car incident. When combined, these two policies are often referred to as full coverage car insurance. But how much does it cost? Let’s take a look at the average monthly cost of full coverage car insurance.

Factors That Influence Costs

There are a variety of factors that influence the cost of full coverage car insurance. The first is the amount of coverage you choose. The amount of coverage you need is based on the value of your car, the number of cars you have, and the amount of money you have available to pay for repairs or replacement. The type of car you drive also affects the cost of your full coverage car insurance. Some vehicles are more expensive to insure due to their performance, size, or weight.

Your driving record is another factor that affects the cost of full coverage car insurance. If you have a clean driving record, you will likely get a better rate than someone who has had more than one accident or ticket in the past. Insurance companies also take into account the age of the driver, the number of miles driven per year, and the area where you live. All of these factors can affect the cost of full coverage car insurance.

Average Monthly Cost For Full Coverage Car Insurance

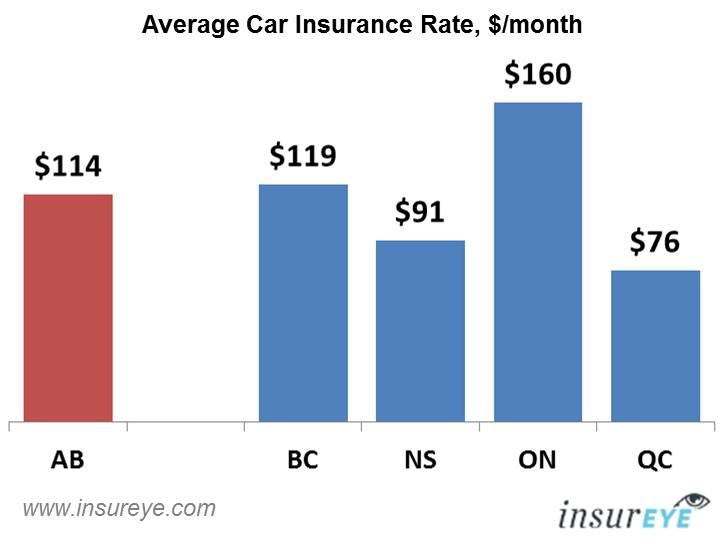

The average monthly cost for full coverage car insurance is around $114 for a single driver. This average rate is based on a policy with a $500 deductible, $100,000 in liability coverage, and $50,000 in collision coverage. The cost of full coverage car insurance will vary depending on the factors mentioned above, such as the type of car and the driver’s driving record.

How To Reduce The Cost Of Full Coverage Car Insurance

The best way to reduce the cost of full coverage car insurance is to shop around. Compare rates from multiple insurance companies to get the best deal. Some insurance companies may offer discounts if you bundle your auto policy with a home or renters insurance policy. You can also save money by raising your deductible or opting for higher deductibles on collision and comprehensive coverage.

It’s also a good idea to keep a clean driving record. Insurance companies reward drivers with good driving records by giving them lower rates. You can also take a defensive driving course or install an anti-theft device to get a discount on your full coverage car insurance.

Conclusion

The average monthly cost of full coverage car insurance is around $114 for a single driver. However, the cost can vary depending on how much coverage you choose, the type of car you drive, and your driving record. To get the best rate, shop around and compare rates from multiple insurance companies. You can also save money by raising your deductible, taking a defensive driving course, or installing an anti-theft device.

The average cost of car insurance in the US, from coast to coast

Quick Answer: What Is The Average Car Insurance Rate?? - AutoacService

ALL You Need to Know About the Average Car Insurance Cost

Car Insurance Alberta | Average Rate is $114 per month

ALL You Need to Know About the Average Car Insurance Cost