Month To Month Car Insurance Policy

Month To Month Car Insurance Policy: The Benefits

If you’re looking for a flexible car insurance policy, you may want to consider a month to month car insurance policy. This type of insurance offers you the flexibility to make changes whenever you need to, and you can pay off the policy in smaller chunks each month rather than paying for a whole year’s worth of coverage in one lump sum. Here are some of the benefits of having a month to month car insurance policy.

Flexibility

A month to month car insurance policy is incredibly flexible. If you need to make changes to your policy, you can do so at any time. You can change the coverage, add or remove drivers, or increase or decrease your deductible. This type of policy allows you to make changes when you need them, instead of waiting for your annual policy to come up for renewal. This can help you save money, as you can adjust your coverage depending on your current needs.

Affordable Payments

When you pay for a year’s worth of car insurance in one lump sum, you may find it difficult to come up with the money all at once. A month to month car insurance policy allows you to make smaller payments each month, which can make it easier to afford your insurance. This can help you keep your coverage up to date, and you’ll have the peace of mind knowing that your car is covered if anything should happen.

No Long-Term Commitment

Another benefit of a month to month car insurance policy is that you don’t have to make a long-term commitment. If you decide to switch to another insurer, you can cancel your policy at any time without any penalty. You’ll only be responsible for paying for the coverage you’ve used during the current month, so you won’t have to worry about paying for a full year’s worth of coverage if you decide to switch.

No Cancellation Fees

A month to month car insurance policy also doesn’t come with any cancellation fees. This is in stark contrast to an annual policy, which may come with a cancellation fee if you decide to switch before the end of the policy period. With a month to month policy, you can cancel at any time with no penalty, so you can switch to another insurer without worrying about having to pay extra.

Get Covered Now

If you’re looking for a flexible car insurance policy, a month to month policy may be the right choice for you. You’ll get the coverage you need, and you’ll be able to make changes to your policy whenever you need to. Plus, you won’t have to worry about paying a cancellation fee if you decide to switch to another insurer. With a month to month policy, you can get the coverage you need and keep it up to date without having to make a long-term commitment.

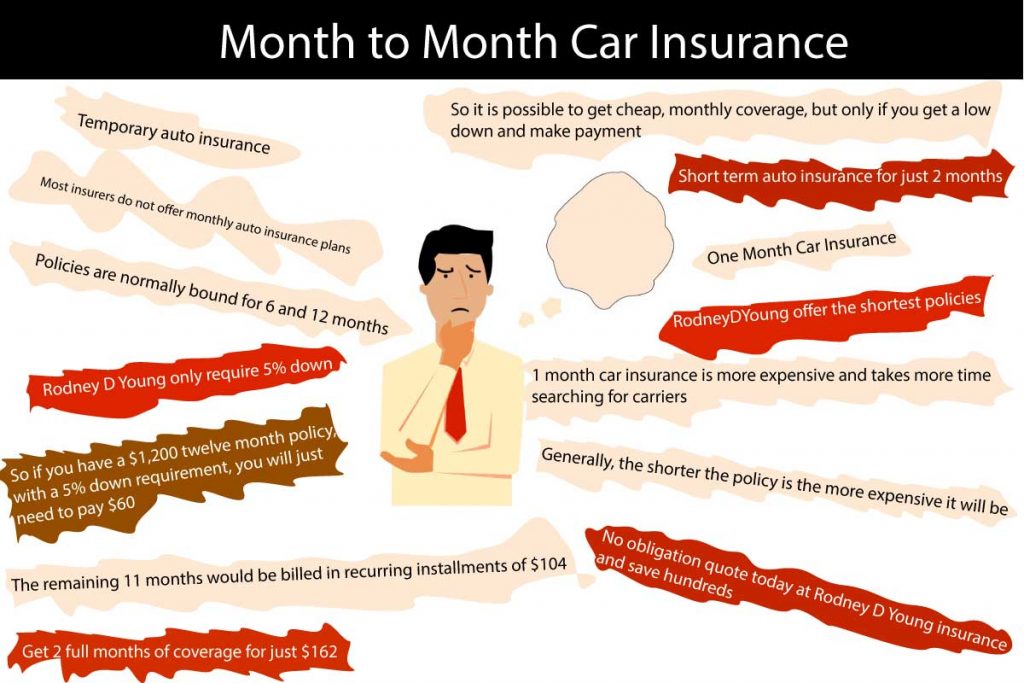

Month to Month Car Insurance | Just at Rodney D Young

Month To Month Car Insurance For All The People

One Month Insurance Plan Car - วิริยะประกันภัย | THE VIRIYAH INSURANCE

List Of Average Monthly Car Insurance For 18 Year Old Female 2022 - SPB

PPT - Month To Month Car Insurance Companies PowerPoint Presentation